$445 coming as a Canada Family Benefit: If you’re part of a Canadian family raising kids under 18, then the upcoming $445 Canada Family Benefit payment in November 2025 is a big deal you don’t want to miss. This monthly, tax-free payment is crafted by the Canadian government with one simple goal: to help families manage the soaring cost of living by easing essential expenses like food, clothing, child care, and utilities. Whether you’re new to navigating government benefits or a financial pro looking to optimize family cash flow, this guide breaks it all down—clear, friendly, and expert-level, so even a 10-year-old could grasp it while being a solid resource for planners and parents alike. Think of this payment as a steady hand from the government helping you juggle day-to-day finances amid inflation and rising bills. From fresh school supplies in September to winter heating costs in December, this benefit can ease the burden and create breathing room in your budget.

Table of Contents

$445 coming as a Canada Family Benefit

The $445 Canada Family Benefit arriving in November 2025 is a significant boost for Canadian families navigating everyday financial challenges. This tax-free, monthly payment is a vital resource—helping meet children’s needs, reduce financial stress, and support family wellbeing nationwide. By staying informed on eligibility, filing taxes properly, and maximizing combined federal and provincial benefits, families and financial advisors can harness this program for lasting stability. Remember: November 20, 2025, is your date to receive support—plan ahead and claim it confidently.

| Feature | Details |

|---|---|

| Maximum Payment | Up to $445 per child per month |

| Annual Benefit | Up to $5,340 per child per year |

| Eligibility | Canadian residents with dependent children under 18, valid SIN, tax filing required |

| Payment Date (November 2025) | Scheduled for November 20, 2025 |

| Payment Method | Direct deposit or mailed cheque |

| Income-Based Adjustment | Reduces gradually as family income rises |

| Provincial Benefit Top-Ups | Some provinces add additional child benefits on top of the federal payment |

| Where To Learn More | Canada Revenue Agency official site |

What is the $445 coming as a Canada Family Benefit?

This benefit is a monthly, non-taxable payment managed by the Canada Revenue Agency (CRA), designed to support families with children under 18 by offsetting the high costs that come with raising them. Unlike temporary pandemic relief or one-off payments, the $445 Canada Family Benefit is a steady, reliable source of income that families can count on.

For instance, a family with two children could pocket nearly $11,000 annually, helping pay for winter coats, back-to-school essentials, groceries, and even utility bills—a real boost when inflation keeps nibbling at your budget.

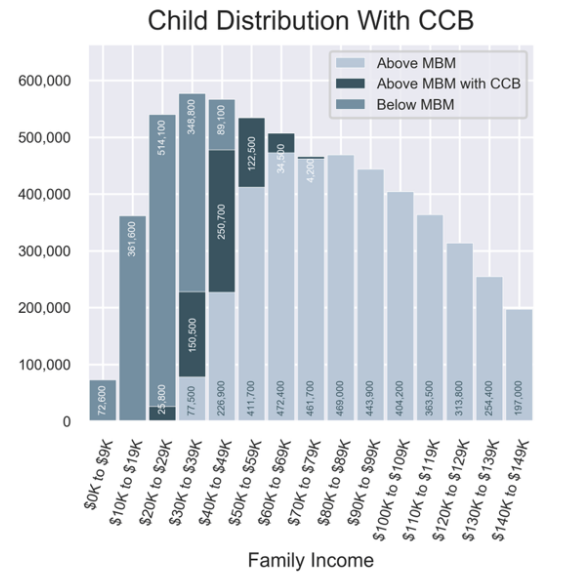

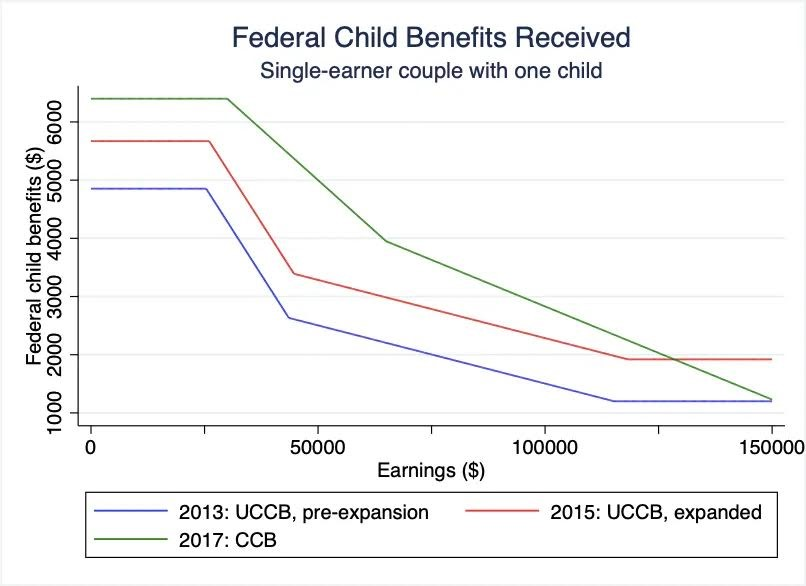

The $445 amount reflects an increase designed to keep pace with today’s economic realities. It builds on the successful foundation of the Canada Child Benefit (CCB), which has lifted hundreds of thousands of children out of poverty since its introduction, making it one of Canada’s most significant social support programs.

Who Qualifies for the $445 Canada Family Benefit?

Qualifying is straightforward, but it’s crucial to meet all the following:

- Residency Status: You and your kids must be Canadian residents for tax purposes. This means you must have established significant residential ties in Canada. Eligible individuals include Canadian citizens, permanent residents, protected persons, and temporary residents with a valid permit who have lived in Canada for at least 18 months.

- Social Insurance Number (SIN): You must have a valid SIN, a fundamental piece of ID for accessing government programs.

- Child’s Age & Care: The child must be under 18 years and living with you most of the time. You must be primarily responsible for the child’s care and upbringing.

- Tax Filing: You (or your spouse/common-law partner) must file your 2024 T1 Income Tax and Benefit Return on time by April 30, 2025. Even if your family earns little or no income, filing taxes is essential to qualify because the CRA uses this data to calculate benefit amounts based on your Adjusted Family Net Income (AFNI).

- Income Threshold: Families earning less than $37,487 AFNI qualify for the full $445 monthly amount. If your income is higher, the payment decreases on a sliding scale.

The CRA considers all these factors before issuing payments, ensuring that funds go to families who need them most.

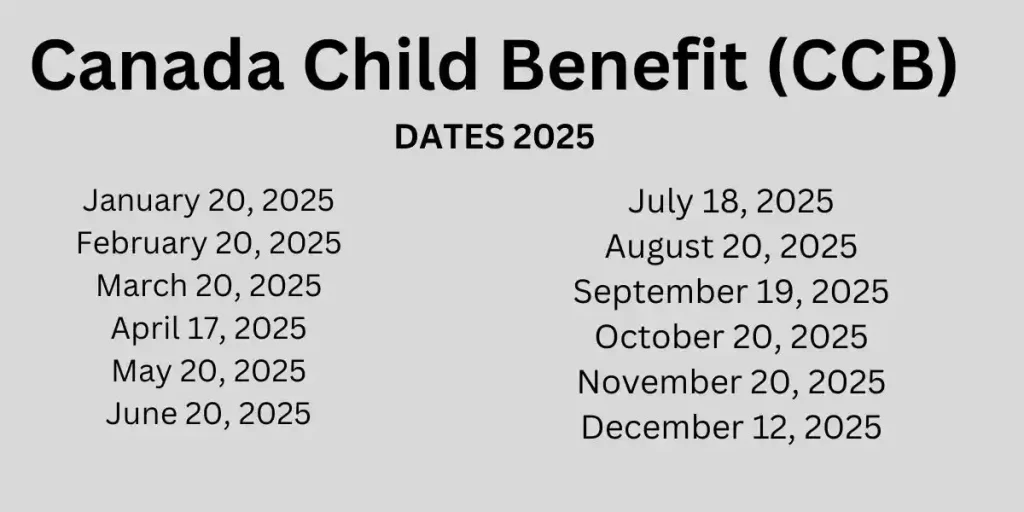

When Will You Get Your Payment?

Mark your calendar: the payment date for the November 2025 Canada Family Benefit is November 20, 2025. Payments typically arrive through direct deposit, allowing you to access the funds quickly and securely. If you’re among the few receiving mailed cheques, expect a slight delay of a few extra days.

This scheduled payment timeline helps families budget monthly expenses, making it easier to plan for recurring costs like rent, groceries, and education supplies.

The CRA maintains a detailed payment calendar for all their benefits—knowing when exactly the funds arrive means you can time major purchases or savings better.

How Does the Payment Amount Work?

The key to understanding how much you’ll get is knowing your Adjusted Family Net Income (AFNI) from your 2024 tax filings. Here’s how it breaks down:

- Families with AFNI less than or equal to $37,487: Receive full payment of $445 per child.

- For incomes above this threshold: The payment reduces gradually as income rises.

- Families with special circumstances, like children eligible for the Disability Tax Credit, may receive additional monthly top-ups.

The calculation method uses your family net income minus certain benefits like the Universal Child Care Benefit to arrive at your AFNI. This ensures that benefits are pretty targeted and adjust fairly to your income situation.

Importantly, the benefit is paid per child, so families with multiple kids stand to gain proportionally more support.

Practical Example: Calculating Your Benefit

Let’s say the Smith family has two children and an AFNI of $35,000. They qualify for the full $445 per child, meaning monthly payments of $890 and over $10,000 annually.

On the other hand, the Johnson family with two kids and an AFNI of $50,000 will receive a reduced amount—maybe closer to $300 per child monthly, depending on sliding scale specifics.

Knowing this helps you estimate your household’s benefit, allowing better financial planning.

Understanding Adjusted Family Net Income (AFNI)

AFNI isn’t just your total paycheck; it’s your total family income minus some specific benefits like the Universal Child Care Benefit and Registered Disability Savings Plan income. This adjusted figure gives the CRA a more realistic view of your economic situation, ensuring benefits effectively target families in need.

If you’re uncertain about your AFNI, CRA provides online calculators and guidance worksheets, which can help you better forecast your expected benefits.

How to Maximize Your $445 coming as a Canada Family Benefit?

Here are some actionable tips to make sure you get every dollar you deserve:

- File Taxes Accurate and On Time: It’s non-negotiable. Even no-income households must file May 2025 to be eligible.

- Sign up for CRA Online Services: Set up your CRA My Account or download the MyBenefits CRA app to monitor payments and update family info.

- Keep Family Info Updated: Ensure your address, child custody details, and SINs are current with CRA to prevent payment interruptions.

- Explore Provincial/Territorial Benefits: Provinces like Alberta and British Columbia offer additional family benefit payments that stack with the federal amount.

- Factor Into Your Budget: Use the payment dates to map out monthly budgets covering groceries, education, and utility bills.

- Apply for Disability Top-Ups: If your child qualifies for the Disability Tax Credit, claim the Child Disability Benefit too.

Common Pitfalls to Avoid

- Delayed or Missing Tax Filings: Can result in payment suspensions or delays.

- Incorrect SIN or Custody Data: Errors cause benefits to pause until fixed.

- Ignoring Provincial Supplements: Missed opportunities to boost your benefit.

- Assuming Fixed Benefit Amounts: These can fluctuate per annual tax info.

Impact on Professional Financial Planning

For professional financial advisors, factoring in the $445 family benefit payment adds an important cash flow dimension to client portfolios. It boosts discretionary income available for debt repayment, emergency savings, or education funds. Ensuring clients file timely tax returns to qualify significantly enhances their financial health and planning outcomes.

Additionally, understanding provincial supplementary benefits allows advisors to tailor comprehensive family strategies to optimize government support.

Provincial and Territorial Top-Ups

Many provinces enhance the federal Canada Family Benefit:

- Alberta Child and Family Benefit: Offers quarterly payments based on income and family size.

- B.C. Family Benefit: Additional payments based on AFNI and family structure.

- Québec Family Allowance: Annual indexed payments for eligible families.

- Other provinces offer similar top-ups, making it worthwhile to research local programs.

Applying for and combining these benefits can boost your total monthly payment well beyond $445 per child.

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

$360 Canada OTB In November 2025 – These people are eligible, Check Eligibility & Payment