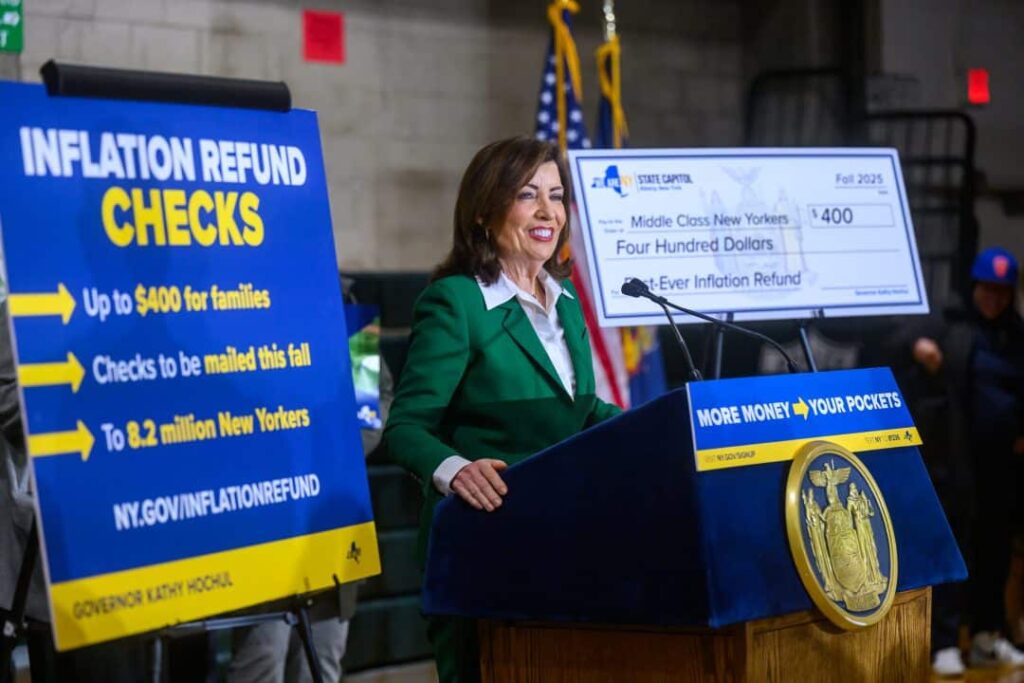

$400 Inflation Refund Check: Looking to score some extra cash this fall? The $400 inflation refund check is making waves, especially in New York, where millions of residents are set to receive these one-time payments as relief from the rising costs of living. Whether you’re a bustling New Yorker or just paying attention to national headlines, this check could help cushion the bite of inflation’s pinch on your wallet. In this article, we’ll break down everything you need to know about the $400 inflation refund check—who’s eligible, how much you can get, when to expect the cash, and some smart advice on what to do once you get it. No jargon, no hassle—just straight talk about your money and what it means for you.

$400 Inflation Refund Check

The $400 inflation refund check from New York is a welcomed financial boost designed to ease the burden of rising expenses caused by inflation. For many, this automatic payment represents a valuable opportunity to pay down debt, cover essential costs, or simply provide a bit of breathing room in their budgets this fall. Remember, the key steps are ensuring you’ve filed your 2023 taxes, meeting the income rules, and waiting patiently for the check to arrive in your mail.

| Topic | Details |

|---|---|

| Eligibility | New York residents who filed 2023 state income tax returns (Form IT-201) and meet income limits |

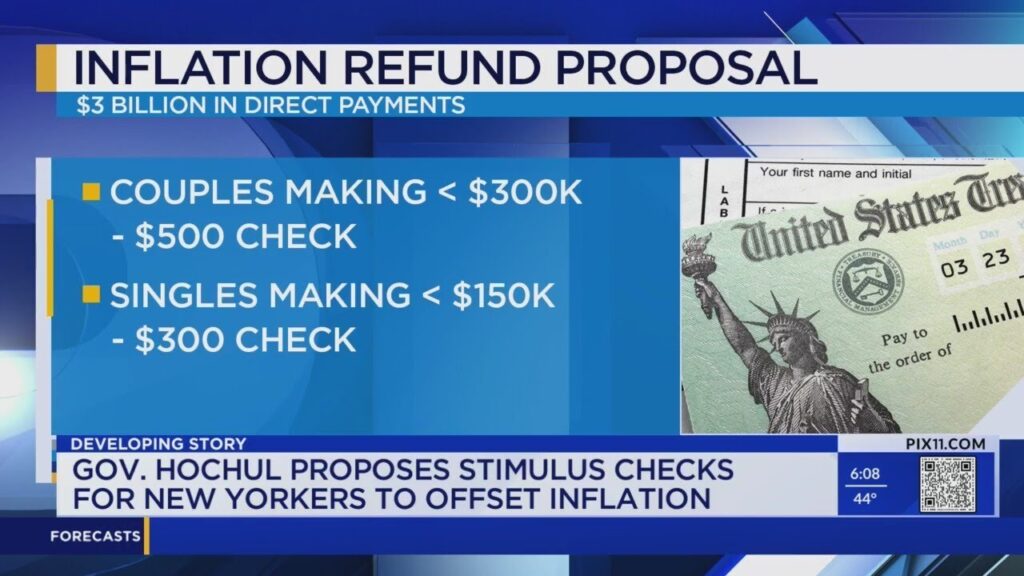

| Income Thresholds | Joint filers up to $300,000; Single filers up to $150,000 |

| Check Amounts | $400 max for joint filers with income ≤ $150,000; $300 for joint filers $150k-$300k |

| $200 max for singles ≤ $75,000; $150 for singles $75k-$150k | |

| Check Distribution | Started late Sept 2025, ongoing through Oct-Nov |

| How to Get It | Automatic; mailed to address on file—no application required |

| Official Info & Updates | Visit New York State Dept. of Taxation & Finance |

What’s the $400 Inflation Refund Check All About?

Inflation’s been rough, right? Groceries, gas, rent—they’re all creeping higher. So, states like New York stepped up, gathering extra sales tax revenues driven by inflation, and decided to share some of that cash back with taxpayers. This inflation refund check is a way to give middle-class folks a break, putting $150 to $400 back in their pockets this fall.

Governor Kathy Hochul championed this program, and for many New Yorkers, the good news is that it’s automatic—meaning if you filed your 2023 tax return and qualify by income, you don’t need to fill out a single form. The state’s got your info and will mail the check to the address they have on record.

Inflation in 2025: Why These Payments Matter

2025 has seen inflation cool off compared to the super highs of the last few years, but prices for everyday essentials still remain above pre-pandemic levels. Consumer price indexes show persistent increases, especially in energy, food, and housing, which pinch family budgets big time. These inflation refund checks are part of a broader government effort to ease cost-of-living pressures while the economy adjusts back to normal conditions.

Who’s Eligible? Breaking Down the Numbers

It’s not just a free-for-all giveaway. Here’s how eligibility breaks down for the New York inflation refund based on your filing status and income:

| Filing Status | Income Range | Refund Amount |

|---|---|---|

| Joint Filers | Up to $150,000 | $400 |

| Joint Filers | $150,001 to $300,000 | $300 |

| Single Filers | Up to $75,000 | $200 |

| Single Filers | $75,001 to $150,000 | $150 |

- No age restrictions and you must not be claimed as someone else’s dependent.

- The income is based on 2023 New York adjusted gross income from your state tax return.

- The refund targets working and middle-class families who felt the squeeze from inflation most.

If you filed as head of household, married filing separately, or surviving spouse, similar income rules apply based on adjusted gross income thresholds.

When Will You Get Your Check? The Mailing Schedule Explained

The state started mailing out the inflation refund checks on September 26, 2025, and will continue sending them in batches throughout October and November. It doesn’t matter where in New York you live or your ZIP code—the mailout happens in waves, so your neighbor might get theirs days or weeks before you.

If you moved since filing your 2023 taxes, it’s recommended to update your address with the New York State Department of Taxation and Finance to avoid missing your check. And be cautious: official checks will only come via mail or direct deposit if you’ve set it up—you won’t be asked for extra info via email, phone, or texts.

How to Track Your $400 Inflation Refund Check?

Curious where your check is? The New York State Department of Taxation & Finance provides an easy-to-use online tool to check your refund status anytime. Just head to their official refund status page, enter your Social Security number and other details, and track when your payment is expected.

Tracking your payment helps you avoid guessing or falling for fraudulent scams from folks pretending to help you get your money quicker.

How Does This Refund Compare to Previous Stimulus Efforts?

Remember the COVID-19 stimulus payments? Those were federal checks aimed at helping Americans during the pandemic crisis, with amounts varying by income and family size. The $400 inflation refund from New York is a smaller, state-level boost focused specifically on offsetting higher sales taxes and living costs, making it more targeted.

This new refund is not part of a federal stimulus but rather a state initiative from surplus revenues collected in an inflationary environment.

Are There Any Tax Implications?

Good news: The $400 inflation refund check generally does not count as taxable income on your federal or state returns. It’s a rebate, not income, so you won’t have to pay tax on this money. Still, you should retain records of the check and related communications from New York’s tax department just in case.

How Different Income Groups Benefit?

The tiered refund structure means middle and lower-income earners get a bigger chunk per person, recognizing their tighter budgets. Higher earners receive smaller refunds, reflecting both ability to absorb inflation and equitable distribution goals.

People at the lowest income bracket still get a meaningful $150-$200 boost, which can be a helpful add-on for essentials.

Beware of Scams: Protect Your Money

Unfortunately, scam artists love to strike when big money payments roll out. Watch out for:

- Fake texts or emails demanding personal information or “processing fees.”

- Phone calls claiming to be from the state asking for bank account info.

- Fake websites that look official but steal your data.

Remember: Official inflation refund checks are automatic. You never have to apply, pay fees, or provide sensitive info after filing your taxes. If in doubt, confirm authenticity at the official New York State website.

Economic Impact of the Refund Program

Putting billions back into New Yorkers’ pockets usually gets spent quickly on goods and services, helping local businesses and supporting economic activity. That’s the whole point: helping families maintain purchasing power while the economy stabilizes from inflation shocks.

How to Make the Most of Your $400 Inflation Refund Check?

Getting an extra few hundred bucks feels great, but it’s smart to make it work for you:

- Tackle High-Interest Debt: Think credit cards or payday loans. Paying down expensive debt first saves you more money over time.

- Build or Boost Your Emergency Fund: A little cash tucked away can shield you from future surprises.

- Cover Basic Expenses: Use it to catch up on bills like utilities, groceries, or gas.

- Invest in Skills or Tools: If you’re working or running a business, spend on something that can help you earn more down the line.

The key is to think about what’s most urgent for your situation—paying off debt often has the biggest payoff in the long run.

Step-by-Step Guide: Getting Your $400 Inflation Refund Check

Step 1: Confirm You Filed Your 2023 New York State Income Tax Return

Your eligibility hinges on having filed Form IT-201 for the 2023 tax year. If you didn’t file yet but owe taxes, get on that ASAP. No filing means no check.

Step 2: Check Your 2023 Income Against Eligible Thresholds

Review your tax return to confirm your adjusted gross income fits the eligibility criteria for your filing status.

Step 3: Verify Your Mailing Address on File with New York State

If you’ve moved, update your address online or via contact with the Department of Taxation and Finance to ensure delivery.

Step 4: Wait for the Check in the Mail (or Direct Deposit if Set Up)

The checks started mailing late September and will continue through November 2025.

Step 5: Protect Yourself from Scams

Beware of texts, emails, or calls claiming you need to provide extra info to get your check. The official checks are automatic—you won’t have to prove your identity or apply again.

Step 6: Use Your Refund Wisely

Whether paying debt, covering bills, or saving it, plan how best to use the money to ease financial stress or improve long-term stability.

$725 Monthly Stimulus Benefits Coming in October 2025: Check FESP Payment Eligibility & Payment Date

$1,390 Stimulus Payment For these People in October 2025 – Check Eligibility & Payment Date

$5,108 Social Security Payments in October 2025: Check Eligibility Criteria and Payment Dates!