$1976 Direct Deposit Coming: If you’ve been scrolling Facebook, TikTok, or YouTube lately, you’ve probably seen headlines screaming about a $1,976 direct deposit coming in October 2025. Some posts claim the government is sending extra money to Social Security recipients; others say it’s a “special bonus” check for early retirees. It sounds exciting, right? But let’s slow down and take a real look. This guide breaks down exactly where that number comes from, who will actually see money hit their accounts, and what changes are happening in October 2025 that everyone receiving federal benefits needs to know. We’ll keep it simple, factual, and clear enough for anyone—from retirees to high-school students—to understand.

$1976 Direct Deposit Coming

Let’s call it what it is: the viral claim about a $1,976 direct deposit coming in October 2025 is mostly misinformation. The number refers to the average Social Security retirement payment, not an extra or bonus deposit. The true change that month is the full transition to electronic payments only, which will make benefit delivery faster, safer, and more reliable. If you or someone you know still receives paper checks, take a few minutes to set up direct deposit today.

| Topic | What It Means | Details & Stats |

|---|---|---|

| $1,976 figure | Average Social Security benefit (2025) | Average retired worker benefit = $1,976/month |

| Change in October 2025 | End of paper checks | Benefits must be delivered electronically (fiscal.treasury.gov) |

| Average COLA 2025 | 2.5% increase | Cost-of-living adjustment due to inflation |

| Eligibility for benefits | Requires 40 work credits | About 10 years of work history paying into Social Security |

| SSDI average payment (2025) | $1,537/month | Based on SSA statistics |

| Retirees receiving benefits | ~51 million Americans | As of mid-2025 |

| Official link | Learn more | SSA.gov |

What’s the Real Story Behind the $1976 Direct Deposit Coming?

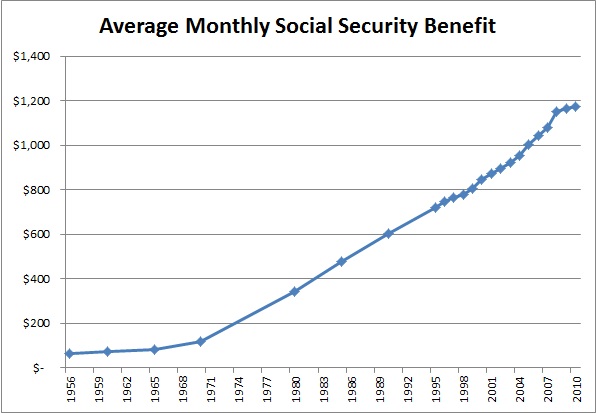

The $1,976 everyone’s talking about isn’t a surprise one-time payout. It’s actually the average monthly Social Security retirement benefit estimated by the Social Security Administration (SSA) for 2025.

According to official SSA data, the typical retired worker in 2025 receives around $1,976 per month, depending on work history, lifetime earnings, and the age they started collecting benefits.

That means some retirees collect more than that, and others less. The figure is a statistical average—not a guaranteed amount or special stimulus.

Still, because the number looks specific and coincides with a real policy change happening in October 2025, rumors took off quickly on social media.

What’s Actually Changing in October 2025?

Here’s where the truth begins to mix with fiction.

Starting October 2025, the U.S. Department of the Treasury will completely phase out paper checks for all federal benefit programs.

That includes:

- Social Security Retirement Benefits

- Supplemental Security Income (SSI)

- Social Security Disability Insurance (SSDI)

- Veterans Affairs payments

- Railroad Retirement benefits

From that month onward, benefits will be sent only through electronic means—either direct deposit to your bank or credit union, or via the Direct Express® prepaid debit card program.

So yes, everyone on Social Security or other benefits will get their money through direct deposit, but it’s not an extra check. It’s simply the government finishing its digital transition for faster, safer payments.

Why the $1976 Direct Deposit Coming Rumor Took Off?

Let’s be honest—everybody loves the idea of extra money showing up in their account. That’s why the rumor spread so fast.

But here’s why it stuck:

- It blends truth and fiction. $1,976 is a real SSA statistic, but it’s not a bonus payment.

- “Direct deposit” headlines sound official. Since all benefits will move to direct deposit in October, the claim looks believable.

- Confusing government language. Official announcements are often full of jargon, which makes room for misinterpretation online.

- Clickbait economy. Many sites push these headlines for traffic, not accuracy.

The Real Social Security Payment Schedule for October 2025

To see when you’ll actually get your money, check your birth date. The SSA uses this standard schedule:

| Birth Date | Payment Date (October 2025) |

|---|---|

| 1st–10th | Wednesday, October 8 |

| 11th–20th | Wednesday, October 15 |

| 21st–31st | Wednesday, October 22 |

| SSI recipients | Wednesday, October 1 |

People who receive both SSI and Social Security benefits often get SSI first (the 1st of the month) and Social Security on their designated Wednesday.

How Social Security Determines Your Benefit Amount?

Let’s make this part simple and clear:

- You earn credits by working.

In 2025, every $1,810 in earnings equals one credit. You can earn up to four credits each year.

You need 40 credits (roughly 10 years of work) to qualify for retirement benefits. - SSA averages your highest 35 earning years.

They adjust for inflation and create your Average Indexed Monthly Earnings (AIME). - They apply “bend points.”

Your benefit formula is:- 90% of first $1,226 of AIME

- 32% of AIME between $1,226 and $7,391

- 15% of any AIME above $7,391

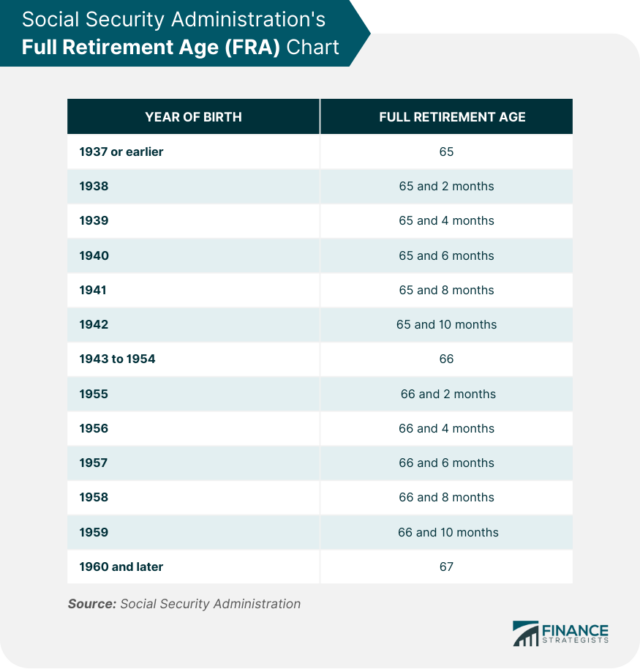

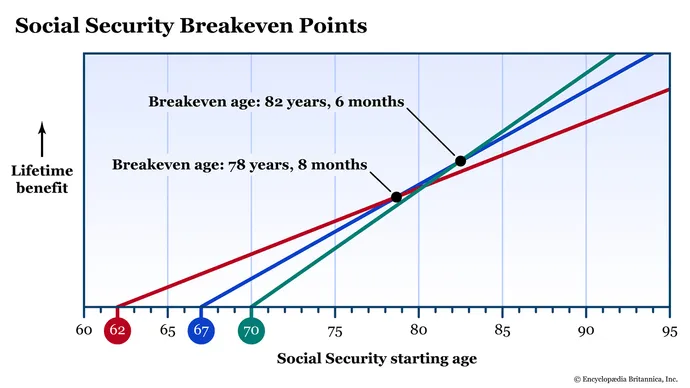

- Your age matters.

- Claim at 62, and your check shrinks (maybe by 25–30%).

- Wait until 67 (Full Retirement Age), and you get your full amount.

- Delay to 70, and your benefit grows roughly 8% per year.

- COLA adjustments keep up with inflation.

For 2025, COLA adds 2.5%, reflecting moderate inflation and ensuring retirees don’t lose purchasing power.

This process explains why no two checks are exactly the same. $1,976 is simply the national average—think of it as a yardstick, not a promise.

Why the Paper-to-Digital Shift Matters?

Electronic payment isn’t just about convenience—it’s about security and efficiency. Paper checks are more likely to be delayed, lost, or stolen. The Treasury estimates switching to electronic payments saves taxpayers nearly $100 million annually in postage, printing, and fraud prevention costs.

Plus, during natural disasters or emergencies, direct deposits ensure funds reach recipients even if local mail delivery is disrupted. For older Americans or those in rural areas, this digital shift helps guarantee stability and predictability.

How to Set Up Direct Deposit (Step-by-Step)?

If you’re still getting paper checks—or if you’re helping a parent or grandparent make the switch—here’s exactly how to do it:

- Visit ssa.gov/myaccount.

- Sign in or create your “My Social Security” account.

- Go to the Direct Deposit section.

- Enter your bank routing and account numbers carefully.

- Save and confirm the change.

If you don’t have a bank account, apply for the Direct Express® card, a government-backed prepaid debit card.

How to Verify $1976 Direct Deposit Coming News Before You Share It?

In an age of viral misinformation, it’s important to double-check stories before sharing. Here’s a quick test:

- Check the URL. Official government sites always end with .gov.

- Look for recent press releases on SSA.gov or Treasury.gov.

- Avoid posts without dates or sources.

- Compare with reputable outlets such as AARP, USA Today, or CNBC.

If a claim seems too good to be true—like “everyone gets a $1,976 gift”—it probably is.

Real Talk: What $1,976 Actually Represents?

Here’s how that average breaks down nationally:

- Retired workers: ~$1,976/month

- Disabled workers (SSDI): ~$1,537/month

- Surviving spouses: ~$1,730/month

More than 71 million Americans currently receive monthly Social Security or SSI benefits, and the SSA projects that number will keep growing as Baby Boomers retire.

So when you hear “$1,976,” think of it as a national midpoint. Your own benefit could be higher or lower depending on your earnings, age, and claiming strategy.

How to Boost Your Future Benefits?

If you’re still working, you can take a few smart steps to increase your eventual payout:

- Work at least 35 years. Missing years lower your average.

- Aim for higher-earning years. Even a few years of higher income can raise your AIME.

- Delay claiming if possible. Every year after your full retirement age adds up to an 8% boost.

- Keep your income steady. Avoid long gaps if you can—it affects your calculation.

- Check your SSA statement yearly. Errors happen, and fixing them early protects your record.

For many professionals planning retirement, these strategies can make a difference of hundreds of dollars per month.

The Bigger Picture: Social Security’s Future

The Social Security Trustees Report projects that the combined trust funds can pay full benefits until 2035. After that, if Congress makes no changes, the system could still pay about 83% of scheduled benefits from ongoing payroll taxes.

That means Social Security isn’t “running out,” but adjustments—such as raising the payroll tax cap or tweaking the retirement age—may be needed to keep it solvent long-term.

$1,978 Social Security Payment expected in October 2025? Check Payment & Claim Process

October Social Security Payments: Why You Might Get Two SSI Checks This Month

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week