$2000 Economic Relief Payment: If you’ve been hearing buzz about a $2000 economic relief payment hitting accounts this November 2025, you’re definitely not alone. Folks across the U.S. are curious and hopeful about this potential financial boost — especially as the economy keeps fluctuating and many households are juggling expenses. This article breaks down everything you need to know about the $2000 relief check rumor, the official stance from government sources, and what practical steps you can take to stay informed and financially prepared. Understanding the latest on economic relief payments can feel tricky, but this guide will walk you through the details in a straightforward way — think of it like having a knowledgeable friend help you navigate the news, without the confusing jargon.

Table of Contents

$2000 Economic Relief Payment

The rumor of a $2000 economic relief payment arriving in November 2025 has stirred a lot of excitement and questions across the U.S. While past pandemic relief payments set the stage for such financial support, the reality is there is no official payment authorization or announcement yet for this specific $2000 payment. The IRS and Treasury urge citizens to avoid misinformation, check past payments, and stay informed. Whether or not new payments come, managing your finances carefully and preparing ahead will always be your best strategy. Stay sharp, watch official resources, and keep your financial plans ready. Relief, if it arrives, will be clear, accessible, and well-publicized—so don’t fall for hearsay or scams. In the meantime, take control of your money and stay empowered.

| Key Topic | Details |

|---|---|

| Payment Amount | Rumored $2000 economic relief payment for November 2025 |

| Eligibility Criteria | No formal eligibility released; speculation exists |

| Direct Deposit Dates | No official dates announced for this payment |

| How to Check Payment Status | Use IRS online accounts and official channels for verification |

| Previous Relief Payments | IRS issued payments in 2020-2024; new $2000 payment not yet authorized |

| Official Resource | IRS Economic Impact Payments |

What Is the $2000 Economic Relief Payment?

There’s been chatter online and in some news outlets about a new $2000 direct deposit relief payment coming in November 2025. This kind of payment is often referred to as a stimulus check or economic impact payment, aimed at giving financial assistance to qualifying Americans during tough times — like recessions or inflation spikes.

However, it’s important to know that as of now, there is no official government confirmation or authorized program for a $2000 relief check in November 2025. The IRS has not announced any such payment, and websites that report on stimulus checks emphasize that the $2000 figure is still just a rumor or misinformation circulating on social media.

Why the Confusion?

Past stimulus payments during the COVID-19 pandemic set a precedent for direct payments to citizens to ease economic hardship. Because of this history, whenever the economy shows signs of strain, there’s always speculation on new stimulus checks.

Here’s why confusion can happen:

- Politicians and analysts sometimes discuss proposals for economic relief, which can be picked up prematurely by the media or social platforms.

- Social media users and unofficial websites often spread guesses and false reports to capture attention or create viral sensation.

- Economic conditions such as inflation spikes, rising costs, or recessions lead many Americans to wishfully anticipate or expect new payments.

But the official channels, like the IRS and the U.S. Treasury Department, have not authorized or announced a new $2000 payment for November 2025, so it’s best to rely on credible sources. Keeping this in mind helps folks avoid misinformation and unnecessary disappointment.

How Economic Impact Payments Work: A Brief Overview

Understanding the mechanics behind these payments helps demystify how and why you might (or might not) receive one:

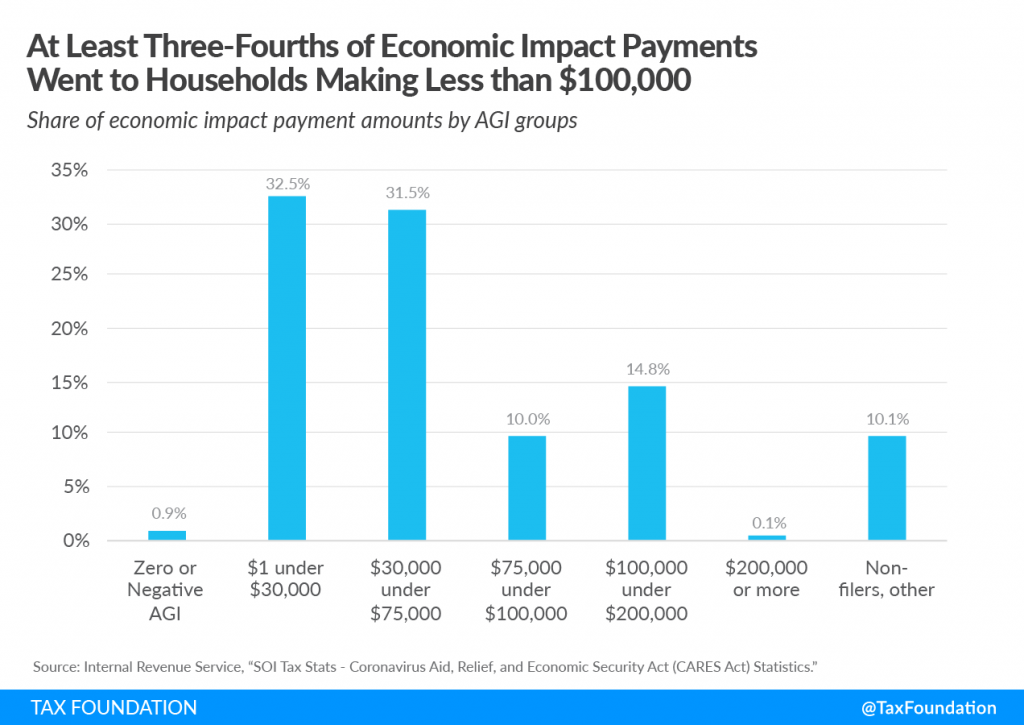

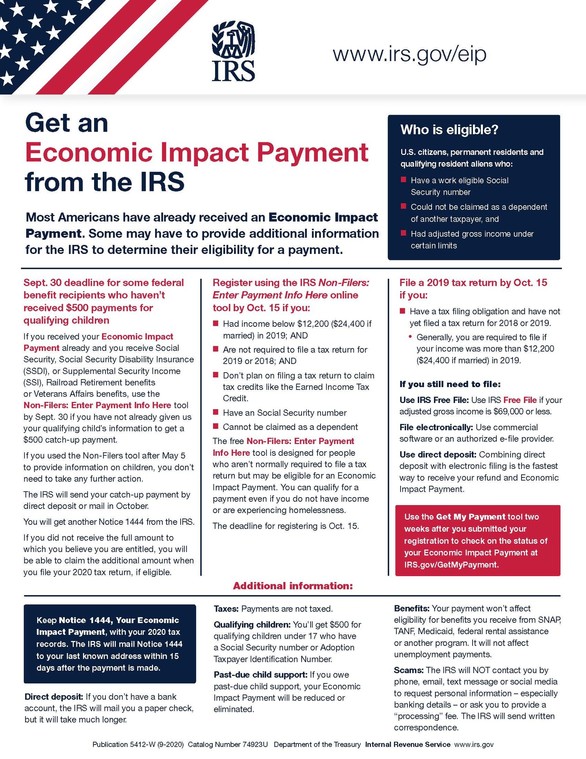

- Eligibility: Payments are based largely on income thresholds determined by your tax filing status and adjusted gross income (AGI). These thresholds help target assistance to low- and middle-income households.

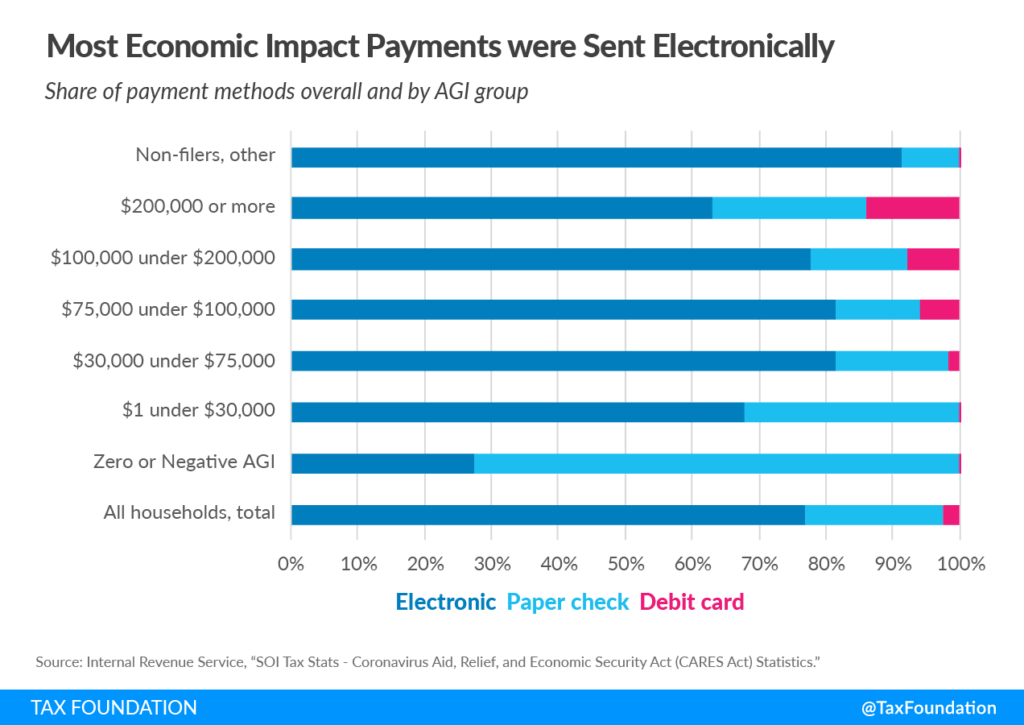

- Distribution Method: Most payments are delivered via direct deposit for speed and safety. If the IRS doesn’t have bank info, paper checks or prepaid debit cards are mailed.

- Claim Process: In earlier rounds, if you missed payments, you could claim the funds as Recovery Rebate Credits on your tax returns, effectively receiving retroactive assistance.

To put this in perspective, earlier rounds of stimulus payments had income eligibility cutoffs—usually phased out between $75,000 and $150,000 AGI depending on filing status. Payments were sometimes reduced gradually for those earning slightly above these thresholds until phased out completely.

If any future payment is authorized, it’s likely to follow a similar framework, although the government could update the amount or eligibility criteria based on changing economic conditions.

IRS Economic Impact Payments History: 2020 to 2024

Between March 2020 and late 2024, the IRS issued multiple rounds of economic relief payments under several pandemic relief laws, distributing hundreds of billions of dollars to Americans.

- First Round (CARES Act, March 2020): Eligible individuals received up to $1,200, with an additional $500 per qualifying child. Payments were phased out for incomes above $75,000 for individuals and $150,000 for married filing jointly.

- Second Round (COVID-related Tax Relief Act, Dec 2020): Distribution of up to $600 for individuals and dependents, maintaining similar income thresholds.

- Third Round (American Rescue Plan Act, March 2021): Payments of up to $1,400 per eligible individual and dependents. This round expanded eligibility to include adult dependents, providing significant additional relief.

- Additionally, the IRS provided Recovery Rebate Credits through tax returns for individuals who did not receive full payments during these periods.

These payments collectively helped boost consumer spending, stabilize households, and support the economy amid pandemic challenges.

In December 2024 and January 2025, the IRS also arranged for special catch-up payments to approximately one million taxpayers who had not claimed their 2021 Recovery Rebate Credit. These efforts ensure that eligible individuals receive their full entitled benefits.

Important IRS Resources for Past Payments

- IRS online accounts securely display the total amounts of past Economic Impact Payments.

- Letter 6475 sent by the IRS verifies third payment details for accurate tax reporting.

- Official IRS webpages provide detailed guides and FAQs on payments and Recovery Rebate Credits.

How to Stay Informed and Avoid Misinformation About $2000 Economic Relief Payment?

The risk of misinformation around stimulus payments has never been higher. Follow these tips to stay safe and informed:

1. Follow Official Government Websites

Bookmark and regularly check trusted sites like IRS.gov and Treasury.gov for authoritative updates. These sites publish official announcements, eligibility requirements, and distribution timelines.

2. Use Secure IRS Tools

Access your IRS online account for accurate information on payments tied to your Social Security Number and tax filings. Avoid third-party websites claiming to offer assistance or “check your stimulus” services as they may be fraudulent.

3. Beware of Scams

IRS does not call, text, or email to ask for banking or personal information related to stimulus payments. Be alert for phishing attempts. If you receive suspicious contacts, report them immediately to TIGTA.gov.

4. Monitor Reliable News Outlets

Trusted national media and financial news sources provide fact-checked, context-rich reports compared to unverified social media rumors.

5. Get in Touch With Local Agencies

Organizations such as legal aid clinics, community nonprofits, and financial counseling services offer support and trustworthy information about relief programs.

Practical Financial Advice While Waiting

Regardless of government action, financially preparing yourself is the smartest move:

- Budget Wisely: Track your income and expenses carefully. Create a monthly spending plan that prioritizes essentials.

- Build Emergency Savings: Aim for an emergency fund to cover at least three months of living costs.

- Avoid High-Interest Debt: Steer clear of predatory loans or credit cards with high-interest rates.

- Seek Professional Help: Don’t hesitate to talk to financial advisors or non-profit counselors who can help you manage money and access benefits.

- Stay Informed About Other Assistance: Check eligibility for food assistance programs, unemployment benefits, or local relief initiatives while awaiting potential federal payments.

Step-by-Step Guide to Checking Your Economic Relief Payment Status

- Create or Log in to Your IRS Online Account: A secure way to access personal tax and payment information.

- Review Past Payments: Check under ‘Tax Records’ to see what Economic Impact Payments have been credited to your account.

- Check for Recovery Rebate Credits: If you missed payments, these credits can be claimed on your federal tax return.

- Stay Alert for Official Announcements: Visit IRS.gov regularly for updates on new relief programs or expanded credits.

- Verify Direct Deposit and Mailing Dates: The IRS usually deposits funds electronically before sending paper checks.

IRS Child Tax Credit Refund in October 2025: Check Payment Amount & Eligibility Update

IRS 2026 Update: New Tax Brackets and Higher Deductions Could Change Your Refund

$3000 on Average Confirmed By IRS As 2025 Tax Refunds: Check Eligibility & Payment Credit Date