$2,200 One-Time Payment: that phrase has got a lot of ears perking up across Canada lately. People are wondering: Is it true? Who gets it? How do I find out if I qualify? In this article, I’ll walk you through everything we know so far (and what we don’t), break it down simply, and give you practical steps to stay one step ahead.

Table of Contents

$2,200 One-Time Payment

The idea of a $2,200 one‑time payment in October 2025 is powerful—especially for those under financial strain. But as of now, it remains unconfirmed. No official word from Service Canada or ESDC has surfaced. That said, many pieces are in place for something like this to happen: the government has done one‑time payments before, and the infrastructure (Service Canada, MSCA, benefit systems) is extensive. The question is whether political will, budgeting, and logistics will align. What you can do is get prepared: watch official sources, have your documents in a row, update bank details, and stay safe from scams. If the program becomes real, you’ll be ready to act and to help others. If it doesn’t, you’ll have learned more about how Canadian social programs work — and you’re better equipped next time a new benefit rumor comes along.

| Topic | Current Reality / Best Evidence | What to Monitor / What Could Change |

|---|---|---|

| Official confirmation | None so far from Service Canada, ESDC, or Canada.ca | Watch Government of Canada news releases, fall budget, Service Canada updates |

| Possible eligible groups (rumored) | Seniors, persons on disability, low‑income households | These are not confirmed; the final list may differ or be narrower |

| Automatic vs application | Rumors say automatic for existing benefit recipients; application for others | Real rules may require registration or verification |

| Timing & distribution | Rumors say October 2025 | Could be delayed, phased, or split across months |

| Risk of misinformation | High | Always cross-check with official Canada.ca / Service Canada sources |

| Government capacity & cost | ESDC is already one of Canada’s biggest spending departments (≈ $94.48B in FY 2024) (canadaspends.com) | New payments require budget allocation, legislative backing, and administrative readiness |

| Comparable precedent | Canada has done one‑time or stimulus payments (COVID era) | But each program differs in scale, timing, and rules |

Why Are Folks Talking About $2,200 One-Time Payment?

Rumors about a $2,200 one‑time payment in October 2025 have spread widely on social media, news aggregator sites, and community forums. Many people are hopeful—especially seniors, individuals on disability, or low‑income households—because such a payment could provide meaningful relief amid inflation, high living costs, and rising expenses.

It’s totally reasonable to want clarity. But the catch is: as of now, no official Canadian government or Service Canada announcement confirms it. That means we treat it as a possibility, not a guarantee.

Still, understanding how benefits roll out, what criteria tend to be used, and how you can position yourself means you’ll be ready (if and when it becomes real). Let’s dive deeper.

Understanding the Context

Why This Rumor Keeps Floating?

We live in a time where money is tight for many. With inflation, rising housing costs, and economic uncertainty, a one‑time payment is exactly the kind of hope many people latch onto. Combine that with:

- Social media sharing of unverified claims

- Desire for relief among seniors, families, unemployed folks

- Mistakes by websites that repeat rumors without fact-checking

And you get a wildfire of misinformation.

The rumor is tempting—especially when you hear $2,200, a figure that could make a difference in someone’s life. But it’s important to stay grounded. A rumor can feel real, but until it’s confirmed by Service Canada or the Canadian government, it’s just that—a rumor.

What’s the Role of ESDC & Service Canada?

The Employment and Social Development Canada (ESDC) is the federal department responsible for social programs, benefits, and supporting employment in Canada. Service Canada is the delivery arm—they handle direct services, benefit distribution, customer service, processing, etc. If any $2,200 payment is real, it will be designed, approved, and partly delivered through ESDC / Service Canada.

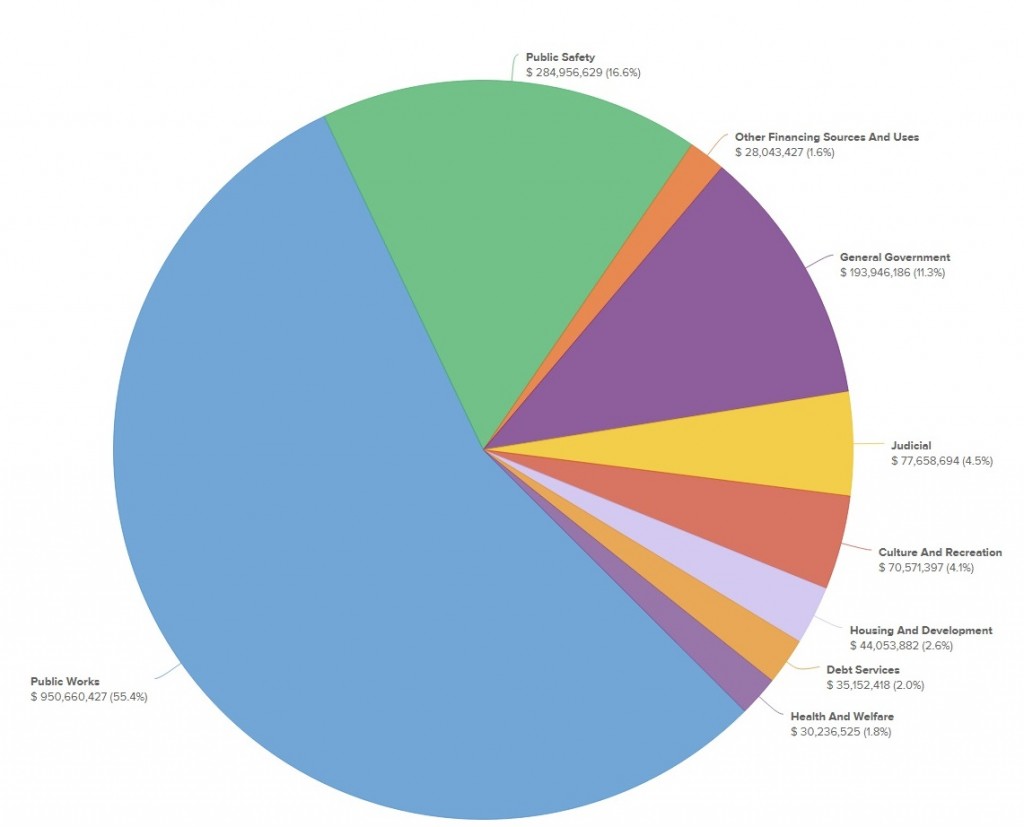

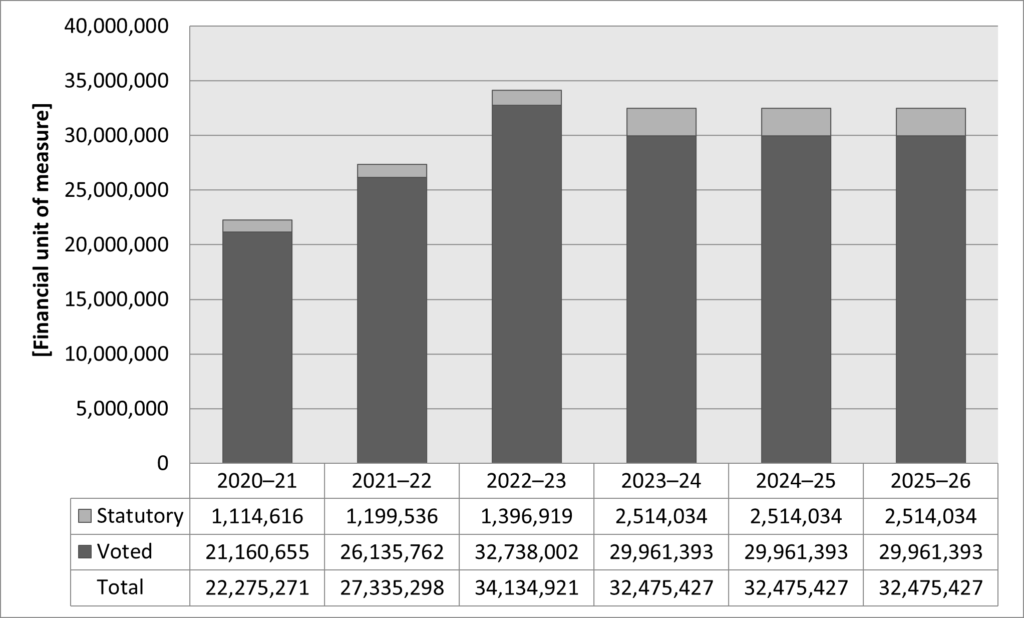

ESDC is no small player: in fiscal year 2024, it spent $94.48 billion, making up ~18.4% of overall federal spending. That budget size shows how massive social programs already are, and how much capacity is required to add extra payments.

How Past One-Time or Stimulus Payments Worked?

Examples: during COVID‑19, Canada rolled out emergency benefit programs, stimulus payments, and top-ups. These programs required legislative authority, Treasury Board approval, rollout plans, and risk mitigation (fraud control, verification, appeals). The lessons from those will likely inform how any $2,200 payment, if real, is handled.

What the Rumors Say (and What They Miss)?

Common Claims

- Seniors (65+) with low income would get it

- People on disability (CPP‑D or equivalent) would qualify

- Low‑income households under certain thresholds (e.g. $30,000–$45,000)

- Some people would automatically receive it, others would need to apply

- Payment date: October 2025

- Possibly lump sum direct deposit

What’s Missing (Gaps)

- No official source confirms any of those

- No precise income thresholds published

- No clarity on residency, tax filing, or application rules

- Unclear whether it’s taxable or tax‑free

- No published cost estimate or funding source

- No plan for appeals or reconsideration has been released

Because of these gaps, we cannot bank on any rumor as fact.

What It Might Take to Make It Real?

Understanding how government programs come to life can help us guess which rumors are likely—and which are less so.

Budget & Legislative Approval

A $2,200 one‑time payment is big money. It must be authorized in the federal budget, debated in Parliament, and approved by Treasury Board or Cabinet. Delays, amendments, or cost scaling are common in this step.

Administrative Capacity & Fraud Control

- Identity verification (matching SIN, address, tax records)

- Preventing duplicate claims or fraud

- Processing bulk payments (millions of people)

- Handling appeals, errors, and disputes

Because Service Canada already manages big benefit programs like OAS, GIS, CPP, they’re used to heavy loads—but adding one more program at scale is still a big lift.

Provincial / Regional Variations

Even though this is a federal payment, provinces might complicate things. For instance:

- Differences in cost of living may drive pressure for provincial top‑ups

- Provinces with their own social assistance or benefits systems may integrate or coordinate

- People move between provinces, complicating residency criteria

Stakeholder Input & Pushback

Advocacy groups, seniors’ associations, disability rights groups, and community organizations will likely try to influence eligibility rules (e.g. include rural people, remove bureaucratic barriers). At the same time, critics may argue about cost, fairness, or inflation effects.

How to Stay Ready For $2,200 One-Time Payment— A Step-By-Step Guide

Here’s a clear, actionable roadmap you can follow—whether you’re an everyday person or a professional helping clients.

Step 1: Create / Login to My Service Canada Account (MSCA)

If you haven’t already, sign up. MSCA is where you’ll get notifications, see benefit status, and interact with Service Canada.

Check regularly for:

- Notices or alerts about new programs

- Messages under “benefits & payments”

- Required document uploads or confirmations

Step 2: Monitor Official Sources

Bookmark and follow:

- Canada.ca – Government of Canada News & Releases

- ESDC press releases via canada.ca

- Service Canada official social media (only verified accounts)

- Benefit program pages (for example, OAS, CPP, or disability pages)

If a new program is real, it’ll show up there first.

Step 3: Gather & Prepare Supporting Documents

Have these ready:

| Document | Purpose | Notes |

|---|---|---|

| Latest tax return(s) | Show your income | Use Line 15000 (net income) etc. |

| Proof of residence / ID | Residency criteria | Driver’s license, utility bills, lease |

| Benefit status / enrollment | If you already receive OAS, CPP, GIS | Show documentation |

| Bank / direct deposit info | For payment deposits | Confirm your account is up to date |

When (if) the program opens, you won’t be scrambling.

Step 4: Watch for Official Application / Enrollment Window

If you’re not automatically included, there will likely be a window when applications open. Mark your calendar, set alerts, and check MSCA for “actions required.”

Step 5: Apply (If Needed) and Track Status

- Submit required forms and uploads

- Get a confirmation number or receipt

- Periodically check status via MSCA

- If denied, read the denial reason carefully and consider appeal

Step 6: Use the Payment Wisely (If You Receive It)

Think of this as extra cash you can use smartly. Some ideas:

- Pay overdue rent, mortgage, or utilities

- Refill medication supplies

- Buy essential groceries or household goods

- Add to emergency savings

- Consider paying down debt with highest interest

For professionals helping clients, guide them to use it strategically.

Step 7: Stay Alert for Adjustments & Extensions

Governments sometimes:

- Extend deadlines

- Add a second tranche or top‑up

- Adjust rules (e.g. raise income threshold)

- Offer appeal windows

Keep checking for changes.

Stakeholder & Expert Perspectives

While official sources are quiet, here’s what different stakeholders might say (and you should watch for):

- Senior advocacy groups (e.g. National Pensioners Federation) might press for inclusive rules and streamline application processes

- Disability rights organizations would push for low barriers, simple documentation, and accommodation

- Financial planners may warn about tax impact, benefits clawback, or using it wisely

- Academics / policy analysts might debate the fiscal cost, inflation risk, or fairness

- Media outlets are likely to interview affected people, fact-check rumors, and pressure government for clarity

When you see quotes from those groups, cross-check against official sources before believing any specific figure or eligibility claim.

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Canada’s Small Business Carbon Rebate: Check Eligibility Criteria and Payment Dates!