$1,790 and $943 Monthly OAS Increase: If you’ve been hearing chatter about the $1,790 and $943 Monthly OAS Increase in 2025 and wondering what’s really going on, you’re in the right spot. Whether you’re just hitting your golden years, planning for retirement, or helping loved ones get their finances sorted, it’s crucial to understand how Old Age Security (OAS) benefits work, what those numbers actually mean, and how to claim your payments timely and correctly. Let’s break down this important topic in a way that’s clear, straightforward, and backed by trusted expertise.

$1,790 and $943 Monthly OAS Increase

The Old Age Security program plays a vital role in providing financial security to Canadian seniors. While the headline figures like $1,790 and $943 often refer to combined benefits, the base OAS pension remains closer to $740 monthly for most retirees, with a scheduled 0.7% increase for late 2025 ensuring inflation protection. Knowing when and how to claim your OAS benefits, understanding income thresholds, and using strategic financial planning can make a significant difference in your retirement quality of life.

| Topic | Details |

|---|---|

| Monthly OAS Increase | 0.7% for the October–December quarter |

| Typical OAS Payment (Age 65–74) | About $740.09/month |

| Payment for 75+ | About $814.10/month |

| $1,790 and $943 Figures | Likely include supplements or total package, not sole OAS |

| Payment Date for Q4 2025 | October 29, 2025 |

| Claim Process | Automatic for most; manual via My Service Canada or paper forms |

| Income Clawback Threshold | $93,454 net income in 2025 |

| Official Information Source | Canada.ca OAS Benefits |

What Is the Old Age Security (OAS) Program?

The Old Age Security program is one of Canada’s cornerstone retirement income plans. It provides a monthly pension to eligible seniors aged 65 and over, designed to help cover living expenses during retirement. It is funded through general tax revenues, not tied directly to an individual’s employment history, which sets it apart from Canada Pension Plan (CPP).

Who Can Get OAS?

Eligibility is based primarily on residency and age:

- You must be a Canadian citizen or legal resident.

- You should have lived in Canada for at least 10 years since turning 18 to qualify for a partial pension.

- To receive the full pension, you need 40 years of residence in Canada after age 18.

- If you live outside Canada now but meet the residency requirements, you may still qualify.

Breaking Down the $1,790 and $943 Monthly OAS Increase Numbers

Here’s where things get interesting. The amounts $1,790 and $943 might sound like they’re automatically what you get each month, but that’s not quite the case.

- The standard OAS pension for most seniors aged 65–74 is approximately $740.09 per month as of the last quarter in 2025.

- Seniors aged 75+ receive about $814.10 due to a 10% supplement introduced a few years back.

- The figures $1,790 and $943 usually reference combined benefits. This could mean your base OAS payment plus supplements like the Guaranteed Income Supplement (GIS), which offers additional support to low-income seniors, or even components from other pensions.

- For example, seniors with little to no other income might receive a combined monthly amount close to $1,790 from OAS and GIS together.

This distinction is crucial because just seeing those figures without understanding the specifics might create confusion about what seniors should expect in their bank accounts.

How Are OAS Payments Adjusted?

OAS payments are adjusted quarterly to keep up with inflation, as measured by the Consumer Price Index (CPI):

- For the October to December 2025 quarter, the CPI indicated a 0.7% increase.

- This is how OAS ensures seniors don’t lose purchasing power due to rising prices.

- For example, if CPI stays low or drops, your OAS payment does not decrease; it only holds steady or increases.

This quarterly adjustment means your pension reflects the real cost of living more accurately than a fixed amount.

When Are Payments Made?

OAS payments come in on a monthly basis, and they are generally paid on the last business day of the month:

- The October 2025 payment will land in eligible seniors’ bank accounts on October 29, 2025.

- Subsequent payments will follow the same pattern monthly.

- Payments are typically withdrawn automatically via direct deposit, which is highly recommended to ensure fast and safe receipt of funds without delays.

How to Apply and Claim $1,790 and $943 Monthly OAS Increase?

Automatic Enrollment

Most Canadians are automatically enrolled before they turn 65 if the government has their information. Service Canada usually sends out notification letters around your 64th birthday to let you know what to expect.

Applying Manually

If you don’t receive the notification or have had changes in your residence status or personal details, you’ll need to apply:

- Through the My Service Canada Account (MSCA) online portal, which is a convenient, secure platform.

- Or by filling a paper application form (ISP-3550) found on the official government website.

Required Documents

Have these ready for the smoothest experience:

- Proof of age (birth certificate, passport)

- Social Insurance Number (SIN)

- Details on residence history since age 18

- Spouse or common-law partner’s information (if applicable)

Choosing When to Start

- You can begin receiving OAS after turning 65.

- Deferring your OAS up to age 70 results in a 0.6% monthly increase—that’s about a 7.2% yearly jump, which can add up to a 42% increase if deferred the full 5 years.

- It’s a smart move financially if you don’t need the money immediately and want to boost monthly income.

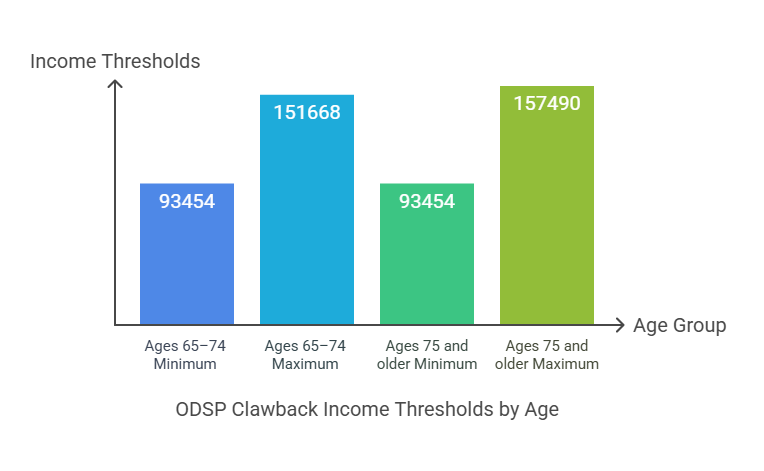

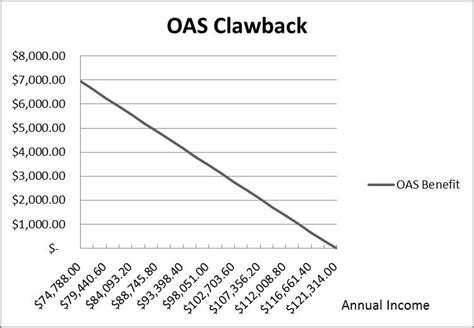

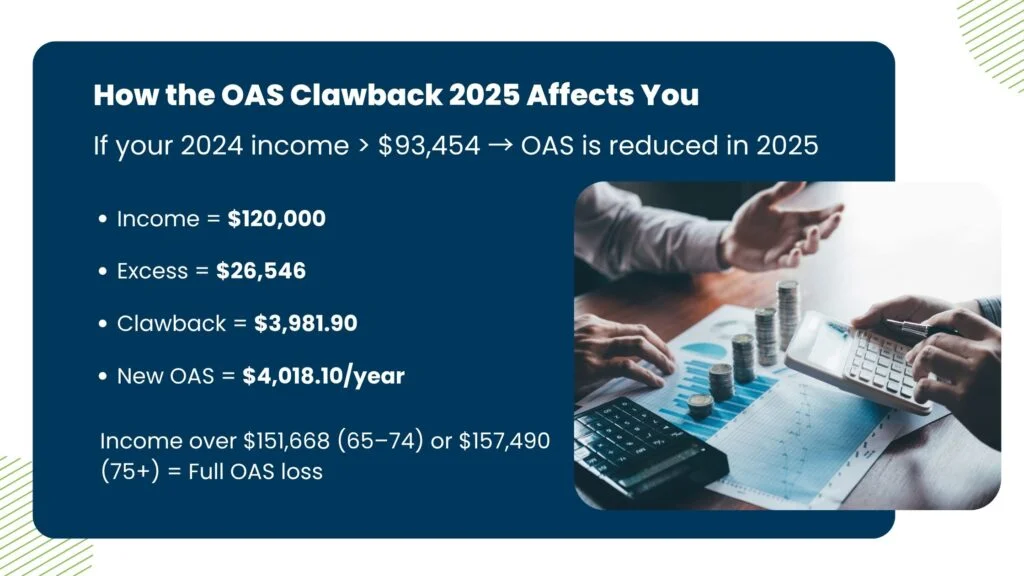

Income Clawback: What It Means and How to Manage It

If your total net income exceeds a certain threshold, the government reduces your OAS payments through an income recovery program known as the clawback:

- For 2025, the clawback starts at $93,454 of net income.

- Beyond this point, 15% of any amount over the threshold is clawed back.

- High-income seniors might see a significant reduction or complete elimination of OAS payments.

- This clawback applies only to OAS, not the GIS supplement.

Understanding this threshold is essential for income tax planning and retirement income strategies to minimize losses.

Comparing OAS to U.S. Social Security

For American readers or those familiar with U.S. retirement benefits, here’s a quick comparison:

| Feature | Canada OAS | U.S. Social Security |

|---|---|---|

| Eligibility | Age 65+, residency-based | Age 62+, work credits-based |

| Payment Amount | Approximately $740 monthly base | Varies, based on work earnings |

| Inflation Adjustments | Quarterly, based on CPI | Annually, based on CPI-W |

| Income Clawback | Yes, starting at $93,454 income | No direct clawback, but benefits taxed based on income |

| Supplements | GIS for low-income seniors | SSDI and Supplemental Security Income |

This highlights a fundamental difference: OAS is residency-based and supplemented based on income, while U.S. Social Security depends largely on your earnings record.

Tips to Maximize Your OAS Benefits

Professionals and seniors alike can benefit from these strategies:

- Apply early: Giving yourself a cushion before your 65th birthday can prevent payment delays.

- Consider deferral: If you’re healthy and have other income sources, deferring OAS can boost your monthly earnings.

- Manage your income carefully: Stay aware of clawback thresholds to avoid unexpected reductions.

- Keep documents updated: Address changes, marital status updates, and residency history affect your eligibility and payment.

- Use official calculators: Canada’s OAS calculator can forecast your pension and supplement amounts.

Impact of Inflation and Future Outlook

Inflation influences OAS benefits directly. The government uses the CPI to measure inflation’s impact on everyday living expenses, ensuring seniors maintain their purchasing power.

- Inflation cycles can raise OAS payments significantly over time.

- Economic uncertainties make it important to stay updated annually on potential changes.

- The federal government regularly reviews OAS policy in response to demographic shifts and budget considerations, so staying educated about possible reforms is wise.

Recent Reforms and What’s Next

The Canadian government has made improvements recently, such as:

- Introducing a 10% supplement for seniors aged 75 and older.

- Increasing GIS payments and adjusting clawback thresholds.

- Improving online access to benefits via the MSCA portal.

Moving forward, you can expect gradual policy changes aimed at better supporting low- and middle-income seniors while ensuring the system remains sustainable.

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date

CRA $533 One-Time Support in October 2025: Eligibility Criteria & Payment Date

Common Mistakes to Avoid

- Waiting too long to apply or failing to notify the government of changes.

- Not signing up for direct deposit, which can delay payment.

- Overlooking supplementary benefits like GIS and the Allowance.

- Underestimating the impact of income clawback on tax returns.

- Forgetting to check annual benefit adjustments.