$4,873 Social Security Payment: If you’re hearing about the $4,873 Social Security payment in November 2025 and wondering what’s going on, this article is your straightforward guide. Whether you’re planning retirement, managing finances, or just curious, you’ll learn who qualifies for this maximum payout, when payments arrive, and practical tips to get the most out of Social Security. It breaks down complicated stuff in a clear, conversational style, making it easy for everyone to understand while offering deep insights for professionals.

Table of Contents

$4,873 Social Security Payment

The $4,873 Social Security payment in November 2025 marks the peak of lifetime devotion and patience in claiming benefits. While this top-tier check is for a select group, knowing how earnings history, claiming age, and COLA affect your payout empowers you to make wise retirement choices. Be proactive: verify earnings, consider your claiming age carefully, and keep an eye on official changes to optimize financial security.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit | Up to $4,873 for retirees claiming at age 70 with max earnings history |

| Eligibility | 35 years of max or near-max earnings, full retirement age (67+), claiming at or after 67 |

| Payment Dates (Nov 2025) | November 3, 12, 19, and 26 by birth date; SSI paid early on October 31 |

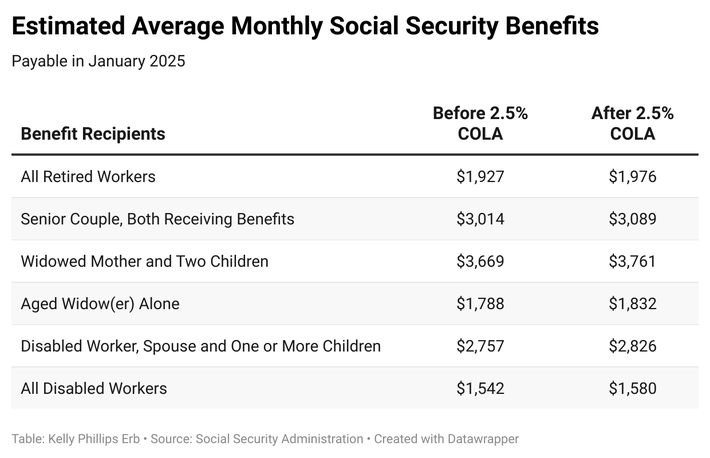

| Average Monthly Benefit (2025) | Approximately $1,905 |

| 2025 Cost-of-Living Adjustment (COLA) | 2.5% increase effective January 2025 |

| Government Shutdown Impact | Payments unaffected in November despite shutdown concerns |

| Official Info & Tools | Social Security Administration (SSA) official website |

What Is the $4,873 Social Security Payment for November 2025?

The $4,873 figure you hear is the maximum Social Security monthly benefit someone can receive as of November 2025. But remember, this number is reserved for people who have:

- Worked for at least 35 years paying the highest taxable Social Security wages consistent with inflation adjustments.

- Waited until age 70 to claim benefits, capturing delayed retirement credits that boost your payment.

Most people don’t get the max because their earnings or claiming age differ. To put it simply, the more you earn and the longer you wait to claim (up to age 70), the higher your payout can be.

This maximum payment reflects the Social Security Administration’s formula that rewards higher lifetime earners who delay claiming benefits. Social Security isn’t just a pension — it’s designed to incentivize saving for a longer working life, which benefits both individuals and the overall system sustainability.

How Does Social Security Calculate Your Benefit?

Your benefit depends mainly on three factors:

- Your earnings history: The Social Security Administration (SSA) calculates your benefit based on your 35 highest-earning years, indexed to account for national wage growth. This means older earnings are adjusted upward to reflect inflation and wage growth over time, so your benefit mirrors your actual economic progress.

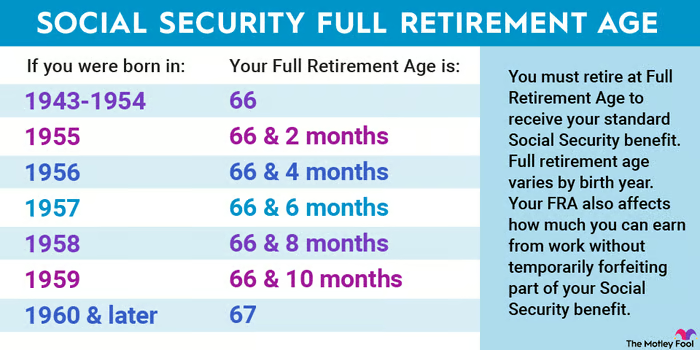

- Your age when you claim: You can start collecting benefits at age 62, but claiming early reduces your benefit by a permanent percentage. Full retirement age (FRA) is 67 for most people born in 1960 or later. Delaying benefits past FRA up to 70 increases your benefit by about 8% per year due to delayed retirement credits.

- Cost-of-Living Adjustments (COLA): SSA increases benefits annually based on inflation measured by the Consumer Price Index. For 2025, the COLA was 2.5%, helping your benefit keep up with rising prices.

The Calculation Process

The SSA calculates your Average Indexed Monthly Earnings (AIME) by summing your indexed earnings over 35 years and dividing by the total number of months in those years (420). For years when you didn’t work or earned below taxable limits, those months count as zero and bring down your average.

Next, the Primary Insurance Amount (PIA) is computed using a progressive formula with bend points that provide higher replacement percentages for lower earnings and lower percentages for higher earnings to ensure fairness.

For 2025, the bend points are:

- 90% of the first $1,226 of AIME,

- 32% of AIME between $1,226 and $7,391,

- 15% of AIME above $7,391.

The sum of these parts is your PIA, which is essentially your monthly benefit at full retirement age.

Eligibility Criteria for Maximum Benefits

To qualify for the maximum $4,873 payment, you generally must:

- Work for at least 35 years, earning the maximum taxable wage base or close to it. The taxable maximum for 2025 is $176,100.

- Claim benefits no earlier than age 70, to earn delayed retirement credits that substantively increase your check.

- Have no gaps or errors in your earnings record. Keep regular checks on SSA’s records to make sure every working year is credited and properly recorded, as mistakes can reduce your benefits.

Important to Know

The maximum $4,873 applies mostly to people born in 1955 who turn 70 in 2025, as benefit formulas slightly adjust by birth cohort. Many Americans qualify for benefits but receive lower payments due to lower earnings, early claiming, or fewer full earning years.

When Are Social Security Payments Issued in November 2025?

Social Security payments are released according to the beneficiary’s birth date:

- November 3: For those who claimed benefits before May 1997 or currently receive Supplemental Security Income (SSI).

- November 12: For birthdays from the 1st to the 10th.

- November 19: For birthdays from the 11th to the 20th.

- November 26: For birthdays from the 21st to the 31st.

November 2025’s SSI payment was sent early on October 31, due to November 1 falling on a weekend, which is standard practice.

Most beneficiaries receive payments via direct deposit, which is secure and fast. If you receive paper checks, factor in possible delays in mail.

What About Government Shutdowns and Social Security?

Social Security payments are mandatory spending, meaning these benefits are legally exempt from shutdown-related delays. Even amid federal funding disputes, such as a government shutdown, Social Security benefits continue without disruption.

In November 2025, despite political uncertainty in Washington, millions of Americans received their benefits on time, a crucial reassurance for retirees relying on this income for daily expenses.

Understanding the 2025 Cost-Of-Living Adjustment (COLA)

The SSA applied a 2.5% COLA increase for 2025, reflecting a moderate rise in inflation. This adjustment helps retirees’ purchasing power keep pace with the rising costs of food, fuel, rent, and healthcare.

- For example, if your monthly Social Security benefit was $1,900 in 2024, your check would increase by roughly $48 in 2025.

- However, higher Medicare Part B premiums in 2025 (expected 11.6% increase) may offset some of this gain for many retirees, reducing their net income boost.

Why Delaying Social Security Benefits Pays?

Delaying benefits up to age 70 yields delayed retirement credits worth about 8% more per year past full retirement age. These increases accumulate to a roughly 24% boost compared to claiming at FRA.

- Claiming at 62 means receiving roughly 70-75% of your full benefit.

- Claiming at FRA (67) pays 100%.

- Waiting until 70 pays about 124% of the FRA benefit — the maximum monthly payment for your cohort.

This strategy is especially beneficial if you expect to live beyond your late 70s or want higher monthly income to cover expenses.

Real-Life Stories: Social Security in Action

- Linda worked hard, earning near the max wage, and waited until age 70 to claim. Her benefit rose from $4,000 at 67 to the max $4,873, an extra $10,000 a year.

- Mark claimed at 62 with a monthly payment under $3,000. Though his lifetime total may be less, he gained cash flow when he needed it right after retiring early.

Practical Strategies to Maximize $4,873 Social Security Payment

Maximizing your payout requires planning:

- Earn enough to top out the taxable maximum wage for 35 years. Inflation-adjusted max wages increase annually.

- Delay claiming your benefits until at least FRA or later where possible, especially if you’re in good health.

- Regularly check your earnings record at SSA.gov — correct any mismatches quickly.

- Understand spousal, divorced, and survivor benefits, which can increase household income.

- Plan for income tax implications. Up to 85% of Social Security benefits can be taxable depending on income.

Historical Trends and What’s Ahead

The maximum Social Security benefit rose steadily over recent decades, reflecting wage growth and policy adjustments. From a max of roughly $3,822 in 2024 to $4,018 at full retirement age in 2025 and $4,873 at 70, the trend continues upward, adjusted by inflation and wage growth.

Looking ahead, the maximum payment for 2026 is projected to reach about $5,108, reflecting ongoing economic conditions.

2026 COLA Update: Social Security and SSI Recipients to See Higher Monthly Checks

US Government Shutdown To Delay Social Security 2026 COLA Update – Check Details