$250 Rebate for Working Canadians: Inflation has hit wallets hard. Grocery prices are up, rents are climbing, and even a trip to the gas station can make anyone wince. That’s why the $250 Rebate for Working Canadians and the GST-free shopping initiative have become some of the most talked-about topics in Canada’s 2025 economic landscape. These measures are designed to ease the squeeze on everyday Canadians — especially those who work hard, pay their taxes, but don’t usually qualify for income-tested benefits.

If you’ve been scrolling through headlines or social media posts asking “Am I getting that $250 rebate?” or “When is the GST-free shopping happening again?”, this guide will lay everything out clearly, with data, examples, and official links you can trust.

Table of Contents

$250 Rebate for Working Canadians

The $250 Rebate for Working Canadians and temporary GST-free shopping reflect the government’s effort to give everyday earners a financial breather during challenging times. While these aren’t permanent solutions, they offer genuine relief and signal recognition for millions of workers. Whether or not the October 2025 extension happens, one thing’s clear — filing your taxes and staying informed ensures you won’t miss out on valuable benefits.

| Topic | Details |

|---|---|

| Program Name | $250 Rebate for Working Canadians & Temporary GST-Free Shopping |

| Announced By | Government of Canada |

| Rebate Amount | $250 one-time, tax-free payment |

| Eligibility | Canadians who worked in 2023; income ≤ $150,000 |

| Application Required? | No – CRA pays automatically if you qualify |

| Payment Date | Expected Spring 2025; October 2025 extension unconfirmed |

| GST-Free Period | Dec 14, 2024 – Feb 15, 2025 (official; no renewal announced yet) |

| Official Resource | Government of Canada – Working Canadians Rebate |

Why $250 Rebate for Working Canadians & GST-Free Shopping Benefits Matter in 2025?

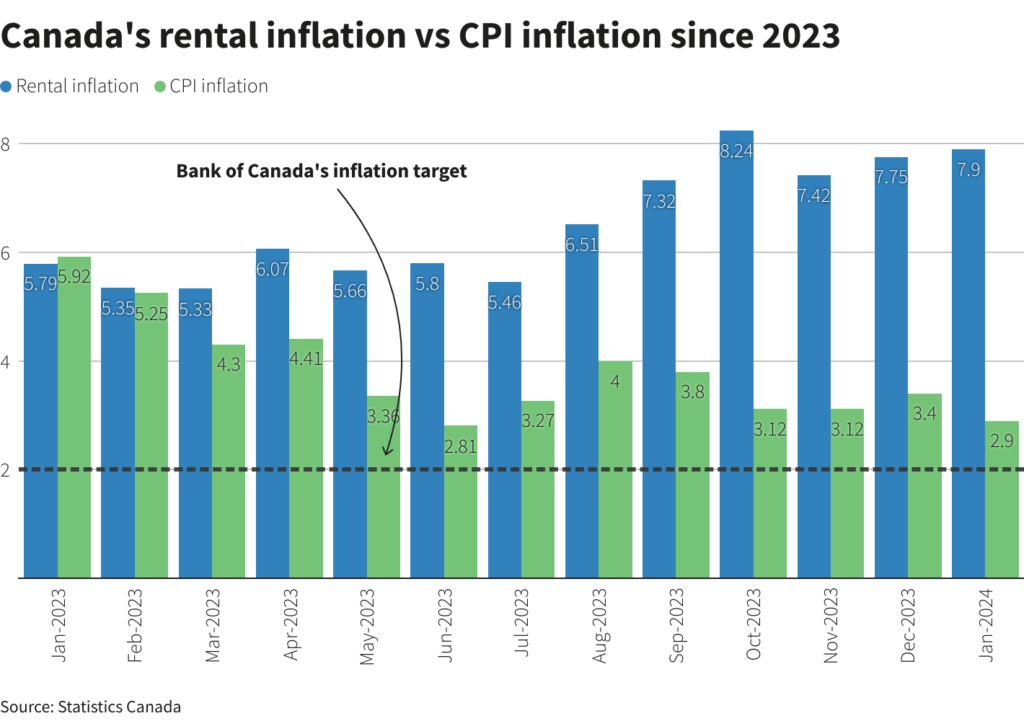

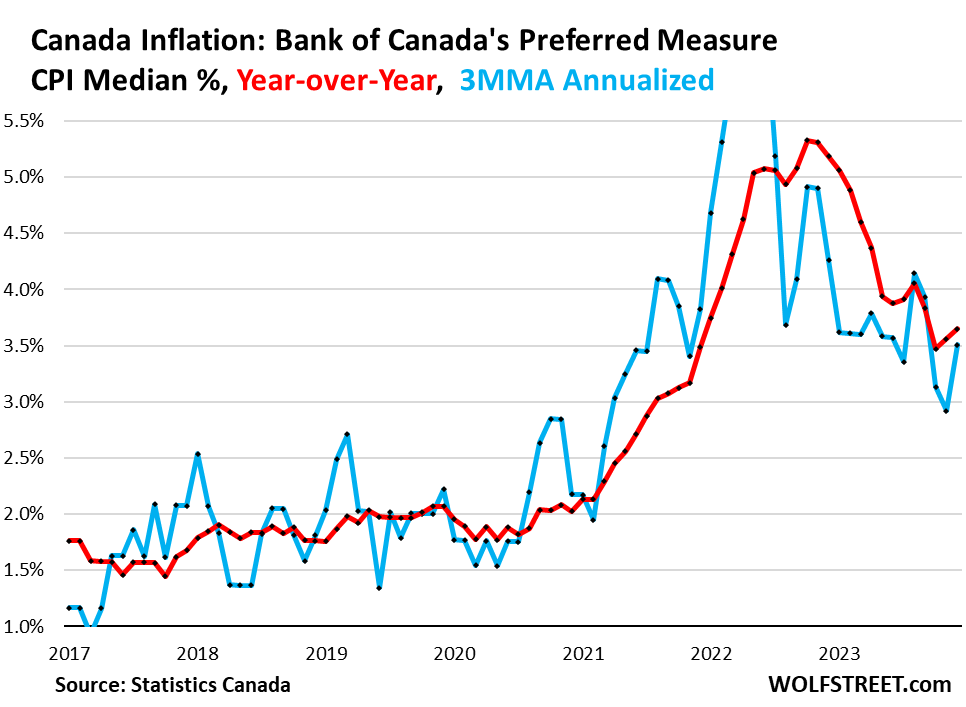

Let’s be real — Canada’s cost of living has been on a tear. According to Statistics Canada, grocery prices rose 5.4% year-over-year in 2024, and average rent for a one-bedroom apartment hit over $1,800 a month nationwide.

For many Canadians, government benefits like the GST credit or climate rebate only go so far. That’s where the Working Canadians Rebate comes in — targeting the middle-income earners who keep the economy moving but often fall between the cracks of existing supports.

The GST-free shopping period, meanwhile, gave consumers temporary relief from sales taxes on essentials — offering a rare, no-red-tape way to save directly at the checkout counter.

Understanding the $250 Rebate for Working Canadians & GST-Free Shopping

Who Qualifies?

Here’s a clear breakdown of who’s eligible for the rebate:

- You worked in 2023 — Whether as an employee or self-employed individual.

- Filed your 2023 taxes by December 31, 2024.

- Income limit: Net income must be $150,000 or less.

- Canadian residency: You must be a resident on March 31, 2025.

- Not incarcerated for 90+ consecutive days before April 1, 2025.

- Alive on April 1, 2025.

That’s it. No extra forms, no special application. The payment will be issued automatically by the Canada Revenue Agency (CRA) — just like the GST credit or Climate Action Incentive payments.

Payment Method & Timing

The government expects to distribute payments in Spring 2025, likely through direct deposit or mailed cheques. However, there’s been online chatter about a possible October 2025 second round. As of now, no official government source has confirmed this.

Why was $250 Rebate for Working Canadians & GST-Free Shopping Introduced?

The rebate and tax break are part of Ottawa’s broader plan to help working Canadians cope with inflation while keeping the economy stable.

According to Finance Canada, about 18.7 million Canadians are eligible for the $250 rebate, translating to roughly $4.7 billion in direct payments nationwide. This isn’t just a political move — it’s a strategic attempt to boost consumer spending and sustain small businesses during uncertain times.

Experts from The Globe and Mail and CBC News note that while $250 won’t fix systemic inflation, it does offer symbolic and psychological relief — reminding Canadians that their government recognizes the financial pressure they face.

GST-Free Shopping: What It Means

Between December 14, 2024, and February 15, 2025, Canadians were able to shop without paying GST/HST on certain essential goods.

Items Covered Included:

- Fresh produce and grocery staples

- Children’s clothing and footwear

- Feminine hygiene and baby products

- Diapers and formula

- Home essentials like detergent and soap

This “tax holiday” saved families roughly 5% to 13% on everyday purchases, depending on the province.

For example, a family of four spending $1,200 on essentials during that period saved around $60–$100 in taxes. It wasn’t life-changing, but for many, every dollar mattered.

Although the program ended in February 2025, there’s speculation that the government may bring back GST-free periods during high-cost seasons (like Thanksgiving or Christmas). No official statement yet, but public support for renewal is strong.

Step-by-Step: How to Get Your $250 Rebate

1. File Your 2023 Taxes:

You must submit your tax return before December 31, 2024. Even if you had a low income, filing ensures CRA has your details.

2. Update CRA Information:

Log in to your CRA MyAccount and confirm your bank info and mailing address.

3. Automatic Payment:

If eligible, you’ll receive the rebate automatically in Spring 2025 — no application required.

4. Check Status:

If you don’t receive your rebate by late May 2025, contact CRA at 1-800-959-8281 or through the secure message center in MyAccount.

How This Rebate Differs from Other Canadian Programs?

| Program | Amount | Frequency | Eligibility | Key Focus |

|---|---|---|---|---|

| Working Canadians Rebate | $250 | One-time | Workers earning ≤ $150K | Reward for employment contribution |

| GST/HST Credit | $496 avg (single) | Quarterly | Low to moderate income | Helps with living costs |

| Canada Workers Benefit (CWB) | Up to $1,518 | Annual (tax-based) | Lower income earners | Boosts take-home pay |

| Climate Action Incentive | $250–$1,000+ | Quarterly | Provincial | Compensates for carbon pricing |

While many benefits focus on low-income households, the Working Canadians Rebate fills a missing gap — supporting the middle class, especially those earning too much for traditional aid but still struggling with rising costs.

Economic and Social Implications

Economically, this rebate injects billions directly into the consumer market, giving a modest but measurable boost to spending.

For small businesses, it could mean slightly higher sales, especially in retail and grocery sectors. According to Business Council of Canada research, even temporary stimulus programs like this can increase short-term GDP growth by 0.1–0.2%.

Socially, the rebate also reinforces a broader goal: acknowledging that working Canadians are the backbone of the economy. It’s a recognition that even those earning decent wages are feeling the pinch — a message that resonates deeply across provinces.

However, financial experts also caution that this rebate should be viewed as a “band-aid,” not a long-term fix. CIBC Economics noted in a 2025 report that without broader tax reforms or cost-control measures, such payments won’t significantly reduce economic inequality.

Practical Ways to Maximize the Benefit

Even though $250 might not sound like much, here are some smart ways to make it go further:

- Pay down small debts: Use it to clear credit card interest or utility arrears.

- Bulk-buy essentials: Stock up on non-perishables during sales or future GST-free windows.

- Emergency fund: Stash it in a high-interest savings account — every little bit counts.

- Support local: Spend part of it at local businesses to circulate money within your community.

If you combine this with existing GST credits and Climate rebates, some families could receive $700–$1,000 in total relief across early 2025.

Beware of Scams and False Info

Whenever money is involved, scammers follow. The CRA never sends texts or direct payment links.

Common scam messages include:

“You’ve received your $250 Working Canadians rebate. Click here to claim.”

Also, be cautious about fake news articles circulating online about an October 2025 GST-free shopping week. As of now, there is no confirmation of that extension.

Expert Opinions

Economist David Macdonald from the Canadian Centre for Policy Alternatives said that while the rebate “won’t dramatically shift affordability,” it “serves as an important gesture for working Canadians caught in the middle.”

Meanwhile, Toronto-based analyst Erin O’Toole noted that “programs like these restore consumer confidence and encourage tax compliance,” since filing taxes becomes more directly rewarding.

CRA Announces Payment Dates for October 2025: Know CRA latest payment date and amount

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date