$1,647.34 Survivor Allowance Payment: If you’ve heard about the $1,647.34 Survivor Allowance Payment in October 2025, you’re not alone. Canadians all across the country have been searching for answers to questions like: “Who qualifies?”, “How much can I get?”, and “When will I receive it?”

Here’s the truth: this payment comes from Canada’s Allowance for the Survivor program, a government benefit under the Old Age Security (OAS) system. It provides monthly, non-taxable financial support to lower-income Canadians aged 60 to 64 who have lost their spouse or common-law partner. As of late 2025, the maximum monthly payment has risen to CAD 1,675.45, reflecting the latest cost-of-living adjustments. This article will break everything down — in simple, conversational language — so you’ll understand how it works, how to qualify, and what steps to take if you or someone you love may be eligible.

Table of Contents

$1,647.34 Survivor Allowance Payment

The $1,647.34 Survivor Allowance Payment in October 2025 (updated to $1,675.45 after cost-of-living adjustments) offers essential support for Canadians aged 60–64 who’ve lost a spouse or partner. It bridges the financial gap before full OAS and GIS eligibility at age 65. If you meet the criteria — age, income, residency, and marital status — don’t wait. Keep your taxes up to date, and monitor your income level to stay eligible. This program is one of Canada’s strongest examples of social compassion — a promise that even after loss, you won’t face financial hardship alone.

| Topic | Key Facts & Data | Professional Insight |

|---|---|---|

| Program Name | Allowance for the Survivor (OAS/GIS) | Federal monthly benefit for low-income survivors aged 60–64 |

| Maximum Amount (Oct–Dec 2025) | CAD 1,675.45/month | Adjusted quarterly for inflation |

| Income Limit (2025) | CAD 30,216/year | Over this = partial or zero benefit |

| Residency Requirement | 10+ years living in Canada after turning 18 | Or via social security agreement |

| Payment Date (Oct 2025) | October 29, 2025 | Matches OAS and GIS payment schedule |

| Taxable? | No — non-taxable | Doesn’t count toward income tax |

| Official Website | CRA Website |

What Is the $1,647.34 Survivor Allowance Payment?

The Allowance for the Survivor is a monthly government payment that helps Canadians between ages 60 and 64 who’ve lost a spouse or common-law partner and now have limited income.

It’s different from CPP Survivor Benefits, which are based on your late spouse’s contributions to the Canada Pension Plan. Instead, this allowance focuses on financial need — if you have low or modest income, you may qualify for this support until you reach age 65.

At age 65, you transition to Old Age Security (OAS) and may also qualify for the Guaranteed Income Supplement (GIS).

The program is designed to keep vulnerable Canadians from slipping into poverty during those in-between years before OAS eligibility.

Background and Purpose

The Allowance for the Survivor was introduced under amendments to the Old Age Security Act in the 1970s, responding to growing recognition that widowed and single seniors — especially women — were at higher risk of financial hardship.

Over the years, the program has evolved to reflect inflation, rising living costs, and changing family dynamics. According to Statistics Canada, women still represent roughly three-quarters of recipients, highlighting its ongoing importance for gender equity and retirement security.

In 2024, more than 60,000 Canadians received this benefit, with an average monthly payment of about CAD 1,420, totaling nearly $900 million annually in federal spending.

OAS, GIS, and Survivor Allowance — What’s the Difference?

| Program | Age | Based On | Max Monthly (Oct 2025) | Taxable? |

|---|---|---|---|---|

| Old Age Security (OAS) | 65+ | Years lived in Canada | CAD 713.34 | Yes |

| Guaranteed Income Supplement (GIS) | 65+ (low income) | Income-tested | Up to CAD 1,065.47 | No |

| Allowance | 60–64 (couples) | Combined income | Up to CAD 1,357.05 | No |

| Allowance for the Survivor | 60–64 (widowed) | Income-tested | Up to CAD 1,675.45 | No |

The Survivor Allowance pays the highest of the four because it targets people who’ve lost their main household income source.

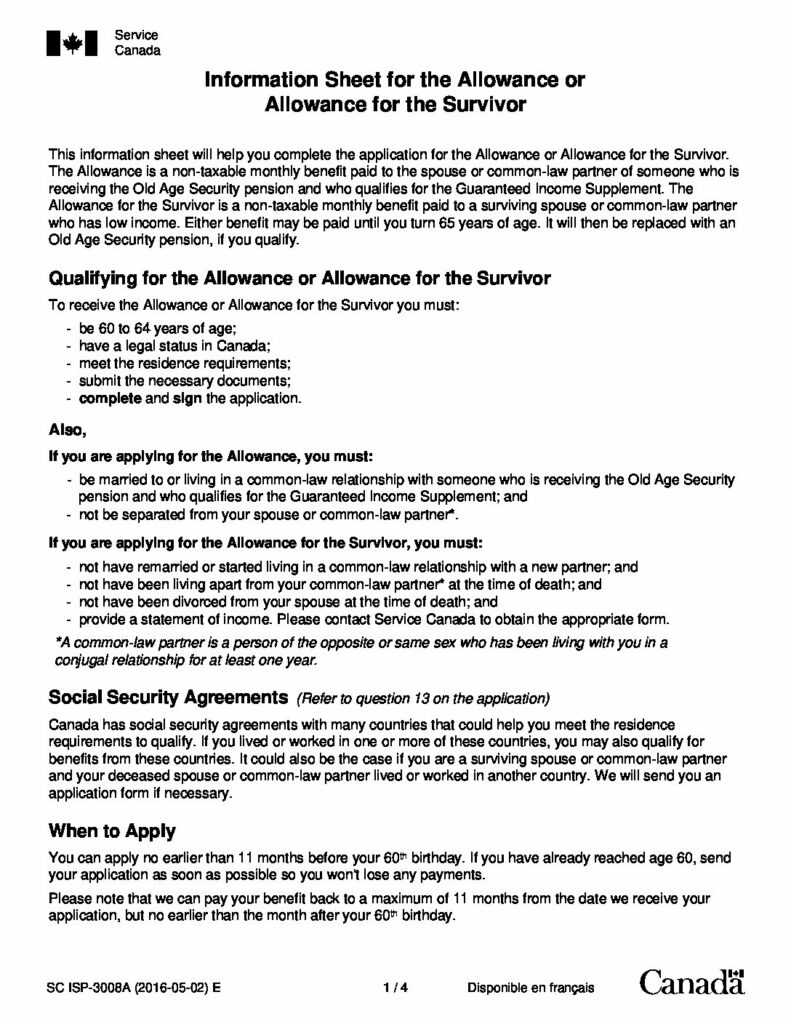

Eligibility Criteria

To qualify for the Survivor Allowance Payment (October 2025), you must:

- Be between 60 and 64 years old.

- Be a Canadian citizen or legal resident.

- Live in Canada and have lived here for at least 10 years after age 18 (exceptions apply under international agreements).

- Have lost your spouse or partner and have not remarried or entered a new common-law relationship.

- Earn less than CAD 30,216 annually based on your previous year’s income.

- Submit an application with proper documentation (it’s not automatic).

If you meet these requirements, you’re likely eligible for the full or partial benefit.

How Much Can You Receive?

The maximum monthly payment from October to December 2025 is CAD 1,675.45, indexed quarterly to inflation.

The benefit is gradually reduced if your income exceeds the threshold. For every dollar above the limit, your benefit decreases proportionally.

Example:

- If your annual income is CAD 25,000 → you may receive close to the full CAD 1,675.45/month.

- If your income is CAD 31,000 → your payment will be reduced or eliminated entirely.

These numbers are updated every three months based on the Consumer Price Index (CPI) to ensure purchasing power keeps pace with inflation.

Payment Dates and Methods

Payments are issued monthly, usually on the same day as OAS and GIS. For October 2025, the scheduled payment date is Wednesday, October 29, 2025.

Payments can be made:

- Direct Deposit into a Canadian bank account (recommended for reliability and speed), or

- Paper cheque mailed to your registered address.

Taxes and Income Reporting

Here’s good news — the Allowance for the Survivor is non-taxable. You won’t have to include it in your taxable income or pay federal income tax on it.

However, it is income-tested, meaning your total net income (from work, pensions, or investments) affects how much you receive.

Even though it’s non-taxable, you must file a tax return every year, because the Canada Revenue Agency (CRA) shares income data with Service Canada to confirm your eligibility.

If you skip filing taxes, your payments could be paused or stopped.

How to Apply for $1,647.34 Survivor Allowance Payment: Step-by-Step

Step 1: Gather Your Documents

You’ll need:

- Your Social Insurance Number (SIN)

- Proof of age and citizenship (passport, birth certificate)

- Death certificate of your spouse or partner

- Income proof (T4 slips, tax return)

- Bank account information for direct deposit

Step 2: Apply Online or By Mail

You can apply in one of two ways:

- Online: Through your My Service Canada Account (MSCA)

- Mail: Complete and send Form ISP3008 (Application for the Allowance or Allowance for the Survivor) to your nearest Service Canada office.

Step 3: Wait for Processing

Processing takes 6 to 12 weeks, depending on volume and completeness.

Step 4: Check Status and Keep Records

You’ll get a confirmation letter when approved. Keep all correspondence in a safe place in case you ever need to appeal or verify information.

Real-Life Example

Linda, age 62, lost her husband in 2023. She’s lived in Ontario since she was 19 and earns CAD 26,000 a year from part-time work and small CPP survivor benefits.

Linda applied through her MSCA account in April 2025 and was approved by July. Starting August, she began receiving CAD 1,640 per month — nearly the full rate.

By October 2025, her adjusted payment was CAD 1,675.45 due to inflation. The funds are directly deposited into her account every month.

Tips to Maximize Eligibility

- Apply Early: You can lose up to 11 months of retroactive payments if you wait too long.

- Use TFSA, not RRSP withdrawals: RRSP withdrawals count as income and may reduce benefits. TFSA withdrawals do not.

- Avoid remarriage or new partnerships before age 65.

- Report changes quickly: Moving abroad, new income, or marriage can affect eligibility.

- Keep income low and consistent: If possible, delay large withdrawals or taxable earnings until after age 65.

Common Mistakes and Myths

| Myth | Reality |

|---|---|

| “Everyone gets $1,647.34.” | That’s the maximum rate — actual payments depend on income. |

| “It’s automatic.” | You must apply manually via MSCA or paper form. |

| “This benefit is taxable.” | It’s non-taxable, so you keep every penny. |

| “It stops at 65 permanently.” | It transitions to OAS and GIS at 65. |

| “You can remarry and keep it.” | Not true — remarriage or new common-law relationships end eligibility. |

Policy and Gender Impact

According to Service Canada, roughly 75% of Survivor Allowance recipients are women — often due to lower lifetime earnings, career interruptions, and longer life expectancy.

The program remains vital in reducing senior poverty, especially among single women aged 60–64. The average beneficiary lives on a combined income below $28,000 per year, emphasizing how critical this allowance is in ensuring dignity and financial security.

Professional Insight

After decades advising Canadians on retirement and social benefits, one thing is clear — timing matters. People often underestimate how small financial decisions, like cashing out an RRSP early, can reduce benefits like this one.

I’ve seen widows lose out on thousands because they waited to apply or didn’t realize income from a part-time job affected their allowance. My advice? Apply early, file taxes every year, and keep your documents organized.

This benefit is not charity — it’s your earned right under Canada’s social safety system.

CRA Announces Payment Dates for October 2025: Know CRA latest payment date and amount

Canada $4100 CRA Direct Payment in October 2025: Check Payment Date & Eligibility Criteria