$1919 Direct Deposit Checks: If you’ve been scrolling through social media or seeing YouTube videos about “$1,919 direct deposit checks in 2025”, you’re probably wondering if it’s true. Can you expect money to hit your account soon? Or is this another viral rumor that sounds too good to be true? Let’s clear the air — with facts, data, and expert insights — so you know exactly what’s going on, how to check your eligibility, and what to do next.

This article brings together real information from trusted sources like the IRS, U.S. Treasury, Kiplinger, and Forbes, explained in an easy, conversational tone. Whether you’re a working professional, a retiree, or just someone trying to make sense of the headlines, this guide is written for you.

$1919 Direct Deposit Checks

As of today, no $1,919 direct deposit checks are scheduled for 2025. The buzz online mixes truth with misinformation — real IRS updates about paperless payments and rebate credits have been exaggerated into rumors of “new stimulus.” Still, it’s smart to stay prepared. File your taxes, update your bank info, and keep an eye on official websites. The IRS and Treasury will always announce new relief programs through verified government channels first — never via viral posts. Financial stability starts with accurate information.

| Topic | What We Know | Why It Matters |

|---|---|---|

| No confirmed $1,919 program | No law or IRS rule authorizes these payments | Avoid scams or misinformation |

| 2021 Recovery Rebate Credits | IRS sending unclaimed funds to 1M+ taxpayers | Real money being sent now |

| Paper check phase-out | Begins September 30, 2025 | You’ll need direct deposit info on file |

| Tariff rebate idea | Proposed in Congress as “American Worker Rebate Act” | Still a bill, not approved |

| State relief payments | Several states offering tax rebates | Possible smaller “stimulus-style” relief |

| Official updates | Always found on IRS.gov or Treasury.gov | Never rely on social media rumors |

What’s Really Happening With the $1919 Direct Deposit Checks?

First things first — there is currently no official program from the IRS or U.S. government that approves new $1,919 direct deposit checks in 2025.

Yes, you might have seen clickbait headlines like “New Stimulus Approved!” or “Fourth Round of Checks Coming Soon!” But as of now, the IRS has not announced or confirmed any such payments.

The confusion likely comes from several overlapping stories:

- The IRS is still sending out unclaimed Recovery Rebate Credits from 2021. These are payments people missed during earlier stimulus rounds.

- Congress members have discussed potential tariff rebate programs that could theoretically fund new checks, but those are only proposals — not law.

- The IRS is phasing out paper refund checks starting September 30, 2025, which has fueled speculation about upcoming “electronic payments.”

These real developments have been twisted online into false claims of an upcoming $1,919 check.

Why the $1919 Direct Deposit Checks Figure Keeps Popping Up?

The number $1,919 has been used in multiple viral posts — but where does it come from? It appears to be an internet fabrication derived from combining inflation-adjusted stimulus amounts and partial state rebate data. Some posts falsely cite “leaked IRS memos,” but no such memo exists on IRS.gov or any public record.

Another source of confusion is that in 2021, some families received around $1,800 to $1,900 combined through the third stimulus and Child Tax Credit advance payments. Scammers reused that number to make their false claims sound realistic.

Historical Context: When the Government Actually Sent Checks

To understand the current situation, let’s revisit when the U.S. really did send direct payments:

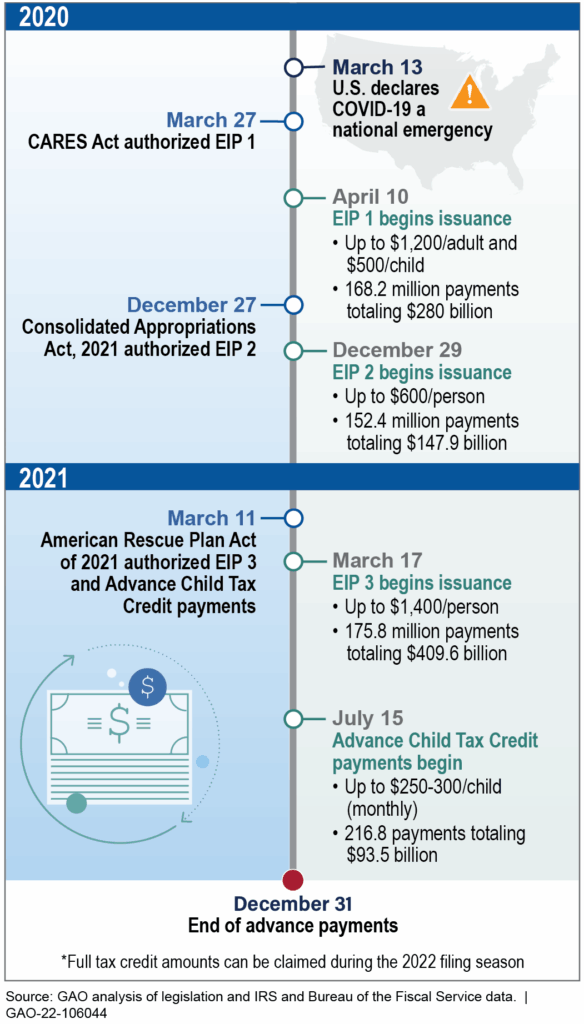

- CARES Act (March 2020): $1,200 per adult + $500 per dependent.

- Consolidated Appropriations Act (Dec 2020): $600 per person.

- American Rescue Plan (March 2021): $1,400 per person.

Each of these programs was part of an official law, passed by Congress and signed by the President. You could track them directly on IRS.gov and Treasury.gov.

Since then, no federal stimulus program has been approved.

However, multiple state governments — including California, Colorado, and Illinois — have launched smaller relief payments for residents using surplus tax funds.

The Role of Congress and the IRS

For any new direct deposit payment (like the rumored $1,919 check) to exist, Congress must pass a law. The IRS cannot create new payments on its own; it can only administer programs authorized by legislation.

Here’s the general process:

- Congress drafts a bill specifying who qualifies and how much they’ll get.

- The President signs the bill into law.

- The IRS and Treasury design the payment system (eligibility, amounts, delivery).

- Payments are distributed — usually starting with direct deposits, then debit cards, then paper checks.

Until that first step happens, everything else is just speculation.

Possible Future Programs: Tariff Rebates and State Checks

There are, however, legislative proposals worth watching.

One is the American Worker Rebate Act, which suggests using tariff revenues collected from imports to fund rebates for American households. The estimated rebate could range from $600 to $1,000 per person — depending on tariff revenue levels — but as of October 2025, it’s still a proposal, not a law.

Separately, states like California (Middle-Class Tax Refund) and Colorado (Taxpayer Bill of Rights rebates) continue issuing localized “stimulus” or refund-style payments based on budget surpluses.

If your state has such a program, check your local Department of Revenue website for eligibility updates.

How a Hypothetical $1919 Direct Deposit Checks Could Work?

Let’s imagine Congress did pass a bill approving a $1,919 payment in 2025. Here’s how it would likely roll out:

Step 1: Legislation Passed – Congress and the President approve the funding and eligibility.

Step 2: Eligibility Determined – IRS uses your latest tax return (usually 2024) to verify income, filing status, and dependents.

Step 3: Direct Deposit Payments – Those with bank info on file receive money first, typically within 2–4 weeks.

Step 4: EIP Cards or Paper Checks – Others get prepaid debit cards or checks by mail.

Step 5: Communication and Adjustments – IRS sends letters confirming payment amounts and allowing corrections or claims for missing funds.

In previous stimulus programs, 80% of eligible taxpayers received their payments within 21 days once approved, according to IRS data.

How to Check Eligibility (For Any IRS Payment)?

Even though no $1,919 payment exists yet, here’s how to be ready for any future relief:

- Visit IRS.gov regularly — that’s where all new payment announcements appear first.

- Log into your IRS Online Account to confirm your bank info and mailing address.

- File your 2024 tax return early — the IRS uses your latest filing to determine eligibility.

- Check the “Where’s My Refund” and “Get My Payment” tools for payment status updates.

- Avoid sharing personal info on unofficial websites or “early registration” forms.

If a new program is approved, the IRS will automatically issue payments — you won’t need to apply anywhere else.

Be Alert: Scams Are Everywhere

The Federal Trade Commission (FTC) has warned that scammers often impersonate government agencies, especially when rumors like this circulate.

Red flags to watch for:

- Messages claiming “you qualify for immediate $1,919 relief”

- Requests for Social Security or bank numbers

- Fake websites that mimic IRS branding

- People asking for “processing fees” to release funds

Remember: The IRS never contacts taxpayers by text, email, or social media to offer payments.

Why Professionals Should Care?

Accountants, financial planners, and tax professionals should keep a close eye on developments like these. Even false rumors can drive real client behavior.

Professionals should:

- Update clients about verified IRS updates only.

- Encourage clients to file accurate returns on time.

- Help identify unclaimed credits (such as Recovery Rebate Credits).

- Warn about phishing and fraud targeting taxpayers.

A clear communication plan saves time and protects your clients’ finances.

Expert Commentary and Economic Impact

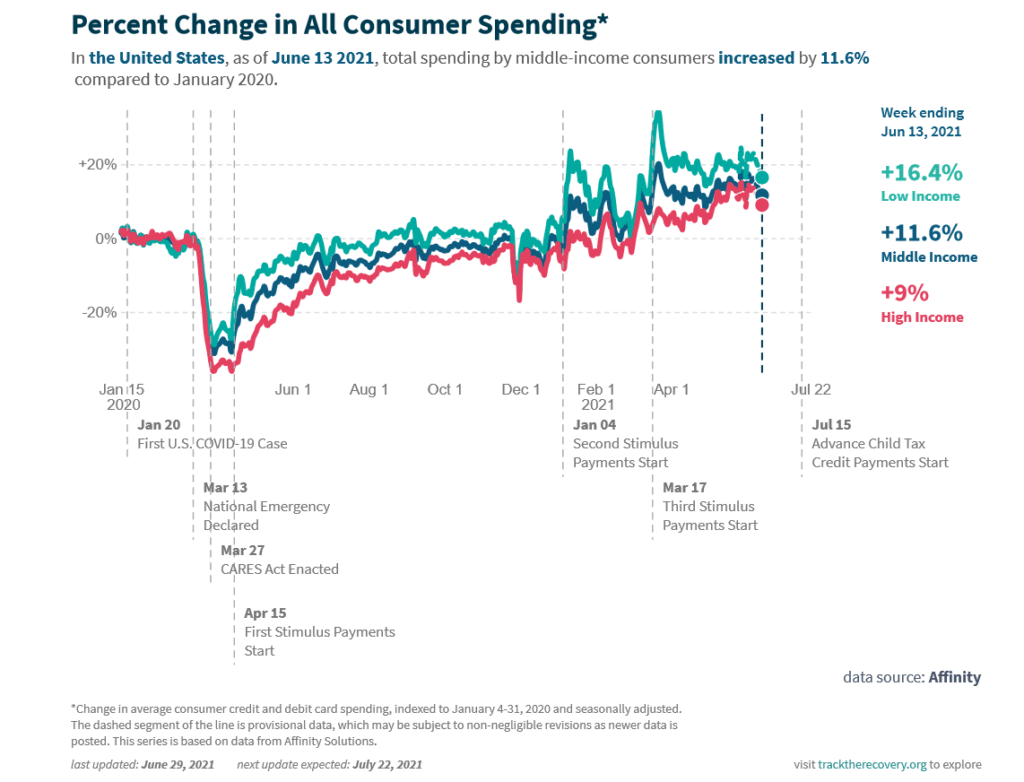

Economists are divided on whether another round of payments would help or harm the economy.

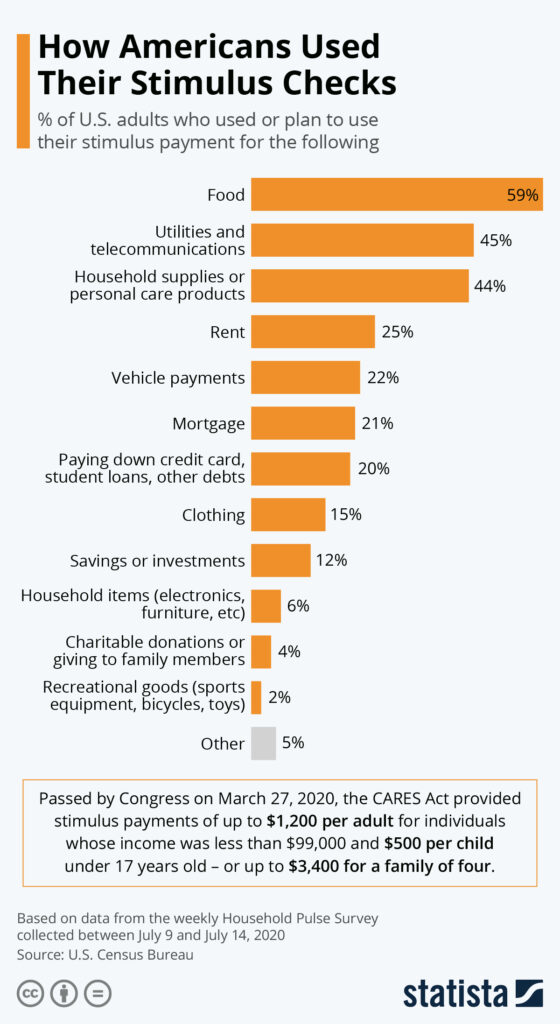

- Supporters argue that direct payments boost consumer spending and stabilize middle-income households.

- Critics warn that new stimulus could increase inflation and add to national debt, which exceeded $35 trillion in 2025 (according to the U.S. Treasury).

In recent years, the government has leaned toward targeted relief, like tax credits or rebates, instead of mass stimulus. That trend is likely to continue unless major economic shocks occur.

$697 Direct Deposit Checks in October 2025; How to get it? Check Eligibility

US $4,983 Direct Deposit In October 2025 – Check Eligibility and Expected Payment Date

$1976 Direct Deposit Coming in October 2025: Only these people will get it, Check Eligibility

How to Stay Informed?

- Bookmark IRS.gov and Treasury.gov for official news.

- Follow reliable outlets like Kiplinger, CNBC, or Forbes for financial updates.

- Avoid social media speculation — always verify with primary sources.

- Sign up for IRS email alerts to get payment updates directly.

- Consult a licensed CPA or enrolled agent before making tax-related decisions.