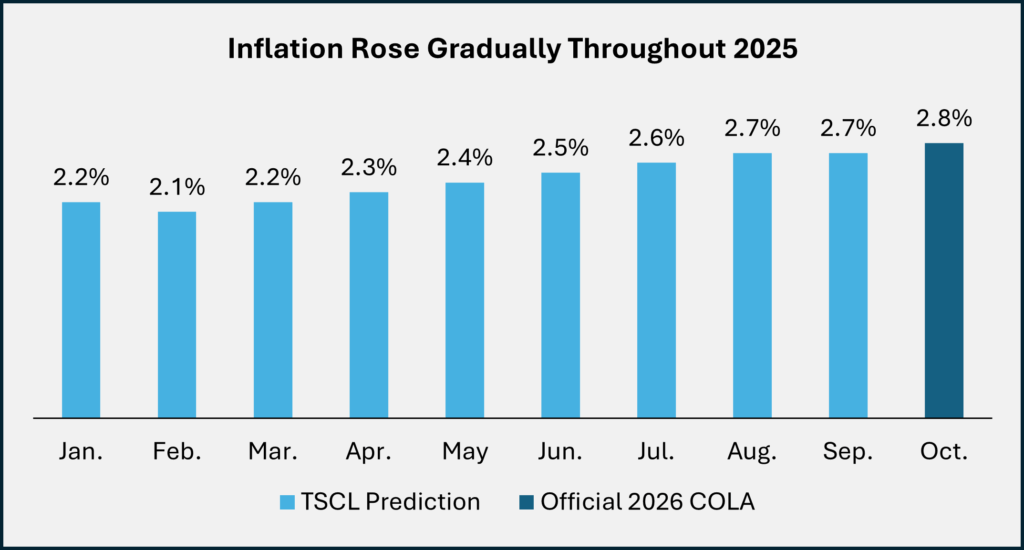

Social Security and Supplemental Security Income (SSI) recipients will see a significant 2.8% increase in their monthly benefits starting in 2026. This adjustment, announced by the Social Security Administration (SSA), is designed to help beneficiaries keep up with inflation and rising living costs. The increase will affect approximately 70 million Americans and follows the SSA’s annual cost-of-living adjustment (COLA), which is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Table of Contents

2026 COLA Update

| Key Fact | Detail/Statistic |

|---|---|

| 2026 COLA Increase for Social Security | 2.8% rise in benefits |

| Average Monthly Social Security Payment | $2,071 (up from $2,015 in 2025) |

| SSI Monthly Payment for Individuals | $994 (up from $967) |

| Maximum Taxable Earnings in 2026 | $184,500 |

| Official Website | SSA.gov |

What Does the 2.8% COLA Mean for Social Security Recipients?

The 2.8% COLA increase for 2026 is expected to raise the average monthly benefit for Social Security recipients by $56, bringing the new monthly average to $2,071, up from $2,015 in 2025. For married couples, the average monthly benefit will rise to $3,208, up from $3,120 in 2025. This increase is seen as a necessary adjustment to ensure that beneficiaries maintain their purchasing power despite inflation.

For many seniors, the COLA increase is seen as a critical lifeline in the face of rising healthcare, housing, and food costs. Despite this, some beneficiaries have expressed concerns that the increase may not fully keep up with the rising cost of living, particularly in areas like healthcare, which has seen significant price hikes in recent years.

SSI Recipients Also See Increased Payments

Supplemental Security Income (SSI) recipients will benefit from the 2.8% COLA increase as well. For individuals, the monthly benefit will rise to $994, up from $967 in 2025. Couples will see their monthly benefit increase to $1,491, up from $1,450. SSI provides financial assistance to those with limited income and resources, and the COLA adjustment is seen as vital for helping these individuals meet basic needs like food, clothing, and shelter.

Given that SSI recipients typically have lower monthly incomes, the COLA adjustment provides a modest but important boost. However, some have argued that the increase is not enough to make up for the rising costs of necessities such as healthcare, prescription drugs, and housing, which disproportionately affect low-income individuals.

Additional Social Security Changes in 2026

In addition to the 2.8% COLA increase, the SSA has announced several other important changes for Social Security in 2026:

- Maximum Taxable Earnings: The maximum earnings subject to Social Security taxes will increase to $184,500 in 2026, up from $176,100 in 2025. This means higher earners will pay Social Security taxes on more of their income.

- Earnings Limit: The earnings limit for individuals under full retirement age will rise to $24,480 annually (up from $23,400). This is the threshold above which Social Security benefits are temporarily reduced for those working while receiving benefits.

- Earnings Limit for Those Reaching Full Retirement Age: For individuals who are within a year of reaching full retirement age, the earnings limit will increase to $65,160 annually, up from $62,160 in 2025. After reaching full retirement age, Social Security beneficiaries can earn any amount without affecting their benefits.

Historical Context: How COLA Adjustments Have Evolved

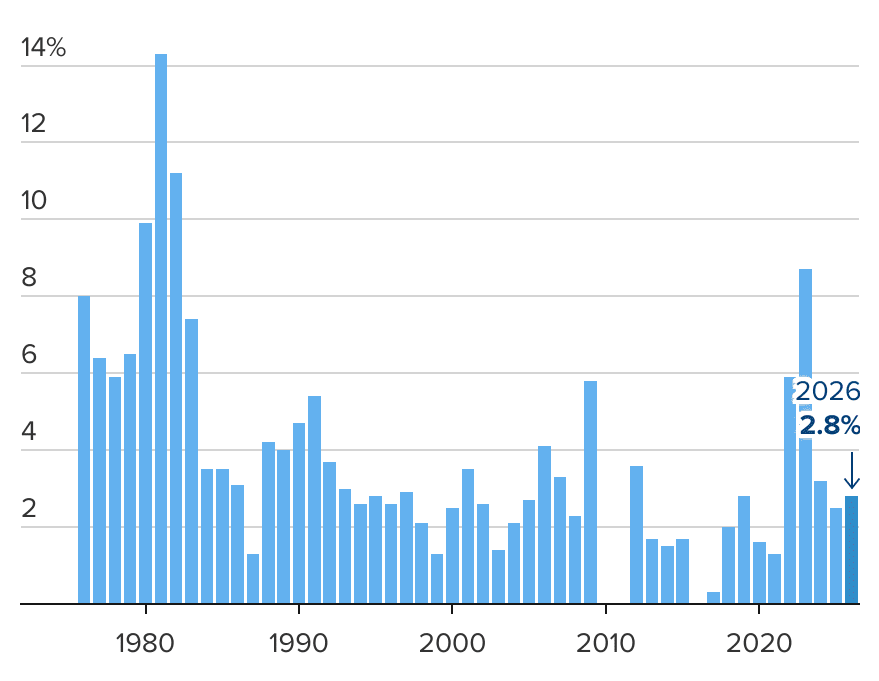

The idea of adjusting Social Security benefits for inflation was formalized in 1975 through the establishment of the COLA. Since then, COLA increases have been based on the CPI-W, which measures inflation for urban wage earners and clerical workers. The adjustments have varied greatly depending on the inflation rate in any given year.

Over the past several decades, COLA increases have ranged from as low as 0.0% in 2016 to as high as 14.3% in 1980, the largest increase ever recorded. The 2.8% increase for 2026 falls somewhere in the middle of this range, reflecting a moderate inflationary period.

In comparison to previous decades, however, some experts argue that the CPI-W does not fully capture the costs that older Americans face, particularly in healthcare and housing. These costs have risen much faster than general inflation, putting many seniors in a difficult financial position despite the COLA increase.

Impact on Different Demographics

The 2.8% COLA increase is not a one-size-fits-all solution. Different groups within the Social Security system will feel the impact of the adjustment in varying ways.

- Retirees: For retirees, Social Security is often the primary source of income. The COLA increase helps to ensure that their benefits keep pace with rising costs. However, retirees with significant healthcare expenses may find that the increase does not fully cover the rising costs of premiums, prescription drugs, and long-term care.

- Veterans and Disabled Individuals: Veterans and individuals with disabilities who rely on Social Security Disability Insurance (SSDI) will also see their benefits increase. For these groups, the COLA is a crucial support, particularly given the high cost of medical care and other disability-related expenses.

- Low-Income Seniors: SSI recipients, who tend to be among the most financially vulnerable, will also benefit from the increase. While any boost is helpful, advocates for low-income seniors argue that the COLA adjustment does not go far enough to alleviate the pressures of rising healthcare and housing costs.

Expert Opinions on the Adequacy of COLA Adjustments

Experts and advocacy groups have weighed in on the adequacy of the 2.8% COLA increase. According to Dr. David John, a senior policy analyst at the Heritage Foundation, “While the 2.8% COLA increase is a positive step, it still doesn’t fully address the real-world pressures that many seniors are facing, particularly in the realm of healthcare.”

Groups like AARP and the National Committee to Preserve Social Security and Medicare have been vocal in calling for a more comprehensive approach to addressing the financial needs of seniors. They argue that the current method of calculating COLA does not fully reflect the expenses that older Americans face.

The Debate Over Social Security Reform

The COLA increase is part of a broader conversation about the sustainability of Social Security. Over the past few decades, the program has faced growing challenges due to an aging population, rising healthcare costs, and increasing income inequality.

Some experts have raised concerns about the long-term viability of Social Security, pointing to projections that the trust fund could run out of money in the next few decades. This has sparked debates about how to reform the system, with proposals ranging from increasing the payroll tax to raising the retirement age.

The COLA increase is a key part of these discussions, as it is seen as a way to help beneficiaries maintain purchasing power in the face of rising inflation. However, without comprehensive reform, some argue that the system may struggle to keep up with the needs of future beneficiaries.

Comparisons to Global Social Safety Nets

When looking at Social Security and SSI benefits in the U.S., it is helpful to compare them to similar programs in other countries. For example, many European countries have their own social safety nets, often with larger COLA adjustments and more extensive healthcare benefits for seniors.

In Canada, for instance, the Old Age Security (OAS) program offers a basic monthly allowance to seniors, which is indexed to inflation. Similarly, many European Union countries offer robust pension systems that adjust to inflation at a higher rate than the U.S.

These international comparisons highlight both the strengths and limitations of the U.S. Social Security system and provide valuable insights into potential areas for improvement.

What’s Next for COLA and Social Security?

Looking ahead, it is clear that the debate over Social Security’s future is far from over. While the 2.8% COLA increase is a step in the right direction, the challenges facing the program are substantial. As the population ages and inflation continues to affect seniors’ purchasing power, discussions about Social Security reform will only intensify.

For now, beneficiaries can look forward to a slightly higher monthly check in 2026, but the larger questions about the program’s long-term sustainability remain.

Seniors 63+ Getting a New Social Security Payment in Days; Check Eligibility & Payment Date

Social Security Boost: How a Simple Strategy Can Increase Your Monthly Payments by $100s

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

FAQ

Q1: When will the 2026 COLA increase take effect?

The 2.8% increase in Social Security and SSI benefits will begin in January 2026.

Q2: How much will the average Social Security check increase in 2026?

The average monthly benefit will rise by $56, from $2,015 to $2,071.

Q3: What is the maximum taxable earnings for Social Security in 2026?

The maximum taxable earnings will increase to $184,500 in 2026.