$445 Canada Family Benefit Payment: Come November 2025, Canadian families are set to receive financial relief through the Canada Family Benefit payment, which now offers up to $445 per child each month. Administered by the Canada Revenue Agency (CRA), this tax-free monthly payment helps families with children under 18 cover essential costs like groceries, education, childcare, and utility bills. Whether you’re new to the program or looking to understand the latest enhancements for 2025, this detailed guide explains everything from eligibility and payment dates to practical tips for maximizing your benefit. This article is written in a friendly, straightforward style that’s clear enough for a 10-year-old yet packed with expert insights and accurate data for professionals or anyone seeking to fully understand this valuable government support.

Table of Contents

$445 Canada Family Benefit Payment

The $445 Canada Family Benefit payment in November 2025 offers crucial, tax-free financial support to Canadian families with kids under 18. By understanding eligibility, filing taxes correctly, meeting deadlines, and utilizing both federal and provincial benefits, families can maximize relief amid rising living costs. This benefit not only eases daily expenses but also plays a key role in reducing child poverty nationwide.

| Key Point | Details |

|---|---|

| Maximum Payment | Up to $445 per child per month |

| Total Annual Benefit | Up to $5,340 per child per year |

| Eligibility | Canadian resident with child under 18; must file 2024 income tax return |

| Payment Date | Scheduled for November 20, 2025 |

| How Payment is Made | Direct deposit (same day) or mailed cheque (few days later) |

| Income Considerations | Amount decreases as family net income rises |

| Additional Provincial Benefits | Some provinces offer extra family benefits alongside federal payments |

| Official Info & Tools | CRA My Account & MyBenefits CRA mobile app for payment tracking and updates |

| Official CRA Website |

What Is the Canada Family Benefit?

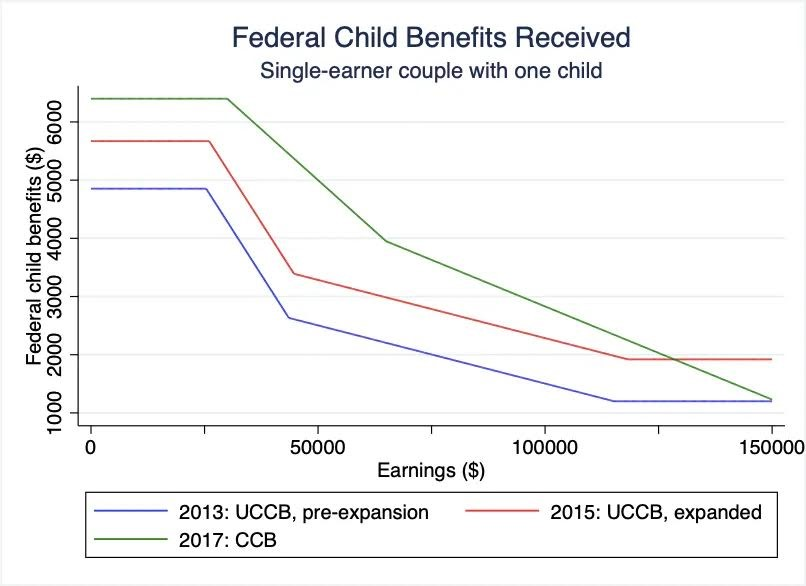

The Canada Family Benefit, more commonly referenced as the Canada Child Benefit (CCB), is a tax-exempt monthly payment designed to help families with children under 18 manage the cost of raising those children. This benefit supports day-to-day expenses—everything from food and clothing to school supplies and childcare. Introduced in 2016, the CCB replaced earlier child benefit programs to better target assistance based on income, ensuring lower-income families receive the most support.

Since its inception, the CCB has lifted over 435,000 children out of poverty and continues to be one of the Canadian government’s most successful anti-poverty initiatives.

How Has the Benefit Changed Over the Years?

The maximum monthly payment per child was about $430 in 2024. In 2025, it increased to roughly $445, reflecting cost-of-living adjustments and government efforts to support families against rising expenses. This 15-dollar bump may seem modest, but annually it means nearly $180 extra per child—potentially covering essentials like warm clothing for winter or extra school fees.

Who Qualifies for the $445 Canada Family Benefit Payment?

Eligibility Criteria (Detailed)

To receive CCB payments, you must meet all of the following:

- Residency: You must be a resident of Canada for tax purposes. This means establishing significant residential ties here.

- Child Age: You must live with a child under 18 years old.

- Primary Caregiver: You are the person primarily responsible for the child’s daily care and upbringing.

- Tax Filing: You and your spouse or common-law partner must file your Canadian income tax returns annually, even if you had no income.

- Status: You or your partner must be either a Canadian citizen, permanent resident, protected person, eligible temporary resident (living in Canada for at least 18 months with a valid permit), or registered under the Indian Act.

Required Documentation

If applying or verifying eligibility, you may need to provide:

- Proof of citizenship or immigration status

- Documents proving residency (utility bills, lease agreements, mortgage statements)

- Proof of child’s birth (birth certificate, passport, hospital birth record)

- Evidence you are the primary caregiver (school or daycare letters, medical records)

Special Situations

- Shared Custody: Payments are split based on custody time.

- Newcomers: Must meet the residency and status conditions; benefits start after tax filing.

- Child Disability Benefit: Additional funds available for children with disabilities.

Income and Payment Amounts

The CRA calculates payments based on your Adjusted Family Net Income (AFNI) from the previous tax year. The benefit phases out gradually as income rises:

- Families earning $37,487 or less qualify for the full annual benefit (up to $7,997 per child in 2025).

- Income between $37,487 and $81,222 is subject to a 7% reduction rate.

- Income above $81,222 faces an additional 3.2% reduction.

Higher-income households get smaller or no benefits, while lower-income families get the maximum support.

When Will You Get Paid? Canada Family Benefit November 2025 Schedule

The scheduled payment date for November 2025 is:

- November 20, 2025

Payments are made monthly, usually on the 20th, with direct deposit arriving the same day and mailed cheques taking several days more. To avoid delays, update banking information with CRA by November 15th.

Other payment dates for the 2025 benefit year range monthly between July 2025 and June 2026, and maintaining timely tax filing is crucial to uninterrupted payments.

Provincial and Territorial Benefits: More Support for Families

Many provinces supplement the federal CCB with their own benefits:

- British Columbia: B.C. Family Benefit offers extra monthly amounts depending on income.

- Alberta: Alberta Child and Family Benefit gives additional financial assistance.

- Ontario: Ontario Child Benefit boosts monthly payments for eligible families.

These programs vary by province, so check local government websites to maximize your total family benefit.

How to Apply and Manage $445 Canada Family Benefit Payment?

Applying for the Canada Family Benefit

- File your taxes: You need to file a T1 Income Tax and Benefit Return in Canada, even if you have no income.

- CRA Registration: Most families are automatically registered after filing taxes, but newcomers or first-time applicants can apply using Form RC66 (Canada Child Benefits Application).

- Direct Deposit Setup: For faster payments, enroll in direct deposit via CRA My Account.

Managing and Tracking Your Payments

Use these convenient tools:

- CRA My Account: Offers payment history, upcoming payment dates, and benefit details.

- MyBenefits CRA Mobile App: Check benefits anytime on your phone.

- Always inform CRA of any changes in custody, address, or income to keep your benefits accurate.

Maximizing Your Benefit: Tips and Tricks

- File taxes on time every year, even if you owe nothing.

- Report life changes like marital status, family size, or custody arrangements promptly.

- Sign up for direct deposit to receive payments faster and avoid lost cheques.

- Use community resources and free tax clinics if filing taxes is challenging.

- Regularly check CRA portals for updates and notices.

Addressing Common Misconceptions

- The benefit is not taxable; you don’t pay taxes on it.

- Even families with no income must file taxes to get the benefit.

- Both single and two-parent households can receive payments.

- Welfare payments or other social assistance do not disqualify you from CCB.

- You don’t need to reapply every year after the first successful claim—just keep filing taxes.

Real Impact: How the Canada Family Benefit Helps Families

The CCB is not just a check—it’s a tool that reduces child poverty significantly. Since 2016, the program helped reduce child poverty by nearly 40%, putting food on the table, clothes on kids’ backs, and helping families afford necessities while stabilizing their finances. Families across Canada, from urban centers to rural towns, rely on this dependable support.

Related Government Programs to Know

- GST/HST Credit: Additional tax-free payments for low-income families that complement the CCB.

- Child Disability Benefit: Extra financial support for children with disabilities.

- Provincial Benefits: Various provinces provide extra assistance tailored to local needs.

Combining these programs can greatly ease financial burdens on families.

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

$628 Canada Grocery Rebate in November 2025: Is it true? How to Check Status