$400 Inflation Refund Checks: The news is spreading fast — New York State has officially started mailing $400 inflation refund checks to millions of residents. This long-awaited relief is meant to give working families a financial breather after years of rising costs on everything from groceries to rent. The checks are part of a state initiative to refund excess sales tax revenue collected during the high-inflation years. And here’s the best part: you don’t have to fill out any forms or apply for anything. If you qualify, the money’s on its way to you automatically.

This guide breaks down who qualifies, when to expect your check, how to track it, and what to do to make the most of your refund. Whether you’re a taxpayer, student, or small business owner, this will walk you through everything you need to know.

Table of Contents

$400 Inflation Refund Checks

The $400 Inflation Refund Checks are New York’s way of giving residents a small but meaningful financial lift in challenging times. Funded by the state’s sales tax surplus, the program ensures that taxpayers — not government coffers — benefit from unexpected revenue gains. By early December 2025, millions of New Yorkers will have received their checks. Whether you use it to catch up on bills, build a safety net, or treat yourself after a tough few years, this refund is a reminder that relief can come when it’s needed most.

| Topic | Details |

|---|---|

| Program Name | New York State Inflation Refund Program |

| Refund Amount | Up to $400 per eligible taxpayer |

| Eligibility Year | Based on 2023 State Income Tax Return (Form IT-201) |

| Distribution Period | September – November 2025 |

| Application Required | No – mailed automatically |

| Payment Type | Paper check (not direct deposit) |

| Funding Source | Excess sales tax revenue from inflation years |

| Official Resource | New York State Tax Department |

| Fraud Warning | Beware of scams asking for personal or banking info |

What Are $400 Inflation Refund Checks?

The $400 inflation refund checks are part of New York’s 2025–2026 state budget plan, introduced by Governor Kathy Hochul to help offset the financial burden caused by inflation.

During the inflation spike between 2022 and 2024, New Yorkers paid higher prices for goods and services. Because the state collects sales tax based on total sales value, it ended up with billions more in tax revenue than usual. Instead of keeping it, the state decided to give a portion back to taxpayers.

According to the Governor’s Office, this one-time refund will reach more than eight million residents, injecting roughly $2.6 billion back into local economies. That’s money that can help cover basic costs, pay down debts, or simply add a little cushion during uncertain times.

“This is about fairness,” said Governor Hochul during the announcement. “When prices rise and the state benefits from those price hikes, New Yorkers deserve to share in that return.”

Why Is New York Sending These Refunds?

Let’s face it — inflation has hit everyone. According to the U.S. Bureau of Labor Statistics, consumer prices have jumped more than 20% since 2021, and even though inflation has cooled slightly in 2025, many families are still playing catch-up.

Groceries, gas, electricity, and healthcare all cost more today than they did five years ago. For example:

- The average grocery bill for a family of four is $140 higher per month than in 2021.

- Rent prices in New York have climbed over 17% since 2020.

- Gasoline prices remain nearly 30% higher than pre-pandemic levels.

This refund is New York’s way of helping to offset some of those extra costs — not as a long-term fix, but as a practical step to give residents some breathing room.

Who Qualifies for the $400 Inflation Refund Checks?

Eligibility is tied to your 2023 income tax return (Form IT-201). You must have filed as a New York resident, not been claimed as a dependent on anyone else’s return, and have an Adjusted Gross Income (AGI) within certain limits.

Here’s how it breaks down:

| Filing Status | AGI Range | Refund Amount |

|---|---|---|

| Married Filing Jointly | ≤ $150,000 | $400 |

| Married Filing Jointly | $150,001 – $300,000 | $300 |

| Single | ≤ $75,000 | $200 |

| Single | $75,001 – $150,000 | $150 |

| Head of Household | ≤ $112,500 | $250 |

If you earned more than those thresholds, you won’t receive this refund — but you may still qualify for other credits like the Earned Income Credit, Child Tax Credit, or New York State Homeowner Tax Rebate Credit.

When Will the Checks Arrive?

The state started mailing the first batch of checks at the end of September 2025. Distribution will continue through October and November, depending on your income level, filing date, and region.

| Timeline | Recipients |

|---|---|

| Late September 2025 | Early tax filers and low-income residents |

| October 2025 | Majority of eligible taxpayers |

| November 2025 | Final mailing wave |

By December 2025, all eligible residents should have received their checks.

These refunds are paper checks only — not direct deposits. Even if you usually get your tax refund electronically, this one comes through the mail. It will be sent to the address on your most recent tax return, so make sure your information is current.

How to Check the Status of Your $400 Inflation Refund Checks?

The New York Department of Taxation and Finance will launch an Inflation Refund Status Tool, allowing residents to verify their payment status.

You’ll need:

- Your Social Security Number (SSN) or ITIN

- Your 2023 Adjusted Gross Income

- Your Mailing ZIP Code

This tool will show whether your check has been issued, mailed, or is still pending processing.

Beware of Scams and Fake Messages

With every major government refund comes a wave of scams. The New York Division of Consumer Protection has already reported fake texts, emails, and calls claiming to be from “NY Refund Services.”

Remember these key points:

- The government will never ask for personal or banking information to issue a refund.

- Do not click on links from unsolicited messages about refunds.

- Always verify official communications — they will come from domains ending in “.ny.gov” only.

How Does This Compare to Other States?

New York isn’t the only state giving financial relief. Several others launched similar programs to help residents manage rising prices.

| State | Program Name | Amount | Year | Funding Source |

|---|---|---|---|---|

| New York | Inflation Refund Program | Up to $400 | 2025 | Sales tax surplus |

| California | Middle-Class Tax Refund | Up to $1,050 | 2023 | Budget surplus |

| Colorado | Taxpayer Rebate | $750 per filer | 2023 | State revenue surplus |

| Illinois | Family Relief Credit | $50–$100 per person | 2023 | Budget reallocation |

| Maine | Inflation Relief Payment | $850 per filer | 2023 | State revenue excess |

New York’s program is notable because it doesn’t rely on borrowing or new taxes — it’s funded directly from excess state revenue, which makes it more sustainable and fiscally sound.

How to Use Your $400 Inflation Refund Checks Wisely?

While $400 may not sound like a fortune, using it strategically can make a meaningful difference. Here are a few smart ideas:

Pay Down High-Interest Debt

Credit card interest rates in 2025 average around 22%. Paying off part of your balance reduces long-term financial stress.

Build or Rebuild Your Emergency Fund

Nearly 40% of Americans say they couldn’t cover a $400 emergency expense, according to the Federal Reserve. Use this check to change that.

Cover Back-to-School or Holiday Costs

The refund timing aligns well with fall expenses — like school supplies or holiday travel — when budgets are often tight.

Invest in Yourself

Consider using the money for a short course, certification, or personal development — investments that often pay off far beyond $400.

The Bigger Picture: Inflation and Household Economics

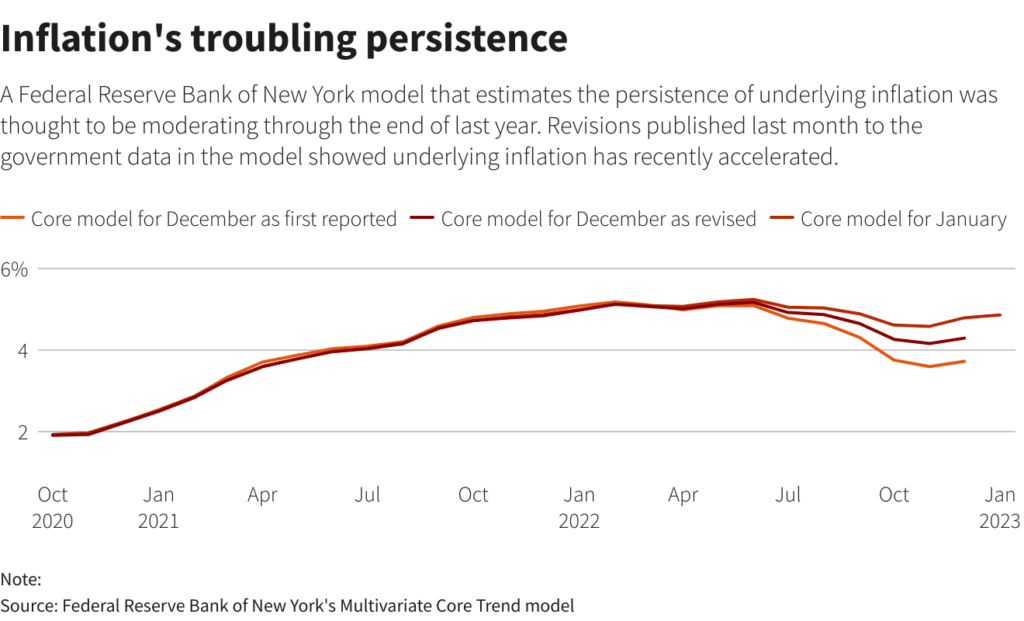

The Federal Reserve reports that inflation peaked at 9.1% in mid-2022 and has since eased to around 3.3% in 2025. While that’s a major improvement, it doesn’t erase years of accumulated price increases.

The average U.S. household still spends about $700 more per month than in 2019 to maintain the same lifestyle. For many families, one-time payments like this refund help bridge gaps and keep local economies stable.

“Refunds like this are smart economic tools,” said Dr. Ethan Morales, a public finance expert at SUNY Albany. “They return taxpayer money efficiently without adding debt or overheating the economy.”

Practical Tips to Stay Informed and Prepared

- File your taxes every year, even if you think you owe nothing. That’s how eligibility is determined.

- Keep your address updated with the state tax department. Returned checks take weeks to reissue.

- Sign up for official alerts from ny.gov for announcements about new programs.

- Stay alert for scams. Legit government communications never come via text or social media DMs.

$400 Inflation Refund Check Coming for these People – Check Eligibility & Payment Date

IRS Child Tax Credit Refund in October 2025: Check Payment Amount & Eligibility Update