$4100 CRA Direct Payment: Hearing chatter about a $4100 CRA direct payment in October 2025? You’re not alone. Whether you’re a senior, a worker, or a parent trying to make ends meet, this topic is on everyone’s lips. With the cost of living ticking up, any extra support feels like a lifeline. But what exactly is this $4,100 payment, who’s eligible, and when will it hit your bank account? This guide will break it all down in plain English, sharing everything you need to know—no confusing jargon, just straight talk.

Table of Contents

$4100 CRA Direct Payment

The $4100 CRA October direct payment is a game-changer for many Canadians but don’t get it twisted—it’s not a one-and-done check. It’s a combo meal of different benefits that add up to substantial support over time. If you’re a senior, a worker grinding a low-income job, or a parent, this financial relief could help cover essentials and ease your budget. Stay sharp: filing your taxes on time, applying for the right benefits, and setting up direct deposit are the most crucial moves to get your money fast. This guide provides trustworthy insights so you can plan your finances smarter and not miss out on what’s rightfully yours. Share this article with friends and family—you might just help someone put more cash in their pocket.

| Benefit Program | Who It Helps | Max Annual Amount (2025) | Payment Schedule |

|---|---|---|---|

| Old Age Security (OAS) | Seniors 65+ | Up to $9,871 annually ($727 monthly) | Monthly |

| Guaranteed Income Supplement (GIS) | Low-income seniors | Up to $12,000 annually (varies by income) | Monthly |

| Canada Pension Plan (CPP) | Retired workers | Up to $16,375 annually ($1,364 monthly) | Monthly |

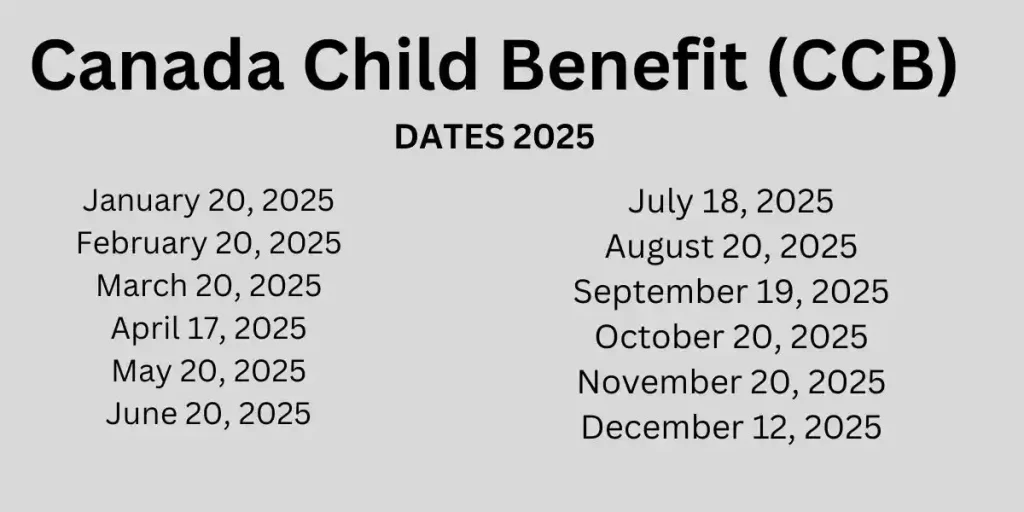

| Canada Child Benefit (CCB) | Families with children <18 | Up to $7,437 per child under 6 annually | Monthly |

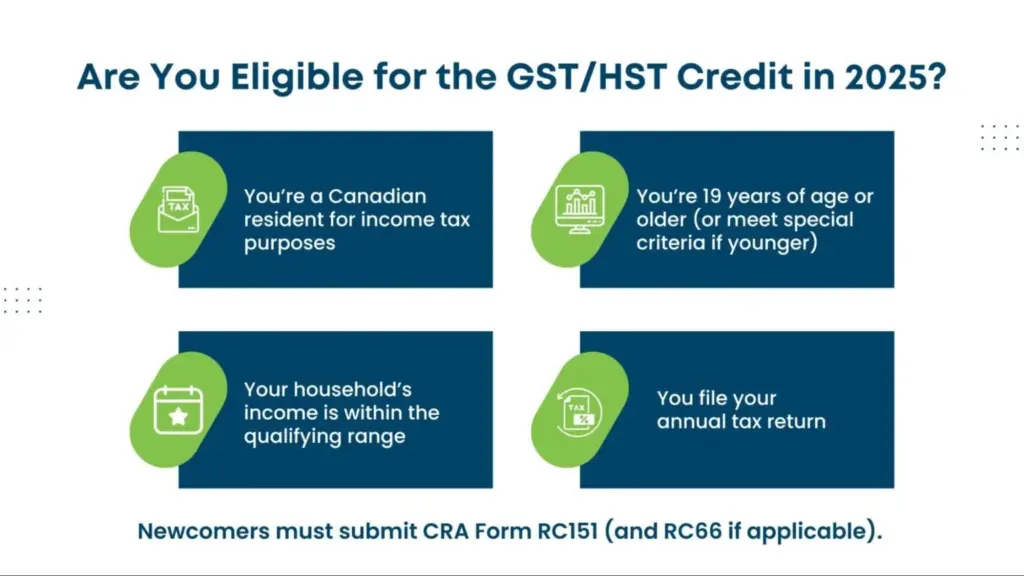

| GST/HST Credit | Low to moderate income families | Up to $992 annually (+ $131 per child) | Quarterly |

| Canada Workers Benefit (CWB) | Low-income workers | Up to $1,428 annually | Quarterly |

What Is the $4100 CRA Direct Payment?

First things first: It’s not one lump sum or a single check. The $4100 figure represents the combined value of multiple government programs and benefits administered by the Canada Revenue Agency (CRA) and Service Canada throughout the year or quarters. Think of it as the sum of monthly or quarterly payments you might be receiving if you qualify for several assistance programs.

Here’s the scoop: The $4100 could include government support from Old Age Security (OAS), Guaranteed Income Supplement (GIS), Canada Pension Plan (CPP), Canada Child Benefit (CCB), GST/HST Credit, Canada Workers Benefit (CWB), and more. If you’re a senior, a low-income worker, or a parent, you might see a mix of these benefits boosting that amount.

How These Benefits Are Funded?

Keep in mind—these programs are taxpayer-funded social supports designed to help Canadians meet essential needs. The government collects taxes to fund these benefits to redistribute financial support where it’s needed most, helping reduce poverty and support vulnerable populations.

Understanding Eligibility: Who Qualifies for the $4100 CRA Direct Payment?

Seniors

- Must be 65 years or older to qualify for Old Age Security (OAS).

- Must have resided in Canada for at least 10 years after age 18.

- Income thresholds apply for Guaranteed Income Supplement (GIS), designed for low-income seniors who receive OAS.

- Sponsored immigrants under sponsorship agreements are excluded until conditions like sponsor death or imprisonment occur.

Workers and Parents

- Canada Workers Benefit (CWB) helps workers 19+ years old with low income from employment or self-employment.

- Canada Child Benefit (CCB) supports families with children under 18.

- GST/HST Credit assists low- to moderate-income individuals and families.

Disability Benefit

- The new Canada Disability Benefit applies to people aged 18 to 64 approved for the Disability Tax Credit.

- Applicants over 65 can receive retroactive payments up to 24 months before turning 65.

- Applicants must have filed tax returns for prior years.

Residency and Citizenship

- Eligibility generally requires Canadian citizenship, permanent residency, or protected person status.

- Temporary residents must have lived in Canada for 18 months prior to qualifying.

Breaking Down the Benefits

Seniors: The Core Recipients of This Support

If you’re 65 or older, you’re likely familiar with the Old Age Security (OAS) program. In 2025, seniors aged 65 to 74 can receive up to $727.67 per month, and those 75 or older can get up to $800.44 per month. But here’s the kicker: If your income is on the lower side, you could qualify for the Guaranteed Income Supplement (GIS) which can add a whopping $1,000 or more monthly. That alone can push your yearly benefit close to or over the $4,100.

To get these, seniors need to have lived in Canada for at least 10 years after turning 18 and must apply through their My Service Canada Account. These monthly payments form a significant chunk of the $4100 figure many seniors rely on.

Retirees with CPP

Did you ever work and contribute to the Canada Pension Plan? If yes, you’re entitled to retirement income from CPP once you hang up your work boots. The amount depends on contributions made, but the max monthly payment in 2025 is about $1,364.60. While many don’t max out, CPP combined with OAS and GIS can offer a solid foundation.

Remember, CPP won’t just land in your account automatically—you need to apply, usually about 6 months before retiring.

Families and Working Parents

If you’re raising kids, the Canada Child Benefit (CCB) has your back—providing tax-free support to help cover essentials like school supplies and daycare. In 2025, you might receive up to $7,437 annually per child under six, paid monthly.

Additionally, families in provinces like Alberta and Ontario may benefit from provincial supplements, boosting federal benefit amounts and easing living costs further.

The Canada Workers Benefit (CWB) also helps out low-income workers, with payments totaling up to $1,428 annually, designed to help cover basics like transportation and groceries.

Tax Credits and Other Supports

- The GST/HST Credit helps lighten the tax load for low- and moderate-income Canadians, with payments up to $992 per year plus $131 for each child, paid quarterly.

- The Ontario Trillium Benefit (OTB) combines energy, sales, and property tax credits.

- The Canada Carbon Rebate (CCR) is for residents in provinces with a carbon tax.

Provincial Top-Ups and Regional Benefits

Several provinces provide additional assistance programs that supplement CRA benefits:

- Alberta Income Support: Offers cash and health benefits to residents unable to pay for basic needs, based on financial and family criteria.

- British Columbia Income Assistance: Provides financial help to those in need alongside federal benefits.

- Ontario Trillium Benefit (OTB): Consolidates energy and property tax credits to support low-income Ontarians.

It’s wise to check your province’s official benefits sites to maximize support available in your area.

Real-Life Examples: Who Gets What?

- Margaret, 68, lives alone with a modest retirement income. She receives OAS plus GIS, totaling close to $18,000 annually, which includes a large part of the $4100 composite.

- John, 45, works a low-wage job and has two kids. He gets benefits like CCB, GST credits, and the Canada Workers Benefit summing to nearly $3,500 yearly.

- Linda, 70, receives CPP and OAS but has no GIS due to higher income. She collects about $20,000 per year from combined CPP and OAS.

These examples show how the $4100 figure is an estimate of total support from multiple streams, varying widely by personal circumstances.

How To Make Sure You Get $4100 CRA Direct Payment?

Step 1: File Your Taxes On Time

Missing your tax filing means you risk missing out on automatic credits like the Canada Child Benefit and GST/HST Credit. Even if you have no income, file your taxes annually. The CRA uses that data to calculate your benefit eligibility.

Step 2: Apply for Non-Automatic Benefits

Some benefits, such as OAS, GIS, and CPP, require separate applications.

Step 3: Set Up Direct Deposit

Avoid waiting on cheques by setting up direct deposit. This guarantees payments hit your bank account fast and safely.

Step 4: Monitor Your Income and Family Changes

Benefits like GIS and CCB depend on income and family size. Inform CRA of any changes like new children, income shifts, or moves to keep payments accurate.

Common Mistakes to Avoid

- Forgetting to file taxes or filing late, which delays benefits.

- Not applying for OAS or CPP on time.

- Failing to update CRA on changes in income or family status.

- Not setting up direct deposit, risking slow cheque delivery.

- Assuming benefits are “automatic” without filing necessary paperwork.

Track Payments and Report Issues

Keep track of your payments through your CRA account online. If payments are missing or late, contact CRA directly at 1-800-959-8281 or via their secure message system online.

The Impact of These Payments on Financial Wellbeing

These payments can mean the difference between struggling and staying afloat for many Canadians. Seniors rely on OAS and GIS to cover essentials; families use CCB for childcare and schooling costs, and low-income workers depend on the CWB to make ends meet.

In 2025, with inflation and housing costs on the rise, these government supports are a critical part of economic stability for millions across the country.

Future Outlook and Policy Changes

The Canadian government continues to review and adjust these programs to better support Canadians facing inflation and economic hardship. Recent policy changes include tightened sponsorship agreements affecting benefit eligibility and expanded disability supports.

Staying informed of policy changes helps ensure you don’t miss out on new or expanded benefits.

Canada $1400 Extra OAS Payment for Seniors Coming in October 2025: Check Payment Dates & Eligibility

Canada $1400 Extra OAS Payment for Seniors Coming in October 2025: Check Payment Dates & Eligibility

CRA Announces Payment Dates for October 2025: Know CRA latest payment date and amount