$1,647.34 Canada Survivor Allowance: Losing a spouse is one of life’s toughest moments—both emotionally and financially. If you’re a Canadian aged 60 to 64 and recently widowed, the Canada Survivor Allowance is a lifeline designed to provide much-needed financial support during this difficult transition. In October 2025, eligible survivors can receive up to $1,647.34 monthly (subject to routine adjustments), giving them a steady source of income until they reach the age of 65 and qualify for Old Age Security (OAS) benefits. Whether you’re personally affected or you help clients, friends, or family navigate government benefits, this comprehensive guide walks you through everything—eligibility, payment schedules, how to apply, managing finances, and understanding this vital program within Canada’s social safety net.

$1,647.34 Canada Survivor Allowance

The Canada Survivor Allowance stands as a crucial financial pillar for widowed Canadians aged 60 to 64, providing up to $1,647.34 monthly during one of life’s hardest transitions. This article has detailed the eligibility, application process, payment schedule, and supporting tips to navigate this benefit with confidence. If you or someone you know qualifies, don’t wait to apply. Acting early ensures this lifeline is in place when you need it most.

| Key Details | Information |

|---|---|

| Payment Amount | Up to $1,647.34 monthly |

| Next Payment Date | October 29, 2025 |

| Eligibility Age | 60 to 64 years old |

| Marital Status | Widowed, not remarried or in common-law partnership |

| Residency Requirement | Canadian citizen or permanent resident with 10+ years of residence in Canada after age 18 |

| Income Limit | Annual income below approximately $29,976 |

| Tax Status | Non-taxable payment |

| Payment Method | Direct deposit or cheque |

| Official Source | Canada Benefits – Survivor Allowance |

What is the $1,647.34 Canada Survivor Allowance?

The Canada Survivor Allowance is financial help from the federal government designed for those whose spouse or common-law partner has passed away and who are between the ages of 60 and 64. Since OAS benefits only begin at 65, this allowance fills the income gap by providing monthly, non-taxable payments to help cover day-to-day expenses like rent, groceries, and medical costs.

In essence, this program is a bridge allowing survivors to maintain financial stability when most vulnerable. The government understands that losing a spouse often leads to emotional upheaval and economic hardship, so it steps in with this timely support. The allowance is part of the broader Guaranteed Income Supplement (GIS) framework in Canada.

Am I Eligible? Here’s What You Need to Know

To qualify for the Survivor Allowance, you must meet the following criteria:

- Age: Between 60 and 64 years old.

- Marital Status: You must be widowed and not remarried or living in a new common-law partnership.

- Residency: Canadian citizen or permanent resident who has lived in Canada for at least 10 years after turning 18.

- Income: Your total annual income must be under approximately $29,976 (this includes income from all sources).

- Not Receiving OAS: You cannot already be receiving Old Age Security benefits.

- Residing in Canada: You must live in Canada at the time of your application and throughout the benefit period.

Special Considerations for Those Who Lived Abroad

If you have lived or worked abroad, Canada has social security agreements with certain countries that may allow you to qualify for a partial allowance even if you do not meet the 10-year residency requirement. Countries like the United States, the United Kingdom, Germany, and others partner with Canada to coordinate benefits for their citizens living across borders.

How Much Will You Receive?

The maximum payment you can receive is approximately $1,647.34 as of October 2025 but varies based on your income—the lower your income, the higher your payment up to the cap. The amount is adjusted quarterly to keep pace with inflation and cost of living changes.

It’s important to understand this benefit is non-taxable income, meaning the government doesn’t take a cut for taxes, so the full amount is yours to use.

When Are Payments Scheduled?

Payments come on a regular schedule to help you manage your budget. Key payment dates for the last quarter of 2025 are:

- October 29, 2025

- November 26, 2025

- December 22, 2025

Regular payment dates make it easier to plan your finances and pay bills on time without scrambling for cash.

How to Apply for the $1,647.34 Canada Survivor Allowance: A Step-by-Step Walkthrough

Applying doesn’t have to be overwhelming. Here’s a simple guide:

Step 1: Confirm Your Eligibility

Use the criteria above to check if you qualify.

Step 2: Gather Documents

You’ll need:

- Social Insurance Number (SIN)

- Your spouse’s death certificate

- Proof of Canadian citizenship or permanent residency

- Your income documents from the previous year

- Bank account details for direct deposit (recommended for speed)

Step 3: Online Application

Create an account on the My Service Canada Account (MSCA) website. This is the fastest and most secure way to apply. You can upload your documents online and track your application’s progress.

Step 4: Alternative Application by Mail

If online access is challenging, download the application form from the official government website, fill it out, and mail it in with the necessary documents. Ensure you keep copies for your records.

Step 5: After Applying

Service Canada will review your application and may contact you for additional info. Respond promptly to avoid delays.

Remember: You can apply up to 11 months before your 60th birthday to avoid missing payments when you become eligible.

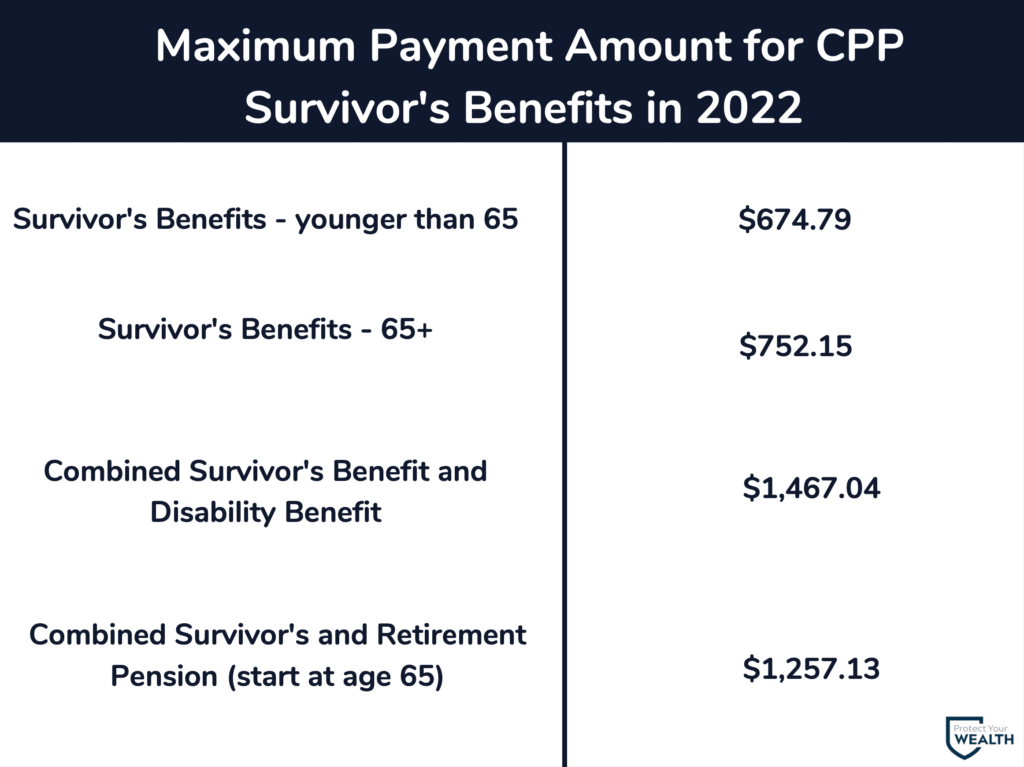

Survivor Allowance vs. CPP Survivor Benefits: What’s the Difference?

Many people wonder how the Survivor Allowance stacks up against the Canada Pension Plan (CPP) Survivor Benefits. Here’s a quick comparison:

| Feature | Canada Survivor Allowance | CPP Survivor Benefits |

|---|---|---|

| Age Range | 60 to 64 | No specific age limit; amount varies |

| Marital Status | Widowed, not remarried or new partnership | Widowed or divorced |

| Income Limit | Yes, income must be below ~$29,976 | No income limit |

| Payment Frequency | Monthly, on set schedule | Monthly payments |

| Taxable | No (non-taxable) | Yes, considered taxable income |

| Residency Requirement | 10+ years in Canada after 18 | Must have contributed to CPP |

| Purpose | Bridge to OAS benefits | Survivor income replacement |

The Survivor Allowance is unique because it directly bridges the gap for those waiting to qualify for OAS, whereas CPP survivor benefits are more varied and based on contributions to the pension plan.

Financial Tips for Survivors

Juggling finances while grieving is hard but crucial for long-term security. Here’s some practical advice:

- Make a budget: Calculate your essential monthly costs—rent/mortgage, food, utilities, medications.

- Prioritize bills: Pay what’s most urgent (housing, electricity, healthcare).

- Apply promptly: Delays in applying can result in missed payments.

- Seek guidance: Financial advisors and social workers can help you navigate all available benefits.

- Beware scams: Don’t share personal info with anyone claiming to represent the government unsolicited.

Common Mistakes to Avoid When Applying

- Waiting too long to apply.

- Forgetting required documents, which leads to processing delays.

- Assuming benefits are automatic (you must actively apply).

- Underreporting or overreporting income.

- Neglecting to notify the government of changes in marital status or income.

Emotional and Financial Support Resources

Beyond financial aid, emotional support is vital during grief. Organizations like the Canadian Mental Health Association and Widow’s Advocate Canada provide counseling, support groups, and resources to help navigate loss. Combine financial support with emotional care for the best path forward.

Changes in Eligibility: Remarriage and Income Fluctuations

If you remarry or enter a new common-law partnership, you typically lose eligibility for the Survivor Allowance. Additionally, if your income rises above the allowed threshold, your payments may reduce or stop.

It’s essential to keep Service Canada informed about any major changes to avoid overpayments or penalties.

Canada Wage News: $17.65/Hour Pay Raise; Is Your Province on the List?

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

$10,800 CRA & Service Canada Payments Expected in October 2025 – Check Eligibility & Payment Date

How Does the Survivor Allowance Fit into Canada’s Social Safety Net?

This allowance is a critical part of Canada’s multi-layered pension and benefit system, which includes:

- Old Age Security (OAS)

- Guaranteed Income Supplement (GIS)

- Canada Pension Plan (CPP) survivor benefits

- Provincial social assistance

Together, these programs work to ensure no Canadian is left financially stranded in later life or during difficult life events like the loss of a spouse.