$1599 CPP Monthly Increase Under New Bill: If you’ve been hearing chatter about a $1,599 monthly boost in Canada Pension Plan (CPP) payments starting November 2025, you’re not alone. With retirement on many minds, Canadians from all walks of life want to know how these changes will affect their financial future. This article will clear up the confusion, breaking down the CPP enhancement program, eligibility details, contribution requirements, and practical advice to make sense of the updates. Whether you’re a retiree, soon-to-be retiree, or just a curious contributor, this guide is tailored to keep things simple yet informative, with a conversational and trustworthy tone.

Table of Contents

$1599 CPP Monthly Increase Under New Bill

The Canada Pension Plan’s November 2025 update represents a meaningful step in providing more financial security for Canada’s retirees, boosted by significant enhancements over the past years. While the highly talked-about $1,599 CPP payment isn’t officially finalized, a strong increase to about $1,576 is confirmed, helping retirees keep pace with inflation and rising living costs. Knowing your contribution status, retirement timing, and options are key to maximizing your CPP benefits. Check your account regularly, and plan strategically to make retirement a comfortable reality.

| Topic | Details |

|---|---|

| Maximum CPP payment (2025) | $1,433 monthly for age 65 retirees |

| Potential November 2025 increase | Around $1,576 monthly (official, pending final confirmation) |

| Eligibility criteria | Age 60+, at least one CPP contribution during working years |

| Contribution requirements | Maximum contributions for ~39+ years for full benefits |

| CPP contribution rate (2025) | 5.95% for employees and employers; 11.90% for self-employed |

| Retirement timing options | Payments from age 60 (reduced) to 70 (increased by up to 42%) |

| Official resources | Canada Pension Plan – Official Site |

What Is the Canada Pension Plan (CPP)?

The CPP is a government-run pension program that provides monthly income to Canadians once they retire, based on how much and how long they contributed during their working years. Contributions are automatically deducted from paychecks, with employers matching amounts for employed workers, while self-employed people pay both sides. Think of CPP as planting seeds over your lifetime that grow into monthly income during retirement.

Why is CPP Important?

Retirement income from CPP offers a crucial safety net to millions of Canadians, helping cover daily expenses and easing the financial transition out of the workforce. It’s designed to be fair and adaptable, responding to how much you contributed and when you start taking benefits, with future adjustments planned for inflation and wage growth.

The November 2025 CPP Increase: What’s the Real Deal?

You may have seen reports stating that CPP payments will jump to $1,599 a month starting November 2025. Here’s what’s actually happening based on official sources:

- The current maximum CPP payment for 65-year-old retirees in 2025 is approximately $1,433 per month.

- Recent announcements suggest an increase to around $1,576 per month in November 2025, adjusted for inflation and phased enhancements.

- The figure of $1,599 is circulating but hasn’t been formally confirmed in official government communications as an exact guaranteed amount.

Understanding the $1599 CPP Monthly Increase Under New Bill

This increase is the result of a multi-year CPP enhancement program that began in 2019. It’s gradual and structured, unlike a sudden hike or bonus. The program aims to:

- Increase maximum benefits by about 33% from the original CPP.

- Expand the contribution base to include a higher earnings ceiling.

- Adjust payments to reflect rising living costs through inflation indexing.

The phased enhancement not only raises payments but also expands who contributes and at what levels, meaning higher future benefits in line with earnings.

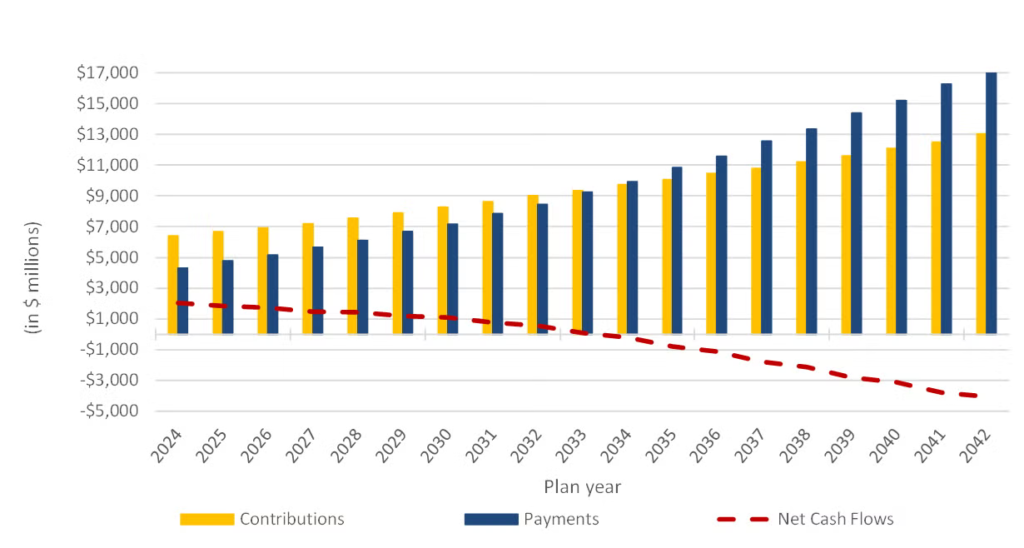

In-Depth Look at the CPP Enhancement Program (2019–2025)

The CPP enhancement program represents one of the largest reforms in CPP’s history, designed to improve financial security for today’s and tomorrow’s retirees. Here are the essential components:

Two Additional Components

The CPP now consists of:

- The base CPP: The original plan, covering earnings up to the yearly maximum pensionable earnings (YMPE).

- The first additional component: Phased in from 2019 to 2023, it increases benefit replacement from 25% to 33% of earnings.

- The second additional component: Phased in during 2024 and 2025, it adds contributions on earnings between the YMPE and a new threshold called the Year’s Additional Maximum Pensionable Earnings (YAMPE), starting at about 7% higher than YMPE in 2024 and 14% higher in 2025.

Contribution Rate Increases

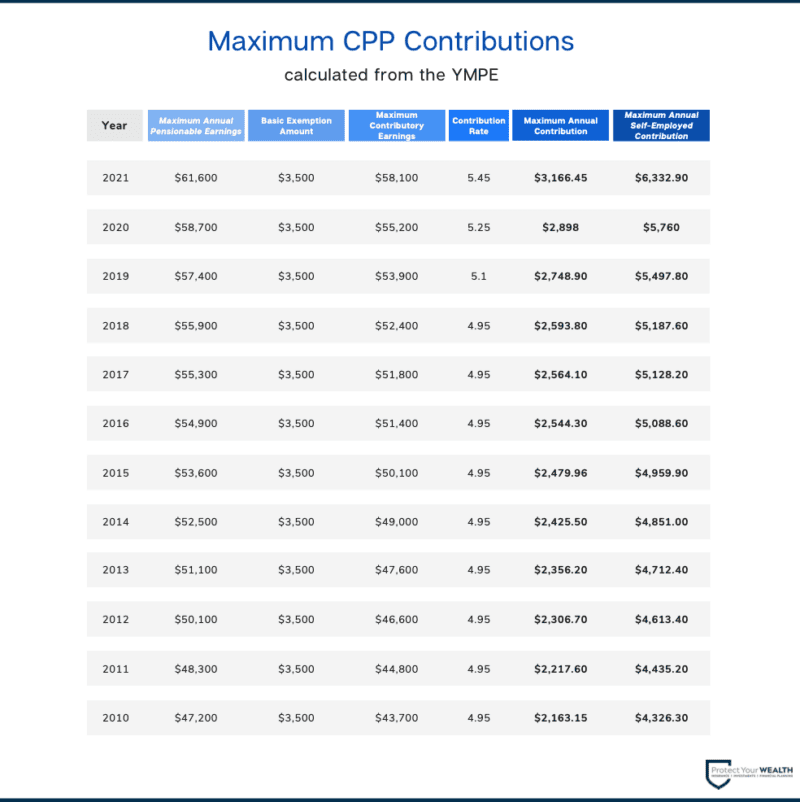

To fund these enhancements, contribution rates rose gradually:

- From 4.95% in 2018 to 5.95% in 2023 for wages up to the YMPE.

- Additional contributions for wages between YMPE and YAMPE started January 2024.

Earnings Ceilings Explained

- Year’s Maximum Pensionable Earnings (YMPE): $71,300 in 2025. This is the base ceiling on which contributions are calculated.

- Year’s Additional Maximum Pensionable Earnings (YAMPE): $81,200 in 2025, representing the threshold for the second-tier contribution.

Long-Term Impact

By 2064, these changes will increase the maximum CPP retirement benefit by nearly 50% compared to the original plan, ensuring better retirement outcomes for contributors.

Who Qualifies and How Much Will You Get?

Eligibility Basics

- Must be at least 60 years old.

- Have made at least one valid CPP contribution during your working life.

- Residency in Canada affects eligibility too.

Contribution History Determines Pay

- Full maximum benefits require ~39 years of maximum contributions starting from 2019.

- Part-time work or working below maximum thresholds leads to proportionally lower benefits.

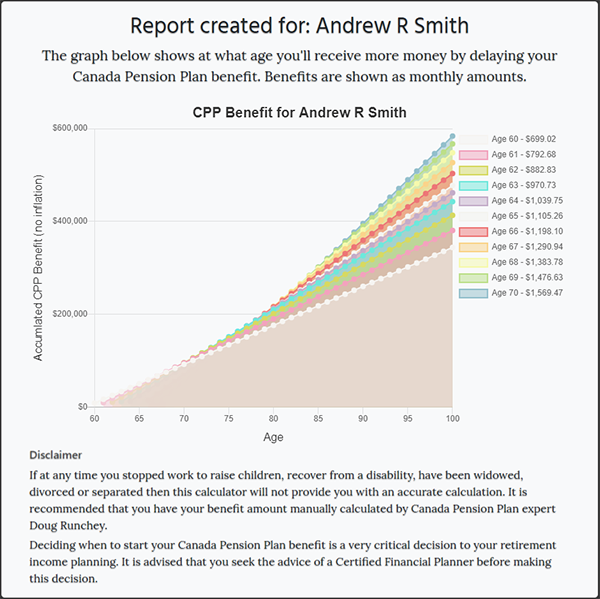

- Early retirement (starting benefits before 65) reduces monthly payments, with a 0.6% reduction per month.

- Delaying retirement beyond 65 increases payments by 0.7% per month, up to 42% more at age 70.

Practical Example

Joe, who worked and contributed the maximum amount for 40 years, may expect a CPP payment of up to $1,576 starting November 2025. Jane, who worked part-time, might receive closer to $850–$1,000 depending on contribution history.

How to Check Your CPP Contributions and Plan for Retirement?

Step 1: Access Your My Service Canada Account

This government portal lets you see:

- Your detailed earnings and contribution record.

- Estimated retirement benefits at different ages.

- Updated payment information including enhancements.

Step 2: Use the CPP Retirement Income Calculator

Available online via the official Canada.ca website, this tool projects your benefit estimate based on your actual CPP history and planned retirement age.

Step 3: Plan Your Retirement Timing

Factors to consider:

- Taking CPP early reduces monthly payments but gives immediate income.

- Waiting until age 70 significantly increases monthly benefits.

- Consider your health, financial needs, and other income sources.

Step 4: Apply Timely

Apply for CPP benefits about 6 months before retirement for smooth processing.

How Can You Maximize Your CPP Benefits?

- Contribute consistently at or near maximum levels.

- Work longer to increase pensionable years.

- Delay benefits till 65+, if financially feasible.

- Combine CPP with other savings like RRSPs and TFSAs for a secure retirement.

- Keep track of government announcements to stay updated on changes.

Canada $750 + $890 Double CPP Payment Coming In October 2025: Check Eligibility, Payment Date

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

What Does The Future Hold for CPP?

The CPP enhancement program will continue evolving:

- Anti-inflation measures will maintain benefit purchasing power.

- Potential further increases in contribution ceilings.

- Added flexibility for retirees to customize their CPP income.

- Governments monitor demographic and economic trends to adjust policies.