$3,267 Supplement in Singapore: If you’ve been hearing chatter about the $3,267 Supplement in Singapore in October 2025, you’re not alone. It’s been making the rounds in the news, workplace conversations, and online forums. But what exactly is it? Is it some sort of bonus? Who qualifies for it? And perhaps the biggest question—when will the money hit your account?

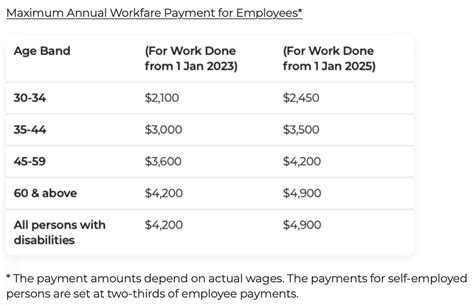

The answer lies in Singapore’s Workfare Income Supplement (WIS) scheme—a government initiative that has been around for nearly two decades. In 2025, the scheme gets an upgrade, with the maximum payout raised to S$3,267 for seniors and persons with disabilities. For many, this figure will appear in their October payout cycle, making it a hot topic. Let’s break it down into simple, practical steps, backed by official data and real-world examples, so you can understand what it means, whether you’re a worker in Singapore, a business owner, or just someone curious about social policy.

$3,267 Supplement in Singapore

The $3,267 Supplement in Singapore in October 2025 isn’t a new handout—it’s the enhanced cap of the Workfare Income Supplement. Employees can expect payouts in October for August work, while self-employed workers must plan around income declarations. With eligibility tied to income, age, citizenship, and property ownership, it’s not for everyone. But for the 440,000+ workers who benefit, it’s a vital boost that helps with today’s expenses and tomorrow’s retirement needs.

| Point | Details |

|---|---|

| Program Name | Workfare Income Supplement (WIS) |

| Maximum Supplement (2025) | Up to S$3,267 for seniors aged 60+ and persons with disabilities |

| Eligibility | Singapore Citizens, earning ≤ S$3,000/month, meeting property and other criteria |

| Payment Mode | Monthly for employees; Annual or conditional for self-employed persons |

| Deposit Timing | Employees: 2 months after work month. SEPs: By end-April or 2 months after income declaration |

| Beneficiaries (2024) | ~440,000 workers benefited; majority aged 50 and above |

| Official Source | CPF WIS Official Page |

A Quick Look Back: The History of WIS

When Singapore first introduced WIS in 2007, the economy was shifting. Globalization and automation were leaving some workers behind, especially those in lower-paying, labor-intensive jobs. The government’s goal was clear:

- Encourage work participation rather than handouts.

- Boost income security for lower-wage citizens.

- Build retirement savings through CPF top-ups.

At the start, the scheme offered payouts of around S$2,400 annually for older workers. Over time:

- 2010–2013: Expanded to cover more workers, including self-employed.

- 2016–2019: Payouts increased, eligibility tightened to target the right groups.

- 2020: Big reforms—higher payouts, more cash for daily use.

- 2025: Maximum annual payout climbs to S$3,267, the highest ever.

This steady growth shows how Singapore balances economic competitiveness with social safety nets.

Why October 2025 Matters?

Here’s the thing—WIS isn’t paid out in one giant check. Instead, it follows a rolling schedule:

- Employees: Payouts are two months after the work month. Work in August 2025? Expect your supplement in October 2025.

- Self-Employed Persons (SEPs): Payments are triggered after income declaration and MediSave contributions. If these happen late in the year, October can be when the first payouts land.

October also matters psychologically. It’s close to the year-end holiday season, when workers face higher expenses. For seniors and low-income earners, a supplement hitting the account in October helps with festive preparations and bills.

Who’s Eligible for the $3,267 Supplement in Singapore?

Eligibility is where most people get confused. Let’s simplify:

1. Age

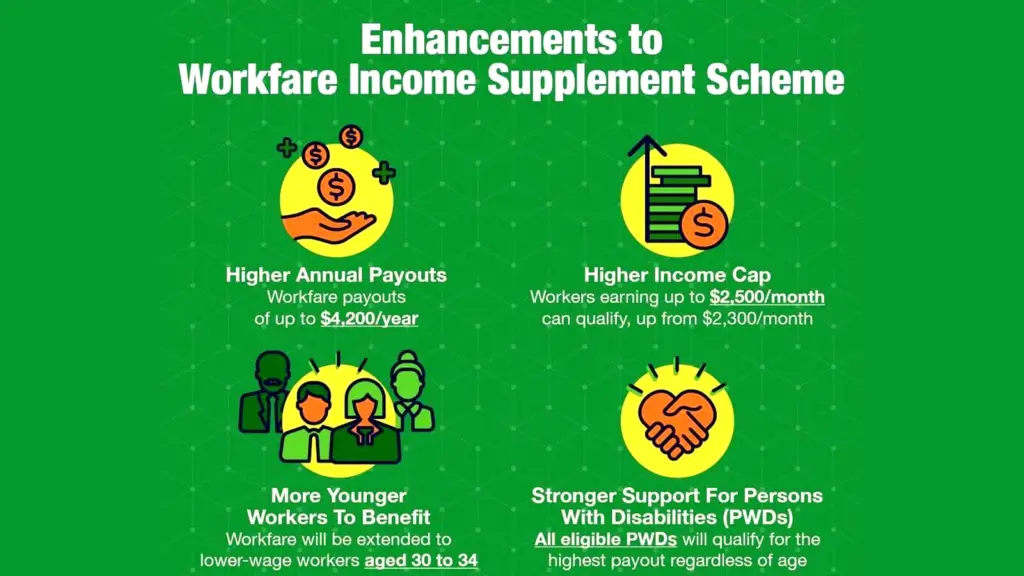

- Must be 30 or older.

- Seniors 60+ and persons with disabilities qualify for the full S$3,267 max payout.

2. Citizenship

- Only Singapore Citizens are eligible. Permanent Residents do not qualify.

3. Income Thresholds

- Monthly income ≤ S$3,000 (on average).

- Minimum income ≥ S$500 per month for employees.

- For self-employed, must declare net trade income.

4. Property Ownership

- Worker and spouse cannot own more than one property.

- Property’s annual value ≤ S$21,000.

5. Work Status

- Employees: Eligibility checked via CPF contributions.

- SEPs: Must file net trade income with IRAS and contribute to MediSave.

How the Payout Works: Cash vs CPF

WIS isn’t 100% cash in hand. It’s designed to meet two goals at once: give workers money now and secure their retirement later.

- Employees: Around 40% in cash, 60% credited into CPF.

- Self-Employed Persons: Larger portion goes into CPF, smaller portion in cash.

This mix makes sure that while workers can pay bills today, they’re also forced savers for tomorrow.

Real-Life Scenarios

Maria (Employee, Age 62, Part-Time Supermarket Worker)

- Earns S$1,800/month.

- Automatically qualifies for WIS via CPF contributions.

- Works in August → Sees payout by October 2025.

Raj (Self-Employed, Age 61, Taxi Driver)

- Declares trade income to IRAS and pays MediSave by March 2026.

- Gets payout in April 2026.

- If he delays till July, the payout shifts to September.

Aisha (Younger Worker, Age 35, Café Assistant)

- Earns S$700/month.

- Qualifies for smaller WIS payout.

- Payments credited monthly into CPF and partial cash.

How Big is the Impact?

WIS isn’t just a number—it affects real lives. According to CPF Board:

- 440,000+ workers received WIS in 2024.

- 70% of them were aged 50 and above, showing how critical the scheme is for seniors.

- Government spends over S$1 billion annually on Workfare and Silver Support combined.

That’s significant when you consider Singapore’s workforce size. It means 1 in 7 workers benefits from WIS.

Comparison With Other Schemes

Within Singapore

- Silver Support Scheme (SSS): Quarterly payouts for seniors with little CPF savings.

- GST Vouchers: Offsets consumption taxes for low-income households.

- Workfare: Encourages work and boosts wages directly.

Globally

- U.S. Earned Income Tax Credit (EITC): Tax refunds averaging US$2,500/year for low-wage workers.

- U.S. Social Security: Retirees get US$1,900/month on average.

- WIS in Singapore: Provides up to S$3,267/year, smaller in cash terms, but uniquely tied to retirement savings.

The difference is clear: Singapore’s model emphasizes work and savings more than direct cash welfare.

Step-by-Step: How to Check Eligibility for $3,267 Supplement in Singapore

- Login to CPF Portal using Singpass.

- Check employer contributions to ensure CPF payments are correct.

- Review monthly income (must be between S$500–S$3,000).

- Confirm property ownership (one property, annual value ≤ S$21,000).

- For SEPs: File income with IRAS and contribute to MediSave by March 31.

Impact on Employers

Employers often underestimate their role in WIS:

- Timely CPF contributions ensure workers get payouts on time.

- Misreporting wages can hurt workers’ eligibility.

- Supporting older workers helps companies keep experienced talent, while WIS cushions wage costs indirectly.

Tips to Maximize Your WIS

- Employees: Monitor CPF contributions monthly.

- SEPs: File and pay by March 31 each year.

- Plan finances: Don’t depend solely on WIS—treat it as a bonus, not your main income.

- Stay informed: Check official updates regularly, as rules change every few years.

Singapore $2,250 AP Payout Confirmed – When You’ll Be Paid & How to Qualify

Singapore’s $1,080 Support for Seniors in October 2025 – Dates, Eligibility & Key Details

Policy Goals Behind the $3,267 Increase

Why raise WIS now? The government is addressing:

- Rising costs of living (inflation averaged 5% between 2022–2023).

- Aging workforce (1 in 4 Singaporeans will be over 65 by 2030).

- Encouraging work longevity—keeping seniors in the job market reduces dependency on welfare.

Finance Minister Lawrence Wong emphasized in Budget 2024:

“Workfare is a cornerstone of our social compact. It rewards work, supplements income, and strengthens retirement security.”