$2600 CRA Payment: If you’ve been hearing the buzz about a $2600 CRA payment in November 2025 and wondering whether you qualify, you’ve hit the right spot. This article will break down what’s really going on with Canada Revenue Agency (CRA) payments this November, who’s eligible, and how the payments come together—explained in a simple, clear way anyone can understand, but with enough detail for financial pros too. November is one of the busiest months when the CRA issues multiple government benefits. These payments sometimes arrive around the same time, making it seem like a big lump sum—such as the $2600 amount that’s been talked about. But the truth? There is no new, single $2600 payment announced by the CRA. Instead, the $2600 figure reflects the combined total of several regular benefits Canadians might receive during November.

Table of Contents

$2600 CRA Payment

The $2600 CRA payment in November 2025 isn’t a sudden, new payment but the sum of various federal and provincial benefits issued during the month. Understanding what makes up this figure can help you budget smarter, avoid fraud, and take full advantage of government support. Keep your tax records updated, monitor your CRA My Account regularly, and plan your finances based on payment schedules. This proactive approach can transform what some see as payday chaos into a predictable and reassuring boost.

| Highlight | Details |

|---|---|

| Total Amount Potential | Up to $2600 as a combined total of various benefits |

| Main Benefits Included | Canada Child Benefit (CCB), Canada Workers Benefit (CWB), Old Age Security (OAS), |

| Guaranteed Income Supplement (GIS), Canada Pension Plan (CPP), Provincial benefits | |

| Important Payment Dates | CWB (Nov 15), CCB (Nov 20), OAS & CPP (Nov 26), Provincial benefits vary |

| New vs Regular Payments | No new one-time $2600 payment; this amount sums existing regular payments |

| Eligibility Factors | Family size, income, age, residence, tax-filing status |

| Official Resource | Canada.ca CRA Benefits |

What Exactly Is the $2600 CRA Payment?

The $2600 figure is often confusing. Many think it’s a new government handout, but really it’s a sum of multiple payments several Canadians get based on eligibility for different benefits. These benefits include:

- Canada Child Benefit (CCB): Supports families raising children under 18.

- Canada Workers Benefit (CWB): A refundable tax credit aimed to help workers with low to moderate income.

- Old Age Security (OAS) & Guaranteed Income Supplement (GIS): Monthly financial support for seniors.

- Canada Pension Plan (CPP): Retirement benefit based on contributions during working years.

- Provincial benefits: These vary by province, including programs like Ontario’s Trillium Benefit or Alberta’s Child and Family Benefit.

These payments are calculated separately and sent on different dates, but if you qualify for multiple benefits, they can add up to $2600 or more in November.

November 2025 CRA Payment Schedule (Detailed)

Here’s when you can expect the major payments in November 2025:

| Benefit | Payment Date | Details |

|---|---|---|

| Advanced Canada Workers Benefit (ACWB) | November 10-15, 2025 | Quarterly advance installment |

| Ontario Trillium Benefit (OTB) | November 10, 2025 | Provincial credit helping with energy and property tax |

| Canada Child Benefit (CCB) | November 20, 2025 | Monthly payment for families with children |

| Old Age Security (OAS), CPP | November 26-29, 2025 | Monthly retirement and seniors’ benefits |

| Alberta Child and Family Benefit (ACFB) | November 27, 2025 | Provincial family-related benefit |

| GST/HST Credit | January 3, 2026 | Quarterly sales tax rebate (not paid in November) |

| Canada Carbon Rebate | April 2026 | Federal climate action incentive payments |

Because benefits span different deposit days, many Canadians see multiple payments in November — all adding up.

Who Is Eligible for $2600 CRA Payment?

Understanding eligibility can be tricky, but here’s a breakdown:

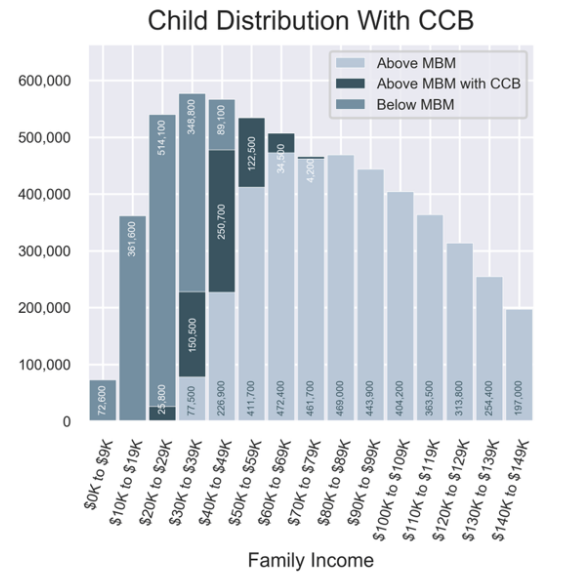

Canada Child Benefit (CCB)

- You must be the primary caregiver of children under 18 who live with you.

- You must be a Canadian resident for tax purposes.

- Your family income influences your payment amount—the lower the income, the higher the benefit.

- Payments are adjusted based on the number and age of children.

- In 2025, CCB eligibility rules were expanded to continue payments for six months after a child’s death if other eligibility conditions are met.

- To maintain eligibility, you and your spouse or common-law partner must file tax returns every year, even if you had no income.

Canada Workers Benefit (CWB)

- Designed for low to moderate-income working Canadians.

- You must file your tax return and meet income thresholds.

- Includes advance quarterly payments like those in November.

- The benefit incentivizes work and helps offset living expenses.

Old Age Security (OAS) & Guaranteed Income Supplement (GIS)

- Available to seniors age 65 and older meeting residency requirements.

- GIS uplifts low-income seniors beyond the base OAS pension.

- Benefits adjust annually based on inflation rates and government budgets.

- Recipients must file tax returns to remain eligible and receive supplements.

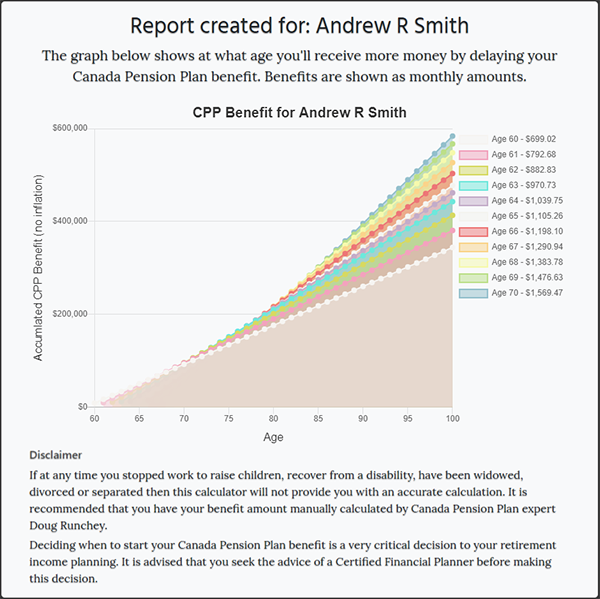

Canada Pension Plan (CPP)

- Monthly retirement income for contributors based on their earnings and contributions.

- Payment amounts depend on how much and how long you contributed.

- Applies to retirees, disability beneficiaries, and survivors.

Provincial Benefits

- Provinces add their own supports. For instance:

- Ontario’s Trillium Benefit assists with energy costs and property taxes.

- Alberta’s Child and Family Benefit helps families with children financially.

- Provinces have their own eligibility criteria, usually based on residence and income.

- Some require separate applications; others are automatic if you receive federal benefits.

Tax Filing and Eligibility

- Filing your 2024 tax return on time is crucial.

- CRA uses this information to calculate your benefit eligibility.

- If you miss filing or file late, benefits can be delayed or reduced.

- Always keep your personal info updated to avoid payment disruptions.

How to Maximize and Manage Your Benefits?

File Taxes Accurately and Early

Timely tax filing ensures benefits flow without interruption. This is especially important for families, seniors, and workers relying on monthly payments.

Use Direct Deposit

Direct deposit is the fastest and safest way to get your CRA payments. Avoid cheques by registering your bank details through CRA’s online portal.

Update CRA With Life Changes

If you move, change your marital status, or update your family size, inform CRA immediately. Changes affect your benefit amounts and eligibility.

Budget Based on Payment Dates

Knowing when payments arrive helps with money management. November often feels like a “double-pay” month when multiple benefits come in.

Explore Provincial Benefits

Research your province’s extra benefits and credits. They might require separate registration but can provide meaningful financial support.

Beware of Scams: Protect Yourself

Big payment months attract scammers pretending to be CRA officials. Here’s how to stay safe:

- CRA does not call or email asking for immediate payments or personal info.

- Always use official CRA websites or “My Account” to verify your payment and eligibility.

- Genuine CRA deposits will show as “CRA DIRECT DEPOSIT” in your bank statement.

- Report suspicious calls, emails, or texts to the Canadian Anti-Fraud Centre.

Real-Life Examples

- Sarah’s Story: A single mother of two qualifying for CCB and Canada Workers Benefit receives around $1,800 in November. This money covers school supplies, rent, and groceries, making a big difference for the family.

- John & Mary’s Story: Retired seniors receiving OAS, GIS, and CPP totaling approximately $2,400 in November, helping them stay warm through the cold months and manage groceries.

- Ontario Family’s Experience: Along with federal benefits, they get $350 from the Ontario Trillium Benefit in November, bringing their total support to around $2,600, which helps cover winter heating and utility bills.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada $300 Federal Payment in November 2025; Who will get it? Check Eligibility

$360 Canada OTB In November 2025 – These people are eligible, Check Eligibility & Payment