$5,000 Wells Fargo Settlement: If you’ve been hearing talk across social media, news outlets, or friends about the $5,000 Wells Fargo settlement rolling out this November 2025, you’re in the perfect spot to get the full scoop. This comprehensive article dives deep into what triggered this settlement, who exactly can get paid, how to check your eligibility, and practical advice to make sense of everything. Whether you’re a regular American banking customer or a finance pro, this guide explains all the details clearly and thoroughly.

Table of Contents

$5,000 Wells Fargo Settlement

The Wells Fargo $5,000 settlement set for distribution in November 2025 is a significant win for Californians affected by unauthorized call recordings. If you submitted a valid claim on time, expect a payment reflecting your privacy rights being acknowledged and compensated. Missed the deadline? Use this as a learning moment to stay informed about your rights and any future claims. This settlement stands as a reminder that consumer privacy is a serious right, even the biggest banks must follow the rules, and vigilance is necessary. Keep your information safe, verify claim details through official channels, and watch out for scams while you wait for your payout.

| Feature | Details |

|---|---|

| Total Settlement Amount | $19.5 million |

| Call Recording Period Covered | October 22, 2014 – November 17, 2023 |

| Typical Payment Per Recorded Call | Approximately $86 |

| Maximum Payment Per Claimant | $5,000 |

| Who is Eligible? | California residents and businesses who received calls without consent |

| Claim Submission Deadline | April 11, 2025 (Now Closed) |

| When Payments Begin | Starting November 2025 |

| How to Check Eligibility and Payment Status | Visit CallRecordingClassAction.com |

| Claim Filing Options | Online through official website or mail to Settlement Administrator in Los Angeles |

Why the $5,000 Wells Fargo Settlement Matters: Protecting Privacy in the Digital Age

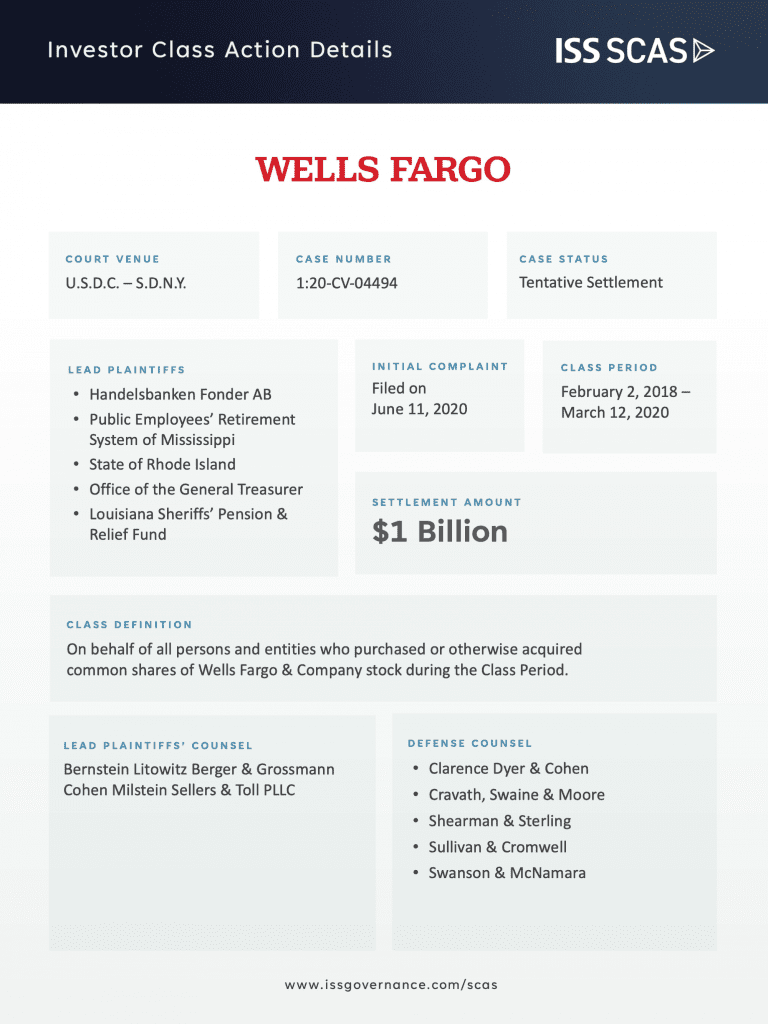

Wells Fargo, a powerhouse in the U.S. financial sector, agreed to pay a total of $19.5 million as a settlement related to secretly recording phone calls without proper consent. Between October 22, 2014, and November 17, 2023, Wells Fargo and its affiliated third-party, The Credit Wholesale Company, Inc., allegedly recorded thousands of phone calls with California customers and businesses without informing them.

Under the California Invasion of Privacy Act (CIPA), companies must get consent from all parties before recording phone conversations. Wells Fargo’s failure to do this violated state law, and this settlement reinforces the importance of consumer privacy in an increasingly digitized world. Given the proliferation of telemarketing, robo-calls, and phone-based customer service, this lawsuit is a crucial reminder that transparency and respect for privacy can’t be overlooked—not even by big banks.

In addition to compensating those affected, the settlement obligates Wells Fargo and its affiliates to cease recording calls without upfront disclosure in California. This pushes for long-term changes in industry practices, ensuring that if your call is recorded, you know about it beforehand.

Who Qualifies to Receive a Payment?

This settlement payout isn’t open to everyone; only specific individuals and businesses qualify. The criteria are:

- You must be a California resident or a California-based business.

- You or your company must have received one or more phone calls from Wells Fargo or The Credit Wholesale Company between October 22, 2014, and November 17, 2023.

- At least one of these calls was illegally recorded without your consent or knowledge, which violates California law.

- You must have submitted a claim by the April 11, 2025, deadline; claims submitted after that date are not eligible.

- For each qualifying call, you are entitled to about $86.

- Multiple calls can add up, but the maximum payout per claimant is $5,000.

- If you were identified as a class member and didn’t opt out, you should receive an automatic payment.

Proof of eligibility may be required, like phone numbers used, call dates, or business information. These help verify that calls you received were part of the recorded set addressed by the lawsuit.

Background: The Lawsuit and How It Started

This settlement came from a class-action lawsuit filed against Wells Fargo, The Credit Wholesale Company, Inc., Priority Technology Holdings, Inc., and Priority Payment Systems, LLC. The suit alleged that The Credit Wholesale Company recorded calls made on Wells Fargo’s behalf to California businesses and consumers without providing any disclosure or obtaining consent.

The calls were mostly for appointment-setting and sales outreach linked to credit card processing equipment and other business services. The issue was the secret recordings, which violated the California Invasion of Privacy Act (CIPA)—one of the strictest state privacy laws in the U.S., requiring all parties to a call to give consent before recording.

Rather than face prolonged legal battles, Wells Fargo and its affiliates agreed to pay the $19.5 million settlement and stop recording appointment-setting calls without disclosure in California. This settlement was preliminarily approved by the court in early 2025 with a final approval hearing held in May 2025.

Steps to Check Eligibility and Claim $5,000 Wells Fargo Settlement

The claim submission deadline was April 11, 2025, so if you missed it, unfortunately, you cannot participate in this round. However, if you did submit a claim, here’s what to do next:

- Visit the Official Settlement Website: The primary source for claim and payment information is CallRecordingClassAction.com. Enter your claim details to check its status.

- Check Your Mail and Email: Payment notifications or checks will be sent starting November 2025. Validate that these are from official settlement contacts.

- Update Your Information: If your contact, address, or banking details have changed since submission, contact the settlement administrator immediately. This avoids payment delays or lost funds.

- Watch for Scams: Do not fall for phishing attempts or fake calls promising to help you get your money for a fee. Only trust official sources.

Missed the Deadline? What You Should Know

Missed the April 11, 2025, claim deadline? Here’s what you need to keep in mind:

- The deadline was strict due to legal requirements, so late claims won’t be accepted.

- Stay proactive by signing up for legal and consumer alerts to catch future class-action settlements or similar claims.

- Maintain records of your business calls or interactions with banks in case new suits arise down the line.

- Know your rights under CIPA and other privacy laws to prevent such violations in the future.

Why This Settlement Sends a Strong Message?

While $5,000 may be a good chunk of change for some, this settlement is much bigger than just money:

- It highlights the power of state privacy laws like California’s CIPA in holding companies accountable.

- Reminds businesses, especially financial institutions, that ignoring privacy compliance can lead to costly lawsuits.

- Reinforces the notion that consumers must be informed about what happens to their personal data and communications.

- Sets stronger benchmarks for how and when businesses can record conversations, boosting overall transparency.

Practical Tips for Consumers and Businesses Going Forward

- Always ask upfront if your call is being recorded. It’s your right to know.

- Keep clear logs or notes related to business calls, especially sales and service interactions.

- Familiarize yourself with local and state laws regarding call recording.

- Avoid sharing sensitive information until you confirm the legitimacy and privacy of the call.

- Use official websites and administrators’ contacts to verify any settlement claims.

What to Expect from the Payment Process?

Once the court approves the settlement terms:

- Payments will start being distributed from November 2025 onward.

- Claimants who opted for direct deposit may receive money faster, but checks will be mailed too.

- Payment processing times can vary based on volume and verification steps.

- Settlements like this usually occur in phases, so patience might be key.

$425M Class Action Settlement: What Capital One Customers Need to Know

Cash App Settlement Claim Status in November 2025 – How to claim it? Check Eligibility