The Social Security Administration (SSA) has confirmed that the $2,831 Social Security payment represents the maximum monthly retirement benefit available at age 62 in 2025 for individuals with consistently high lifetime earnings. For those born in April 1963, who turn 62 this year, the figure has drawn attention as many approach eligibility for early retirement benefits.

$2,831 Social Security Payment

| Key Fact | Detail/Statistic |

|---|---|

| Maximum early benefit at 62 (2025) | $2,831 monthly |

| Full retirement age for 1963 births | 67 years |

| Earliest claiming date for April 1963 births | April 2025 |

| Requirement | 40 work credits, high earnings history |

| Official Website | SSA.gov |

As Americans born in 1963 enter retirement age, policymakers face increasing pressure to ensure Social Security remains solvent. Proposals under discussion include raising the payroll tax cap and adjusting eligibility ages, though no reforms have yet passed Congress.

What the $2,831 Payment Means

The $2,831 Social Security payment is not a guaranteed benefit. It reflects the maximum possible payout for individuals who claim retirement at age 62 in 2025, provided they have consistently earned at or above the annual taxable wage base throughout their careers.

According to the SSA, the majority of retirees will receive lower benefits. Monthly payments are calculated using an individual’s average indexed monthly earnings, adjusted for the age at which benefits are claimed.

“The maximum benefit is achievable only for those with very high and steady earnings histories,” the Social Security Administration noted in its 2025 retirement guidance.

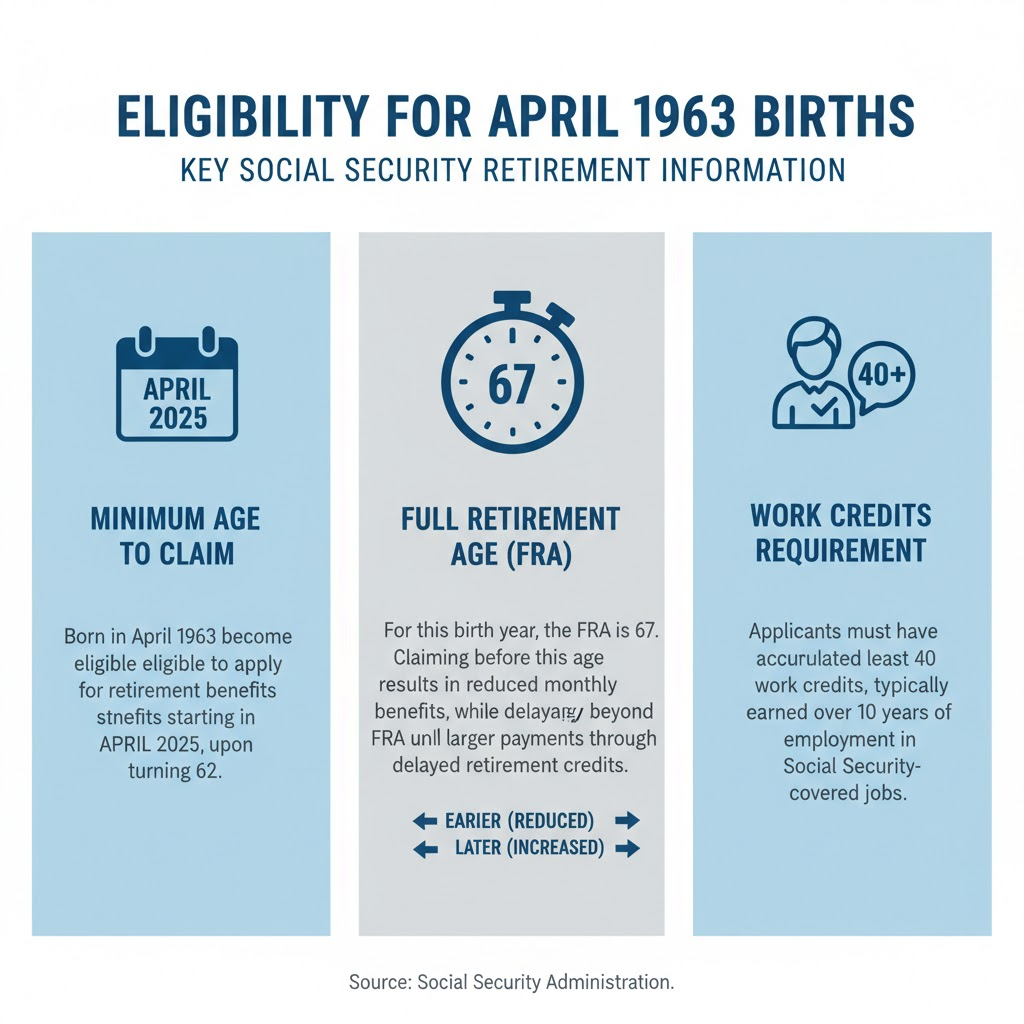

Eligibility for April 1963 Births

Minimum Age to Claim

Those born in April 1963 become eligible to apply for retirement benefits starting in April 2025, upon turning 62.

Full Retirement Age (FRA)

For this birth year, the FRA is 67. Claiming before this age results in reduced monthly benefits, while delaying beyond FRA until age 70 yields larger payments through delayed retirement credits.

Work Credits Requirement

Applicants must have accumulated at least 40 work credits, typically earned over 10 years of employment in Social Security-covered jobs.

Impact of Claiming Early

Claiming benefits at 62 reduces monthly payments permanently. For those born in 1963, the reduction can be as high as 30 percent compared to waiting until age 67. Conversely, postponing benefits beyond FRA increases monthly income until age 70.

“Waiting beyond the full retirement age can result in a much larger benefit,” said David Certner, Social Security policy director at AARP, in a statement earlier this year.

How to Claim the Benefit

- Review Earnings Records

- Access the my Social Security online account to verify work history and benefit estimates.

- Apply

- File online, by phone, or at a local SSA office. The SSA advises applying three months before the intended start date.

- Provide Documentation

- Required documents include proof of identity, birth certificate, citizenship or residency documentation, and banking details for direct deposit.

- Benefit Start Date

- Payments begin the month after eligibility. For April 1963 births, the first payment would arrive in May 2025 if benefits are claimed immediately at age 62.

Broader Context: Retirement Security

The $2,831 maximum reflects broader questions about retirement security in the United States. The SSA has warned that trust fund reserves supporting retirement benefits could face depletion by 2034 without reforms.

The Congressional Budget Office notes that while early claiming provides immediate income, it often reduces lifetime benefits. Financial experts recommend considering health, life expectancy, and work prospects before deciding when to file.

$697 Direct Deposit Checks in October 2025; How to get it? Check Eligibility

US $4983 Direct Deposit in October 2025 For Everyone – Check Eligibility & Payment Date

FAQ

When will my first payment arrive if I claim at 62?

If you were born in April 1963 and claim as soon as you turn 62, your first payment would likely be issued in May 2025, since the SSA pays benefits one month in arrears.

Can I work while receiving Social Security at 62?

Yes, but if you earn above the annual earnings limit set by the SSA, part of your benefits may be withheld. In 2025, the limit is $22,320 per year for those below FRA. Once you reach FRA, the limit no longer applies.

What if I wait until full retirement age?

At 67, you would receive your full calculated benefit with no reduction. For high earners, this could be significantly more than the $2,831 available at 62.

What happens if I delay until 70?

Delaying beyond 67 increases benefits by about 8 percent per year up to age 70, resulting in the highest possible monthly payment.

Is the $2,831 amount adjusted for inflation?

Yes. Social Security benefits are adjusted annually for inflation through the Cost-of-Living Adjustment (COLA), which ensures payments keep pace with rising consumer prices.