$1599 CPP Monthly Payment: If you’re in Canada and curious about the Canada Pension Plan (CPP) payment for November 2025, you’ve landed in the right place. This article breaks down all the essentials of CPP payments — from eligibility, payment schedules, to maximizing your benefits — in a straightforward, conversational style that’s easy for everyone to follow. Despite some buzz about a $1599 monthly payment, the real and official maximum payout for November 2025 is $1,433 per month for eligible recipients. Let’s dive into the details of this essential Canadian benefit and explore how it can serve you or your family.

Table of Contents

$1599 CPP Monthly Payment

The $1,433 CPP monthly payment in November 2025 is a key part of retirement planning for many Canadians. Understanding eligibility, payment dates, and how contributions affect your benefits empowers you to make smart financial decisions. While rumors fly about higher payments, rely on official government information to plan correctly. Use strategies like delaying CPP or complementing it with other savings to secure a steady income in retirement.

| Feature | Details |

|---|---|

| Maximum Monthly CPP Payment 2025 | $1,433 |

| Eligibility | At least 60 years old with contribution history |

| Payment Date for November 2025 | November 26, 2025 |

| Contribution Rate 2025 | 5.95% employee & employer; 11.9% self-employed |

| Retroactive Payments | Up to 12 months if applying after age 65 |

| Official CPP Website | Canada.ca CPP Info |

What is the Canada Pension Plan (CPP)?

The CPP is a government-managed social insurance program designed to provide income security to Canadians during retirement or in case of disability. Simply put, it’s a way for workers to save for their golden years through regular, mandatory contributions while employed.

Both employees and employers contribute an equal share of premiums, while self-employed Canadians pay the full amount themselves. Your future CPP benefit depends directly on how much you’ve paid into the system over your working life and for how long.

The CPP essentially helps plug the gap left when job income stops, offering you a financial cushion so you can sustain your lifestyle during retirement or if faced with a disability. This makes it an integral part of Canada’s social safety net.

A Brief History of the Canada Pension Plan

To appreciate the CPP’s importance today, it’s crucial to look back at its origins. Established in 1965, the CPP was Born out of the recognition that many Canadian seniors lacked sufficient income after retirement. Prior to this, while the government had some social programs, none were comprehensive or earnings-based.

The program was spearheaded by Prime Minister Lester B. Pearson’s Liberal government and launched in 1966 with the aim to provide a compulsory and contributory pension scheme for working Canadians aged 18 to 70. The idea was revolutionary at the time — workers and employers would contribute to a fund throughout their working lives, and in return, retirees and those unable to work would receive monthly benefits.

Key milestones include:

- 1966: CPP begins collecting contributions; initial benefits were modest.

- 1987: Introduction of flexible retirement options allowed Canadians to start receiving pensions as early as 60, albeit with reduced amounts.

- 1996-1998: Major reforms addressed sustainability as Canada’s aging population increased pressure on pension funds.

- 2017 and onward: CPP Enhancements (sometimes called CPP 2.0) gradually phase in higher contributions and benefits aimed at boosting retirement incomes for future generations.

Over nearly 60 years, the CPP has evolved to maintain financial sustainability while adapting to a changing workforce and demographics. Today, it is a cornerstone of Canadian retirement planning.

How Much Can You Expect?

In 2025, eligible recipients who start receiving CPP payments at the standard retirement age of 65 can get up to $1,433 per month, indexed annually for inflation. This amount represents the upper limit based on maximum contributions over a working career.

However, it’s important to understand the variables that affect your exact payment:

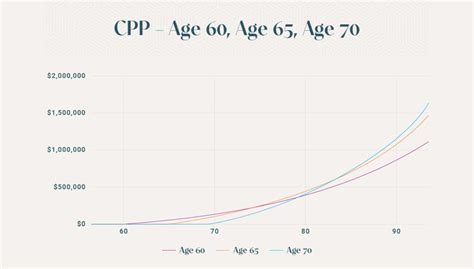

- Contribution history: The more you and your employers contributed (up to annual limits), the higher your CPP payout.

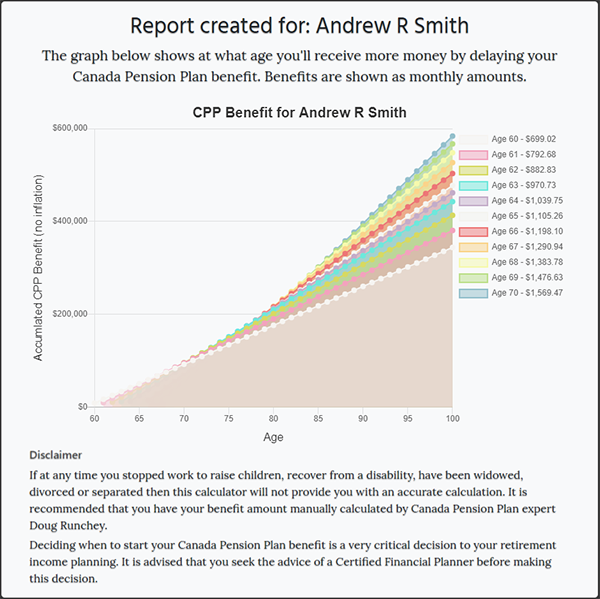

- Age when you start receiving: You can begin collecting CPP as early as 60, but monthly payments decrease by about 0.6% per month you claim before 65. Conversely, if you delay till 70, your payments increase by 0.7% per month.

- Duration and income during working years: The CPP uses your best earning years (up to 40 years under CPP enhancements) to calculate your benefit, allowing you to drop low-income periods.

For example, if Jane retired at 62 with an average contribution history, she might receive a reduced monthly amount compared to her colleague Mike who delayed until 70, receiving boosted payments due to deferral bonuses.

Types of CPP Benefits

CPP isn’t just about retirement. It offers a suite of benefits tailored to different needs:

- Retirement Pension: The main benefit paid monthly, based on your lifetime contributions.

- Disability Benefit: For contributors under 65 who become disabled and can no longer work.

- Survivor’s Pension: Paid to the spouse or common-law partner of a deceased contributor, providing financial support during tough times.

- Children’s Benefits: Available to dependent children of deceased or disabled contributors, helping cover living expenses.

Understanding these benefits allows individuals to access the support they need in various life stages.

Changes Under CPP Enhancement (CPP 2.0)

The CPP has been enhanced recently to better serve a changing workforce, especially as fewer Canadians have employer-sponsored pensions today compared to decades ago.

- The CPP enhancement, phased in from 2019 through 2025, raises contribution rates gradually.

- It boosts retirement income by increasing the portion of earnings replaced by CPP to about one-third (from the previous quarter).

- Benefits under the enhancement are fully funded; contributions are stored in a separate fund to ensure sustainability, unlike the traditional “pay-as-you-go” system.

This enhancement means that younger workers can expect larger future pensions, helping more Canadians enjoy a comfortable retirement.

How to Check Your Eligibility for $1599 CPP Monthly Payment?

To qualify for CPP benefits, you must:

- Have contributed to the CPP while working in Canada.

- Be at least 60 years old to begin receiving pension payments.

- Be able to prove your contribution history via a CPP Statement of Contributions, which can be accessed online through Service Canada.

- Apply for your benefits through the official Government of Canada portal or in person at Service Canada centers.

Eligibility rules also differ slightly for disability and survivor benefits, with specific criteria around disability proof and relationship to the deceased contributor.

When Will You Receive the November 2025 Payment?

CPP payments are deposited monthly, usually during the last week of each month. For November 2025, the expected payment date is:

- November 26, 2025

Payments are direct deposited to your bank account, so ensuring your banking details are current in your My Service Canada Account avoids any delays.

How to Maximize Your CPP Benefits?

Here are several tips to boost your CPP income:

- Work and contribute as long as possible: Increasing your contribution years and earnings maximizes benefits.

- Delay claiming: For every month you delay past 65, your payment grows about 0.7%, adding up to a generous boost if you wait until 70.

- Monitor your CPP Statement: Regularly reviewing your contributions helps you spot errors or missing years.

- Combine with other savings: CPP is only part of your retirement income—consider RRSPs, TFSAs, and employer pensions to round out your finances.

Consider this scenario: Alex continued working until 68, delaying CPP benefits for higher payouts and supplementing savings through investments—this strategy dramatically enhanced his retirement income.

What if Your CPP Application is Denied?

If you’re denied CPP benefits, don’t panic:

- You have the right to ask for a reconsideration of your claim within 90 days.

- If you disagree with the reconsideration decision, you can appeal to the Social Security Tribunal of Canada.

- Supporting your claim with detailed evidence — like medical reports for disability claims or employment records for contribution issues — is crucial.

- Keep all deadlines in mind to maintain appeal rights.

Knowing this process helps ensure you get the benefits you deserve.

Why Some People Thought There Was a $1599 CPP Monthly Payment?

Rumors about a $1,599 CPP payment in November 2025 circulated online, but no official announcements support this figure. The maximum payment remains $1,433, set by annual inflation adjustments. Stay skeptical of unofficial sources and always verify through government channels.

Understanding CPP Contributions

CPP contributions in 2025 are:

- 5.95% paid by employees on earnings between $3,500 and the year’s maximum pensionable earnings ($71,300).

- Matched by employers.

- Self-employed individuals pay the full 11.9%.

These funds are pooled, invested by CPP Investments, and used to fund current and future benefits.

CRA Benefits Payment Dates in November 2025 – OAS, CPP & CWB Benefits Date

CPP $782 + $758 Extra Deposit For November 2025, Check Who Is Eligible?

New CPP/OAS and GIS Payment for Canadian Seniors in November 2025: Check Payment Amount