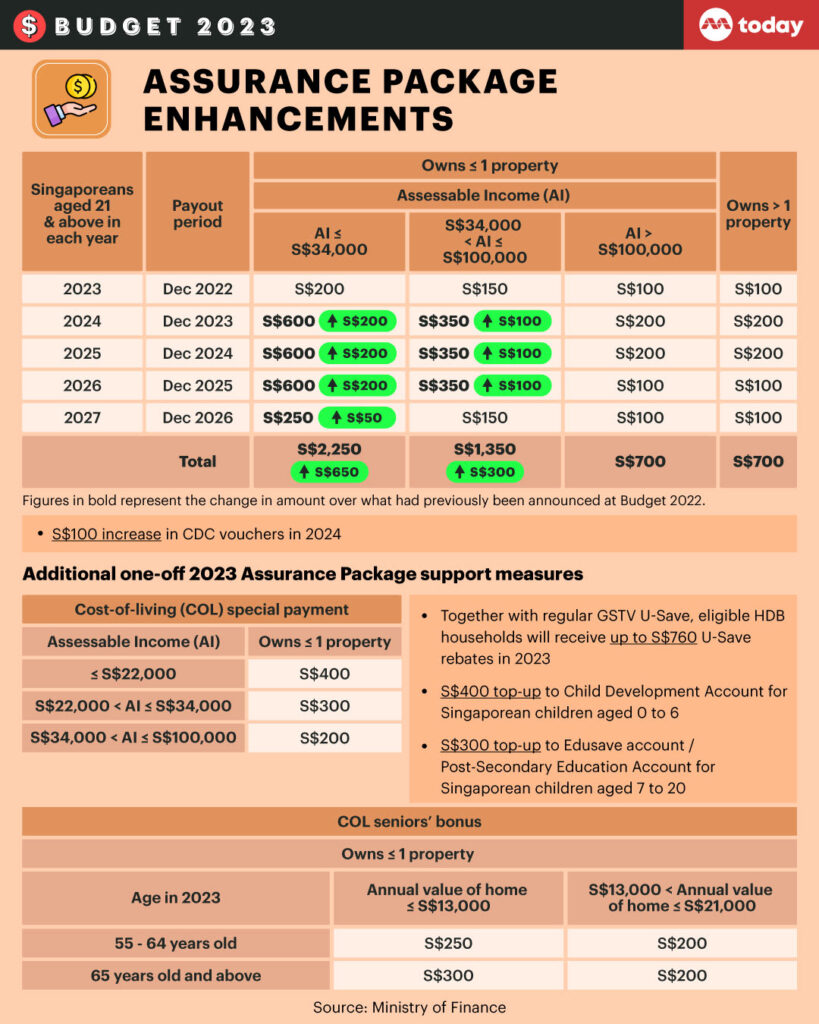

$2,250 AP Cash Payout in Singapore: Are you a Singaporean wondering about the $2,250 Assurance Package (AP) Cash Payout scheduled for November 2025? You’re not alone. This payout is part of Singapore’s government effort to help residents tackle rising living costs by providing direct financial aid. Whether you’re a young working professional, a parent, or a retiree, understanding the ins and outs of this package can help you plan your budget with confidence and ease. The Assurance Package cash payouts are distributed over five years (2022 to 2026) as part of a broader social support framework to ensure no Singaporean gets left behind during times of inflation and economic challenges. So, let’s break it down for you: who qualifies, how much will you get, when you can expect it, and how you can make the most of it.

Table of Contents

$2,250 AP Cash Payout in Singapore

Understanding the $2,250 Assurance Package cash payout is crucial for Singaporeans planning their finances in 2025 and beyond. This initiative offers essential relief amid cost-of-living pressures, targeting eligible citizens with fair, automatic cash assistance yearly up to 2026. Ensure your bank details and PayNow-NRIC link are up to date, plan your budget smartly by including this aid, and stay informed to maximize benefits.

| Topic | Details |

|---|---|

| Eligible Age | Singapore citizens aged 21 and above |

| Total Cash Payout | Up to $2,250 over five years (2022 to 2026) |

| 2025 Payout Amount | Between $100 to $600 depending on income and property ownership |

| Scheduled Payment Date | December 2025 |

| Payment Method | Via PayNow-NRIC linked bank account by default or bank transfer/GovCash |

| Eligibility Factors | Based on assessable income and property ownership |

| Official Site for Eligibility | Assurance Package Official |

What is the Assurance Package Cash Payout?

The Assurance Package (AP) Cash Payout is a government-administered cash assistance scheme designed to provide financial relief against rising costs of living. Since its launch, the government has distributed cash payouts annually to Singapore citizens who meet eligibility criteria based on their income and property ownership.

The idea is simple: Singapore wants to take care of its people during inflationary times, ensuring everyone gets a bit of extra cash to help with grocery bills, utilities, transportation, or everyday expenses. The assistance is automatic — no need to apply — making it hassle-free.

Who Qualifies for the $2,250 AP Cash Payout in Singapore?

To qualify for the AP cash payout, here are the key criteria:

- You must be a Singapore citizen residing in Singapore.

- You must be 21 years old or older in the relevant payout year.

- Your assessable income (income after deductions) must fall into specific brackets, determined using your latest tax assessment.

- You should typically own no more than one property to qualify for the highest payouts.

- Non-citizens and foreign residents are not eligible for this cash payout.

What is Assessable Income?

Assessable income is your total income from employment, business, rent, etc., minus any allowable deductions such as donations or business expenses. You can find your assessable income on your Tax Notice of Assessment issued by the Inland Revenue Authority of Singapore (IRAS).

Example: If your income is $35,000 and you donated $5,000, your assessable income is $30,000.

How Much Can You Expect to Receive?

The total payout spans up to $2,250 over five years (2022-2026) for those meeting the income and property criteria. The 2025 payout varies based on income and property ownership:

| Income and Property Condition | 2025 Estimated Payout |

|---|---|

| Income ≤ $34,000, Own 0-1 Properties | $600 |

| Income $34,001 to $100,000, Own 0-1 Properties | $350 |

| Income > $100,000 or Owns > 1 Property | $100 to $200 |

When and How Will You Get Your Payment?

The 2025 payout is scheduled for December, not November strictly, but funds are typically credited toward the end of the year.

Payments are done automatically via your PayNow-NRIC linked bank account. If you haven’t linked your account by the deadline, the government will credit your registered bank account or use GovCash, so you don’t need to worry about missing out.

Make sure to update your bank details or linking status before November through the official e-service portals to avoid hiccups in payment processing.

History and Evolution of the Assurance Package

The Assurance Package was first introduced at Budget 2020 with an initial allocation of $6 billion intended to cushion Singaporeans from the Goods and Services Tax (GST) hike and inflation. Since then, it has undergone several enhancements and expansions to provide more targeted and effective support:

- November 2022: A $1.4 billion top-up was announced to combat ongoing inflation and the upcoming GST increase in 2023, increasing the package’s total size to roughly $8 billion.

- 2023: The package was further enhanced by an additional $1.1 billion Cost-of-Living (COL) Support Package announced in September 2023, raising the total AP fund to over $10 billion, reinforcing support for middle- and lower-income households.

- The AP has been structured to provide automatic annual payouts from 2022 to 2026, ensuring sustained relief for Singaporeans over several years.

- Seniors (55 years and older) receive additional AP Seniors’ Bonus payouts, totaling between $600 and $900 over three years beginning in 2023, tailored to help with healthcare and retirement costs.

This phased, multi-year approach allows the government to adjust support as inflation trends evolve, without requiring repeated applications or manual interventions from recipients.

Practical Tips for Making the Most of Your $2,250 AP Cash Payout in Singapore

- Budget Wisely: Use the payout to cover essential expenses like groceries, utilities, transportation, or tuition fees. This direct cash injection is meant to ease immediate financial pressure.

- Save Some for Emergencies: Even a small portion tucked away monthly can add a useful cushion.

- Pay Off High-Interest Debt: If you have credit card debts or personal loans, allocate some payout money to reduce interest charges.

- Invest in Financial Literacy: Consider free government or community programs that teach budgeting and money management. This can stretch your payout benefits further.

- Plan Long-Term: If stable, think about medium-risk savings or investing options that can grow your funds, such as CPF top-ups or SRS accounts.

- Stay Informed: Keep track of the official AP website and government portals for updates on payout dates and any changes in eligibility or amounts.

How the AP Cash Payout Fits with Other Government Support?

The AP Cash Payout complements other Singapore government schemes like:

- GST Voucher Scheme: Offers rebates, cash, and Community Development Council (CDC) vouchers to help lower- to middle-income Singaporeans offset GST.

- AP MediSave Bonus: Annual top-ups to CPF MediSave accounts for healthcare needs.

- Special COL Payments: One-off or additional payments during particularly tough inflationary periods.

- Seniors’ Bonus: Additional cash payouts for seniors aged 55+ to ease their healthcare and daily living expenses.

By layering these supports, Singapore aims to cover diverse needs, from everyday expenses to healthcare, ensuring comprehensive social safety nets.

Global Perspective

Many countries have rolled out cost-of-living supports similar to Singapore’s Assurance Package, though methods and sizes vary:

| Country | Support Type | Frequency | Key Eligibility |

|---|---|---|---|

| Singapore | Assurance Package Cash Payout | Annual (over 5 years) | Income & property-based criteria |

| United States | Economic Impact Payments | One-time or periodic | Income thresholds, citizenship |

| Canada | GST/HST Credit & Stimulus | Quarterly/One-time | Income and residency criteria |

| Australia | Cost of Living Payment | Annual/One-time | Income & residency |

Singapore’s approach stands out because it offers predictable, long-term, and automatic payments, minimizing administrative hurdles and ensuring broad coverage.

Government Confirms S$1,300 Cash Payout – Are You Getting Paid in October? Check Eligibility

Government Confirms $2,250 AP Cash Payout – Check Your Status Before Payments Begin

$1,080 Old Age Payment in November 2025: How Singapore’s Social Security Scheme Operates!