$485-$1650 Bonus Stimulus Checks: If you’ve been scrolling through TikTok, Facebook, or YouTube lately, you’ve probably seen posts shouting about “$485 to $1,650 bonus stimulus checks” landing soon for Americans. Some videos even show “proof” of deposits or letters that look official. But are they for real? Let’s slow down and sort truth from hype. I’ve spent over a decade covering tax policy and consumer finance in the U.S., and right now, I can tell you this: there is no confirmed federal bonus stimulus check program sending out payments in that range — at least, not yet. Still, that doesn’t mean there’s nothing happening. In fact, there are several real payment programs going on that are confusing people — and it’s easy to see why. This article breaks down exactly what’s true, what’s not, and how you can check your eligibility for the payments that do exist.

$485-$1650 Bonus Stimulus Checks

So, is the $485–$1,650 bonus stimulus check real? Not yet — and maybe not ever. But understanding what is real matters even more. The IRS is still sending legitimate refunds and credits. States continue offering local relief. And if any new federal program launches, it will be front-page news on IRS.gov and major media outlets, not whispered on social media. Stay skeptical, stay informed, and stay ready — because knowledge, not rumors, is your best stimulus.

| Topic | What’s Confirmed / Reality | What Viral Posts Claim | Professional Insight |

|---|---|---|---|

| Federal Stimulus Checks | No new federal stimulus law passed as of Oct 2025 | Everyone to get $485–$1,650 | False. No official announcement |

| IRS Catch-Up Payments | Up to $1,400 for those who missed 2021 Recovery Rebate | Free “bonus” checks | Real, but it’s a backlog of old payments |

| State Relief Programs | Active in some states like CA, MN, NY | “Nationwide checks” | Only residents of those states qualify |

| Paper Refund Phase-Out | Paper checks end Sept 30, 2025 | “Digital stimulus rollout” | Not new money — just a delivery change |

| Future Federal Stimulus | None planned, per IRS and Treasury | “Coming this fall” | Requires Congress approval |

What Are the $485-$1650 Bonus Stimulus Checks?

The phrase “bonus stimulus check” isn’t part of any official U.S. government program. It’s mostly a viral label used by blogs and social media accounts to describe other ongoing payments.

Here’s what’s really happening:

- The IRS is currently sending out up to $1,400 to about 1 million Americans who never received or claimed their 2021 Recovery Rebate Credit — essentially catching up on old stimulus funds that people missed.

- Some states (like California, Minnesota, and New York) are distributing tax refunds, rebates, or cost-of-living credits to help residents manage inflation. These programs are legitimate but are state-funded, not part of a federal stimulus.

- Meanwhile, the IRS has announced it will phase out paper refund checks starting September 30, 2025, moving toward direct deposit and digital delivery (IRS.gov).

So, while no one is currently getting a new “bonus check” in that specific range, some people are still receiving money from past programs or state-level relief efforts.

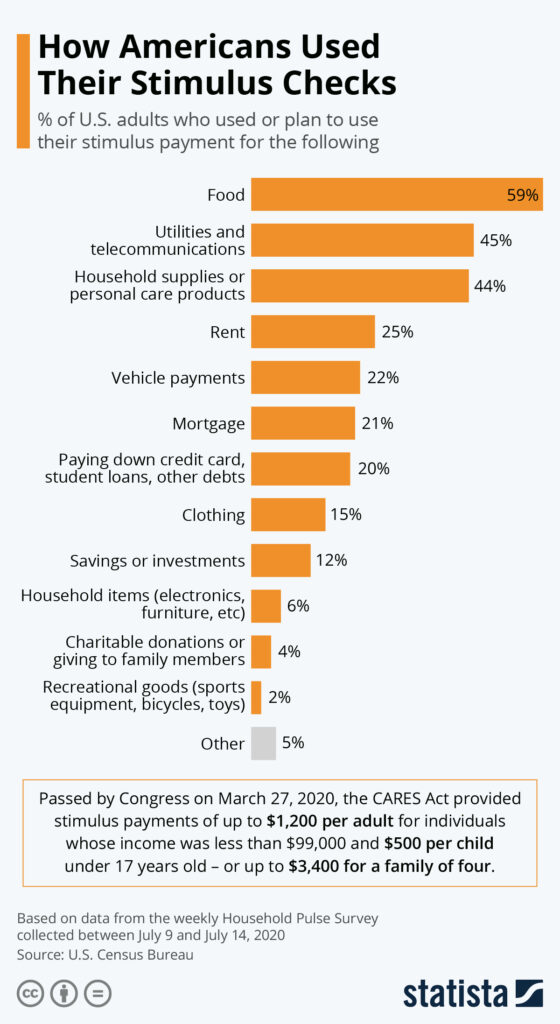

Why the Rumor Keeps Trending?

Let’s be honest — when times are tough, people want good news. With inflation still biting into paychecks and groceries feeling pricier than ever, hearing that “free money” might be on the way sounds comforting. But that’s exactly why misinformation spreads.

- Clickbait Headlines.

Social media thrives on sensational titles like “IRS confirms new checks!” that rarely link to official sources. - Mixing State and Federal News.

California’s refund programs or New York’s property-tax relief often get mistaken as “new federal stimulus.” - Political Hype.

Around election seasons, candidates float ideas about “rebates” or “energy relief.” These proposals sometimes get misinterpreted as already passed laws. - Delayed Stimulus Payments.

The IRS is still mailing out late payments from older credits. When people suddenly receive these, others assume new checks are going out too.

Bottom line: most of these posts twist real updates into something more exciting for clicks.

Real Payments That Are Actually Happening

Let’s focus on the real programs that are active right now and can still put money in your pocket.

1. Recovery Rebate Credit (2021)

If you missed the third COVID-19 stimulus check, you might still be eligible. The Recovery Rebate Credit lets you claim the payment by filing your 2021 tax return — even late, if needed.

- Maximum: $1,400 per person

- Requirements: Filed (or can file) a 2021 return, valid SSN, U.S. citizen or resident

- Deadline: Taxpayers generally have three years to file retroactively for a refund

2. Earned Income Tax Credit (EITC)

The EITC is one of the most overlooked federal benefits. It can give working Americans with modest income a refund worth up to $7,830 in 2025, depending on income and dependents.

- Applies to both individuals and families

- You must file a tax return — even if you don’t owe taxes

3. Child Tax Credit (CTC)

Parents can claim $2,000 per child under 17. For 2025, lawmakers are debating whether to expand this credit again — potentially increasing advance monthly payments, similar to 2021’s pandemic model.

4. State Rebates and Refunds

Several states are still sending out their own one-time relief checks:

- California: Middle Class Tax Refunds between $200–$1,050

- Minnesota: One-time rebates for income under $75,000

- New York: Property-tax relief and energy credits

- Massachusetts: 2025 refund program linked to excess tax revenue

Each state’s rules differ, so check your state Department of Revenue website directly.

The Road to a Real Federal Stimulus: What Must Happen

For a $485–$1,650 “bonus check” to actually happen nationwide, several major steps must occur:

- Congress Must Pass a New Law.

Every previous stimulus — including those in 2020 and 2021 — was created by specific legislation like the CARES Act or American Rescue Plan. Without a bill, there’s no funding. - Funding Must Be Allocated.

Congress has to decide how to pay for it — either by reallocating funds, borrowing, or adjusting taxes. - IRS Implementation Plan.

The IRS would need time to build and test distribution systems, as they did with the “Get My Payment” portal. - Official Announcements.

The Treasury and IRS publish news releases and FAQs before sending money. If you don’t see it on IRS.gov, it isn’t real.

Currently, there’s no pending bill in Congress that fits the description of a new national bonus stimulus.

How to Check and Protect Yourself from $485-$1650 Bonus Stimulus Checks Scams?

Sadly, every time stimulus rumors pop up, scammers follow. Here’s how to stay safe:

- Never pay a fee to “apply” for a stimulus.

- Don’t click links in random texts or emails claiming to be from the IRS.

- Avoid fake websites that imitate “IRS.gov” (look for HTTPS and the .gov domain).

- Report suspicious messages to reportfraud.ftc.gov.

Remember: the IRS never contacts taxpayers by text or social media DMs. If the government owes you money, you’ll get an official letter or direct deposit.

Expert Opinions: Will There Be Another Stimulus in 2025 or 2026?

Economists say the odds are low. Inflation has eased from its 2022 peak, unemployment remains under 4%, and Congress is focused on deficit reduction.

- Forbes reports that lawmakers see no immediate reason for another broad stimulus but might consider targeted credits for seniors or parents if inflation spikes again.

- The Tax Policy Center adds: “Future relief will likely come through expanded tax credits, not checks for everyone.”

Still, political cycles can surprise us. As the 2026 election season nears, both parties might propose new rebates or relief packages to win favor with voters. So while a nationwide check isn’t on the table now, targeted programs are absolutely possible.

Step-by-Step: How to Verify Any Future Payment Program

If a new stimulus or relief check does happen, here’s exactly how to stay ahead of misinformation:

- Follow the IRS Newsroom

- Check Congress.gov for any bill text authorizing payments.

- Subscribe to Treasury press releases or verified finance outlets like Forbes, CNBC, or AP News.

- Set up direct deposit with the IRS to receive any future credits faster.

- Keep your 2024 and 2025 tax filings current. You can’t receive most credits if you haven’t filed.

$1,390 Stimulus Payment For these People in October 2025 – Check Eligibility & Payment Date

$725 Monthly Stimulus Benefits Coming in October 2025: Check FESP Payment Eligibility & Payment Date

$5,108 Stimulus Payment for Seniors in October 2025 – How to get it? Check Eligibility

The Bigger Picture: Why Understanding This Matters

Stimulus rumors may sound small, but they highlight a bigger issue — financial literacy and trust. Too many Americans fall prey to clickbait or scams because accurate, clear communication from official channels doesn’t spread as fast as rumors.

Knowing how these programs actually work gives you power. Whether you’re a teacher, parent, or retiree, being informed helps you make smarter choices about taxes, savings, and benefits.