$4,196 VA Disability Checks: If you’re a veteran receiving VA disability benefits, you might have heard about the $4,196 monthly payment mark coming in 2025. This is big news for many veterans and their families across the United States. Understanding what this means, how payments are scheduled, and what the Cost-of-Living Adjustment (COLA) means for your wallet is crucial to managing your finances and planning ahead. This article breaks down everything you need to know about VA disability payments in 2025 in a clear, conversational way. Whether you’re a veteran yourself or someone helping a family member, this guide offers practical advice, factual updates, and a detailed look at what to expect through the year.

Table of Contents

$4,196 VA Disability Checks

The 2025 VA disability payment increase, topped with a 2.5% COLA, means many veterans will see more dollars landing in their accounts—up to $4,196 a month for those with full disability and dependents. These payments arrive consistently each month, offering peace of mind and vital financial support. Veterans are encouraged to stay informed about their benefits, use official VA resources, and seek support from service organizations to navigate claims and appeals. Proper management of benefits can contribute significantly to financial security and wellbeing.

| Topic | Information |

|---|---|

| Maximum VA Disability Payment | $4,196 per month (100% disabled veteran with dependents) |

| COLA Increase for 2025 | 2.5% (Effective from Dec 1, 2024) |

| Base 100% Disability Payment | Approx. $3,831 per month (no dependents) |

| Payment Schedule | VA disability payments usually arrive on the 1st business day of the next month |

| Examples of Dependents Impact | Additional allowances for spouse, children, parents |

| Eligibility Requirements | Service-connected disability, honorable discharge, proof of condition linked to military service |

| Official VA Website | va.gov |

What is the $4,196 VA Disability Checks?

The $4,196 figure often mentioned refers to the maximum monthly VA disability payment scheduled for 2025. This amount typically applies to a veteran rated at 100% disability with dependents, which includes spouses, children, or parents who qualify for additional support. This isn’t a flat rate for everyone but represents the higher tier of payments within VA benefits.

This payment amount reflects a 2.5% cost-of-living adjustment (COLA) effective December 1, 2024, which is designed to help veterans keep pace with rising costs for housing, food, and healthcare. The base 100% payment without dependents is approximately $3,831 per month, with additional allowances for dependent family members adding towards the max amount.

This increase shows the government’s commitment to helping veterans manage inflation and maintain financial stability.

How VA Disability Payments Work in 2025?

VA disability compensation is a tax-free monthly benefit paid to veterans who have a service-connected disability. This means an injury, illness, or condition that is linked to or worsened by their military service. The benefit helps replace lost earning capacity due to the disability and provides necessary support.

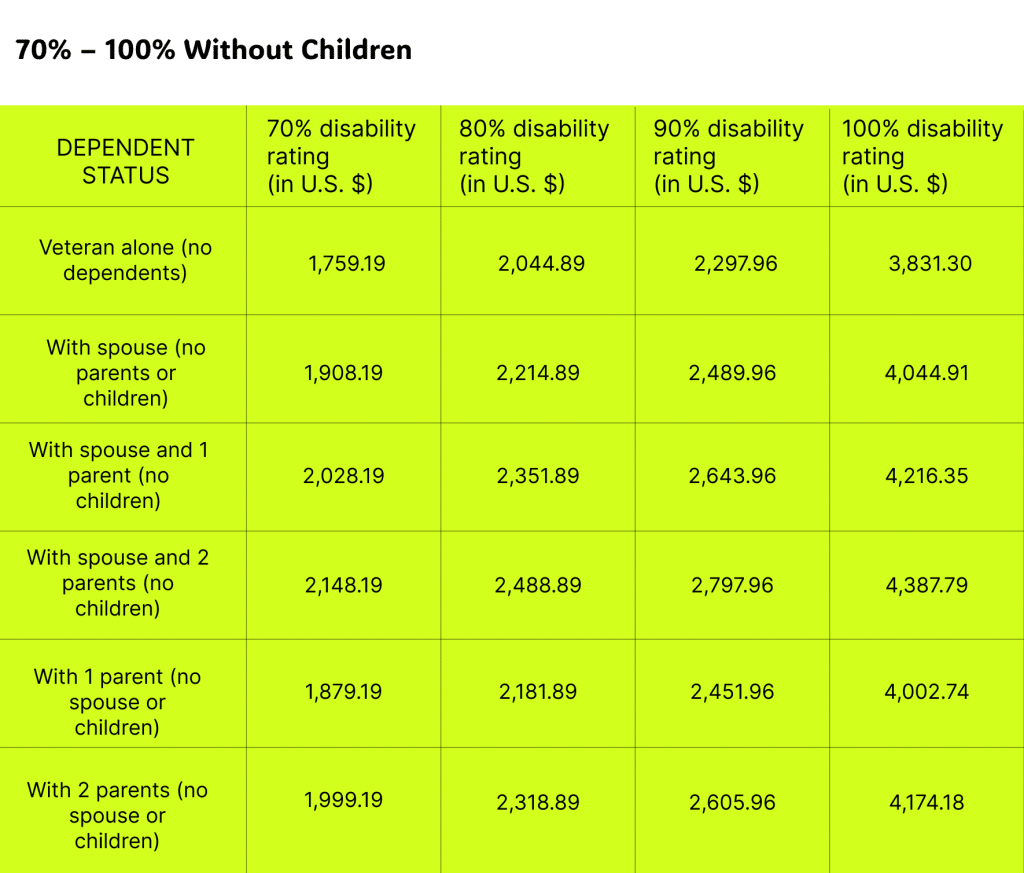

Understanding Disability Ratings

The VA assigns disability ratings on a scale from 0% to 100%, usually in increments of 10%. The rating reflects how much a veteran’s disability affects their ability to work and carry out daily tasks. Higher ratings correspond to higher monthly payments.

For example, monthly payments for 2025 range from:

- 10% disability: $175.51 (no dependent increase)

- 30% disability: $537.42 (single veteran)

- 70% disability: $1,759.19 (single veteran)

- 100% disability: $3,831.30 (single veteran)

Dependents such as spouses, minor children, or dependent parents increase these amounts. For instance, a veteran with a spouse and one child rated at 100% disability receives around $4,196 monthly after dependents’ allowances and COLA.

How Dependents Impact Payments?

Dependent-related benefits include:

- Monthly allowance per additional child under 18 (e.g., approx. $106 at 100% rating)

- Additional aid for spouses who require assistance

- Increased benefits for children over age 18 who are attending school or have disabilities

Cost-of-Living Adjustment (COLA)

The 2.5% COLA increase for 2025 was implemented to counter inflation and rising living expenses. The Social Security Administration calculates COLA annually based on the Consumer Price Index, and the VA must match this increase for disability compensation. This means 2025 monthly payments reflect a 2.5% rise over 2024 amounts, effective December 1, 2024.

VA Disability Payment Schedule for 2025

Payments are typically made on the first business day of the following month for the prior month’s compensation. This means veterans receive January payments on the first business day of February.

Sample 2025 Payment Dates

| Month | Payment Date | Day of Week |

|---|---|---|

| January | Jan 31 | Friday |

| February | Feb 28 | Friday |

| March | Apr 1 | Tuesday |

| April | May 1 | Thursday |

| May | May 30 | Friday |

| October | Oct 31 | Friday |

| November | Dec 1 | Monday |

| December | Dec 31 | Wednesday |

If the first day lands on a weekend or holiday, payments are generally made the prior business day.

How to Apply for $4,196 VA Disability Checks?

If you haven’t applied yet, here’s a basic guide:

- Eligibility: Veterans must have served on active duty, active duty for training, or inactive duty training and have a current disability linked to their service.

- Application: Visit va.gov or call the VA to begin your claim. You’ll need your service medical records, private medical evidence, and supporting documents.

- Helpful Tips: Enlist the help of Veteran Service Organizations (VSOs) such as the Disabled American Veterans (DAV) or Veterans of Foreign Wars (VFW) for filing assistance and appeals.

- Rating Exams: The VA may require Compensation & Pension (C&P) Exams to assess your condition accurately.

Recent VA Policy Updates Affecting Compensation

- The 2.5% COLA increase took effect for the 2025 compensation rates.

- Increased allowances for dependents and surviving family members.

- Expanded recognition of service-connected conditions such as those related to toxic exposures (burn pits, Agent Orange).

- Improved processing speeds with the VA’s modernization efforts aimed at reducing claim backlogs.

- Enhanced mental health disability ratings to better cover PTSD, depression, and related conditions.

- Adjustments to Special Monthly Compensation (SMC) to help veterans with severe disabilities or those requiring aid and attendance.

Managing Your Finances With VA Disability Payments

Successfully managing VA disability payments can help veterans maintain financial stability:

- Budget: Incorporate VA payments into your monthly budget, accounting for daily expenses, utilities, medical costs, and emergencies.

- Emergency Fund: Establish or maintain savings to cover unexpected expenses or delays.

- Additional Benefits: Explore state veterans’ benefits, housing assistance, education benefits, and health care services.

- Professional Help: Consult financial advisors or veterans’ advocates familiar with veterans’ benefits to maximize financial planning and protection.

VA Disability & Social Security: What Veterans Need to Know

Many veterans receive VA payments alongside Social Security benefits. Here’s what to keep in mind:

- Tax Status: VA disability compensation is tax-free; Social Security benefits may be partially taxable based on income.

- No Offset: Receiving VA disability benefits does not reduce Social Security disability or retirement benefits.

- Coordination: When applying for benefits, understand each program’s eligibility criteria to avoid delays.

- Other Benefits: Veterans may qualify for Supplemental Security Income (SSI), Medicaid, or other state-level programs depending on income and disability.

Total Disability Individual Unemployability (TDIU)

If a veteran cannot maintain substantial gainful employment due to their service-connected disabilities but does not meet the 100% rating threshold, TDIU may apply. TDIU grants payments at the 100% disability level, offering financial relief to veterans unable to work due to disability even with a lower combined rating.

Eligibility for TDIU includes:

- Evidence that disabilities prevent gainful employment.

- Medical evaluations confirming the impact on ability to work.

Real-Life Examples of 2025 VA Payments

- John, 100% disabled with a spouse and one child, receives $4,196 monthly.

- Lisa, rated 70% with no dependents, receives about $1,759 monthly.

- Mario, rated 40% with a spouse, a dependent parent and one child, receives approximately $990 monthly.

These examples show how ratings and family status influence the payment amount.

60 VA Disability Pay Increase for 2025: See Your New Monthly Payment Amount

2026 COLA Update: Social Security and SSI Recipients to See Higher Monthly Checks

VA Disability Pay 2026: New Rates Revealed – Are You Getting More? Full Schedule Inside