$1,702 Stimulus Payments: If you’ve been scrolling through social media or reading headlines about a $1,702 stimulus payment in October 2025, you’re not alone. Folks from New York to California are buzzing: “Is Uncle Sam really dropping another check in our bank accounts?” The truth is a little more complicated—and if you’re a working parent, a retiree, or just trying to keep up with bills, you’ll want the facts straight. Before we dive deep: this isn’t another round of federal COVID-era stimulus checks like we saw in 2020–2021. Most of the buzz is actually tied to Alaska’s Permanent Fund Dividend (PFD)—a unique state program that pays qualifying Alaskans each year from oil revenue. Let’s unpack what’s real, what’s rumor, and what it means for you.

$1,702 Stimulus Payments

The headline about $1,702 stimulus payments in October 2025 is partly true—but only if you’re an Alaskan. These payments are tied to the Permanent Fund Dividend program, not a new federal stimulus. For Alaskans, it’s a yearly windfall that can ease financial stress. For everyone else, it’s a reminder to watch state-level programs, maximize tax credits, and plan smart with any unexpected windfalls.

| Topic | Details |

|---|---|

| Payment Amount | $1,702 (based on Alaska Permanent Fund Dividend estimate) |

| Credit Dates | October 2, 2025 (direct deposit), October 23, 2025 (paper checks) |

| Eligibility | Alaska residency, timely application, no major felonies, 1+ year residence |

| Federal Stimulus? | No — this is not a nationwide federal stimulus |

| Official Source | Alaska Department of Revenue – Permanent Fund Dividend Division |

| Past Federal Stimulus | Last federal Recovery Rebate Credits had a claim deadline of April 15, 2025 |

What Exactly Is the $1,702 Stimulus Payments?

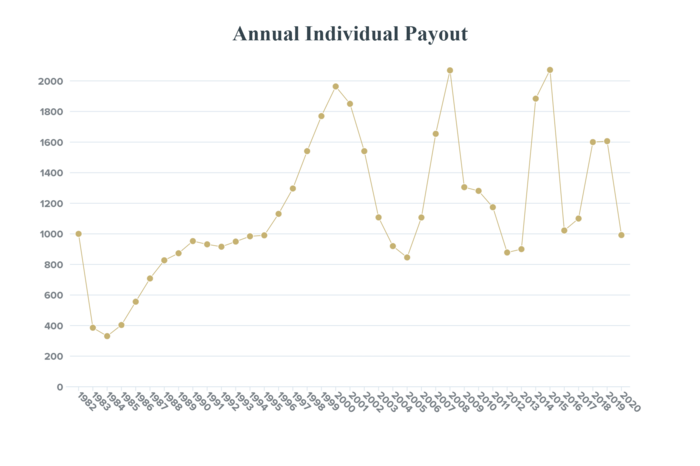

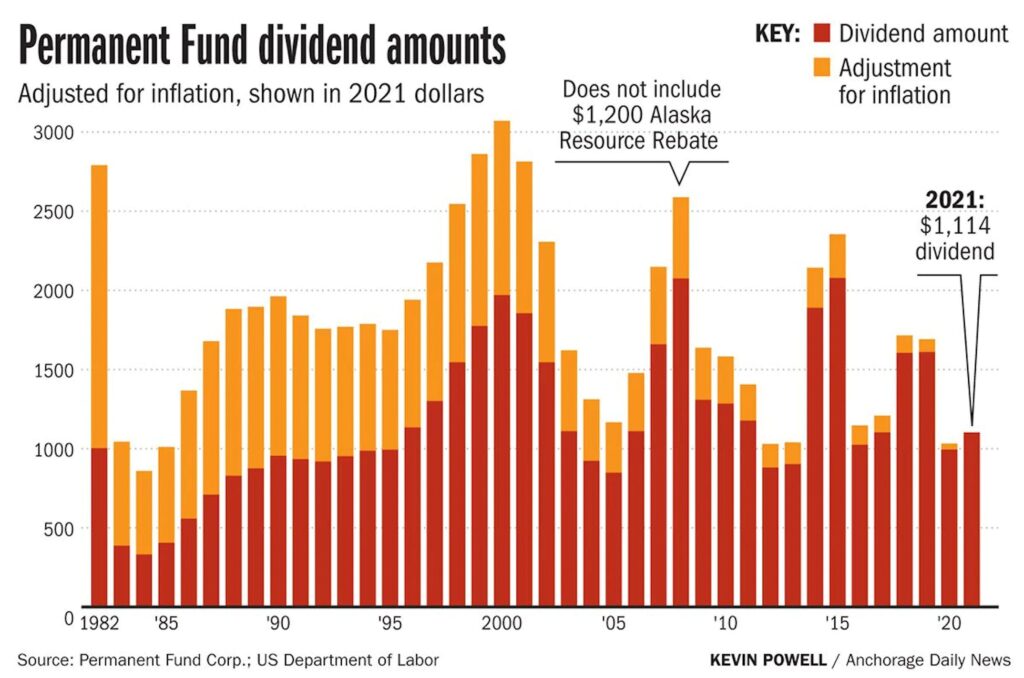

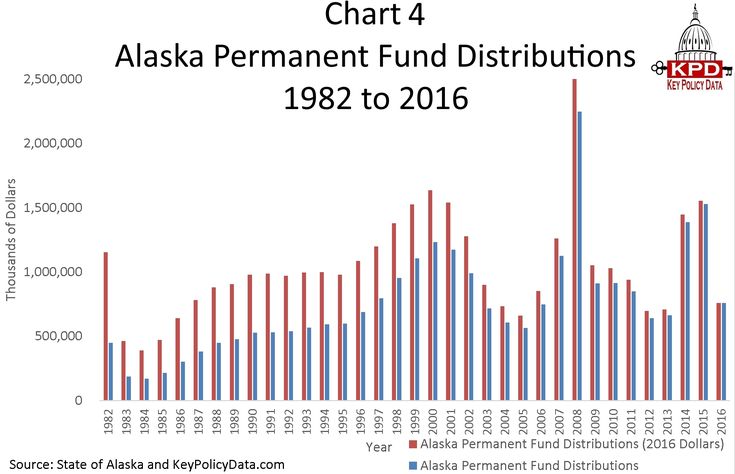

The number floating around—$1,702—is connected to the Alaska Permanent Fund Dividend (PFD). Every year, Alaskans who meet certain residency and eligibility rules get a slice of the state’s oil wealth. In past years, payments have ranged from $1,000 to over $3,200 depending on oil prices and fund performance.

In 2025, projections suggest a payout of around $1,702 per person. For a family of four living in Anchorage, that could mean almost $6,808 in October—money that can help with groceries, heating bills, or even a fishing trip.

The Origins of Alaska’s Permanent Fund Dividend

So, why does Alaska have this program in the first place? Back in 1976, when oil started flowing through the Trans-Alaska Pipeline, state leaders realized something important: oil money wouldn’t last forever. To make sure future generations benefited, Alaskans voted to create the Alaska Permanent Fund, locking a portion of oil revenues into a constitutionally protected savings account.

A few years later, the state began paying dividends directly to residents. The first checks were just $1,000 in 1982, and while the amount has bounced up and down, the tradition remains strong. It’s become a fall ritual—right alongside moose hunting and the first snowfall.

Federal Stimulus vs. Alaska PFD

Here’s the catch: this is not a federal program. The IRS isn’t sending out a fresh round of checks to every American.

- Federal Stimulus (2020–2021): Direct payments tied to pandemic relief, passed by Congress. Everyone in the U.S. who met income rules got one.

- Alaska PFD (2025): Annual payout from state oil fund. Only Alaskans benefit.

So if you’re in Texas, Florida, or Ohio, don’t budget this October expecting $1,702.

Historical Context: Past Federal Stimulus Payments

The U.S. government issued three rounds of stimulus checks during the COVID-19 pandemic:

- March 2020 (CARES Act): $1,200 per eligible adult

- December 2020: $600 per eligible adult

- March 2021 (American Rescue Plan): $1,400 per eligible adult

These checks are now history. The deadline to claim them (as tax credits) was April 15, 2025, according to the IRS. So if you missed it—unfortunately, the window is closed.

This history explains why many folks confuse Alaska’s PFD with another federal stimulus.

Payment Credit Dates in October 2025

According to the Alaska Department of Revenue, here’s the timeline:

- October 2, 2025: Direct deposits hit bank accounts.

- October 23, 2025: Paper checks mailed out.

Residents know these dates well—some even call it “Dividend Day.” Stores often run big sales, and some families plan vacations around it.

Eligibility: Who Qualifies for the $1,702 Stimulus Payments?

Not everyone gets a piece of this pie. The Alaska PFD has clear rules:

- Residency: You must be an Alaska resident for at least one full calendar year.

- Intent to Stay: You plan to remain in Alaska indefinitely.

- Criminal Record: No major felony convictions during the qualifying year.

- Application Deadline: You must apply between January 1 – March 31, 2025.

Even newborn babies born by December 31, 2024, can qualify if their guardians apply.

Step-by-Step: How to Apply for the $1,702 Stimulus Payments

Applying is simple but time-sensitive. Here’s your guide:

- Go to pfd.alaska.gov starting January 1, 2025.

- Create or log in to your “myAlaska” account.

- Fill out the application form with your residency and income details.

- Submit required documents, such as proof of residency.

- Select direct deposit for faster payments.

- Submit before March 31, 2025. Late applications are automatically denied.

Why $1,702? How the Amount Is Calculated

The payout comes from the Alaska Permanent Fund, created in 1976. A portion of state oil revenue is invested, and dividends are based on:

- Oil prices

- Fund earnings

- State budget allocations

For example:

- 2018 PFD: $1,600

- 2022 PFD: $3,284 (record high)

- 2025 Projection: $1,702

Tax Implications: Do You Owe on the PFD?

Yes. The Alaska PFD is considered taxable income by the IRS.

- If you receive $1,702, you must report it on your federal tax return.

- Kids who receive the PFD must also file if their total income exceeds IRS thresholds.

How Alaskans Spend the Dividend?

Every fall, when the checks arrive, spending patterns tell a story:

- Surveys show nearly 50% of families use the PFD for essentials like groceries, rent, and heating fuel.

- Around 25% save or invest it, often in college funds or retirement accounts.

- Others splurge—on new snowmachines, vacations to Hawaii, or holiday shopping.

For many rural residents, especially in villages where costs are higher, the PFD helps cover basic survival expenses.

Economic Impact of the PFD

The PFD isn’t just a personal bonus—it boosts Alaska’s economy:

- Local Businesses: Families spend dividends at stores, restaurants, and service providers.

- Poverty Reduction: Studies show the PFD reduces child poverty by up to 20%.

- Seasonal Spending: Fall retail sales often spike when dividends go out.

Economists often point out that this program is one of the few examples of universal basic income (UBI) in the United States.

Comparison With Other States

Alaska is the only state with a program like this. However, other states occasionally send rebates:

- California: Sent “Middle Class Tax Refund” payments in 2022.

- Maine: Distributed $850 relief checks in 2022.

- New Mexico: Offered rebates tied to oil revenue.

But these are one-time and political; Alaska’s PFD has been going for over 40 years.

Future Outlook: Will the PFD Continue?

The PFD’s future depends on oil prices, investment returns, and state politics. Some lawmakers argue the money should be used more for public services like schools or roads. Others fight to keep the checks flowing.

If oil stays strong, payouts could rise again. If not, $1,702 might look generous compared to leaner years. Either way, the PFD remains a cornerstone of Alaska life.

Warning: Watch Out for Scams

Whenever money’s involved, scammers follow. Beware of:

- Fake emails or texts claiming you need to “verify” your PFD.

- Calls demanding “fees” to release your payment.

- Fake websites mimicking pfd.alaska.gov.

Rule of thumb: The Alaska Department of Revenue will never call you asking for your Social Security number or bank info.

Common Myths About the $1,702 Stimulus

- Myth 1: “Everyone in the U.S. gets it.” False. Only Alaskans.

- Myth 2: “The IRS sends it.” False. It’s state-administered.

- Myth 3: “It’s COVID relief.” False. COVID stimulus is over.

- Myth 4: “You don’t need to apply.” False. Applications are required.

Financial Planning Tips for Your PFD

As an experienced financial advisor would say: don’t just blow it. Here’s how to make the most of it:

- Save 20% immediately. Even $300 tucked into savings grows over time.

- Pay down high-interest debt. If you’ve got a credit card at 20% APR, your PFD can save you far more than spending it.

- Invest in kids. College 529 plans are tax-advantaged and turn today’s dividend into tomorrow’s tuition.

- Emergency fund. Alaska winters are tough—repairs and heating bills pop up when least expected.

What About the Rest of the U.S.?

If you’re outside Alaska, you won’t get this check—but here are other ways to save money:

- Earned Income Tax Credit (EITC): IRS link

- Child Tax Credit (CTC): Helps families with dependents.

- State Rebates: Some states offer rebates or tax relief.

$1,000 PFD Stimulus for these People – Check October 2025 Payment Date; Eligibility

$1,000 PFD Stimulus Coming for Everyone in Oct 2025 – Who will get it? Check Eligibility

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation