$1450 OAS Benefit Monthly: When you hear about the $1,450 OAS Benefit monthly for low-income seniors in October 2025, you might wonder: “Is this real? Who actually qualifies?” The truth is, not every Canadian senior will receive this exact amount. But for those who do, it’s a powerful lifeline at a time when groceries, rent, and utilities keep climbing. This guide breaks everything down clearly—from the history of Old Age Security (OAS) and Guaranteed Income Supplement (GIS), to who actually sees that $1,450 in their account, when payments land, and how seniors and families can plan around it.

$1450 OAS Benefit Monthly

The $1,450 OAS benefit monthly for low-income seniors in October 2025 isn’t a guaranteed payout for every Canadian senior—it’s a typical combined payment for those receiving Old Age Security (OAS) plus the Guaranteed Income Supplement (GIS). If you’re 65+, living in Canada, and have a modest income, you could see this deposit in your account. Staying informed, filing taxes, and planning carefully are the keys to making the most of Canada’s retirement safety net.

| Key Point | Details |

|---|---|

| Program | Old Age Security (OAS) & Guaranteed Income Supplement (GIS) |

| Maximum OAS (65–74) | CAD $740.09 |

| Maximum GIS (single) | CAD $1,105.43 |

| Combined Maximum Possible | ~CAD $1,845.52/month |

| “$1,450” Estimate | Average OAS + GIS payment for many low-income seniors |

| Eligibility | Must be 65+, Canadian resident, low income, already receiving OAS |

| Next Payment (Oct 2025) | October 29, 2025 |

| Adjustment | Indexed quarterly to inflation (CPI) |

| Official Website | Canada.ca OAS & GIS |

A Brief History of OAS

The Old Age Security program has been around since 1952, designed to keep older Canadians out of poverty. Before that, a smaller program called the Old Age Pensions Act (1927) only supported a limited number of people. OAS opened the door to universal access for seniors who met age and residency requirements.

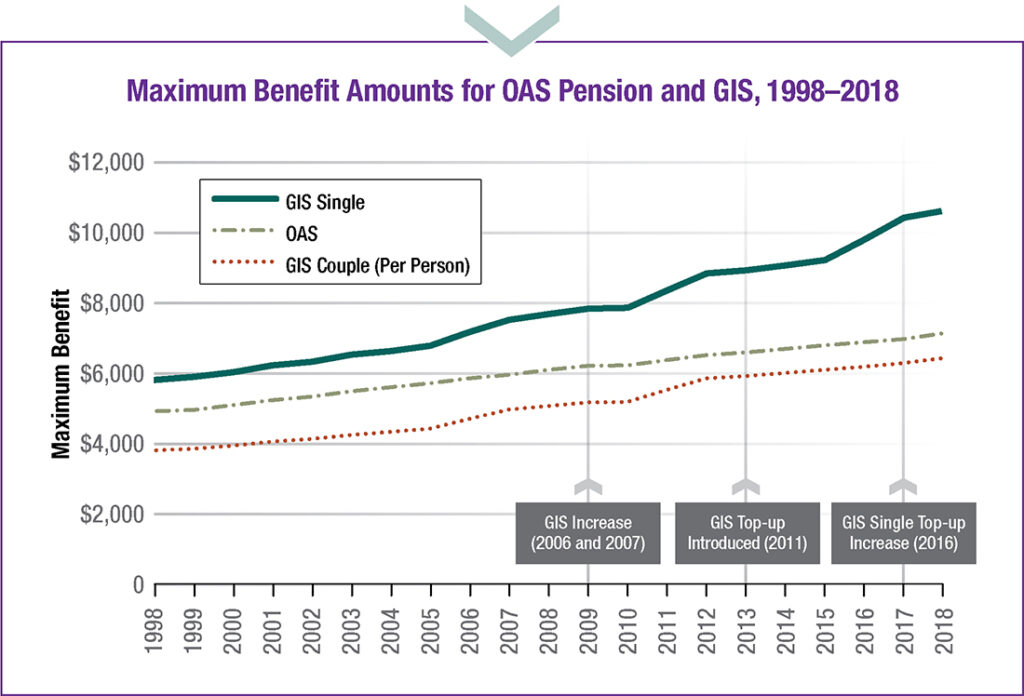

By 1967, the Guaranteed Income Supplement (GIS) was added to target those at the lowest income levels. This was a recognition that OAS alone wasn’t enough to cover essentials like rent, heating, or food.

Fast-forward to today: nearly 7 million Canadians receive OAS, and over 2 million depend on GIS to make ends meet. Together, these programs remain one of the most important social safety nets in the country.

What is Old Age Security (OAS)?

OAS is a monthly taxable pension funded through general tax revenues. Unlike CPP (Canada Pension Plan), you don’t contribute directly to it during your working life—it’s a citizenship and residency-based benefit.

- Eligibility: Age 65+ and at least 10 years living in Canada after turning 18.

- Amount: From October to December 2025, max OAS is $740.09/month for those 65–74. Those 75+ receive slightly higher thanks to a government boost added in 2022.

- Taxable? Yes. OAS is subject to income tax and may be partially or fully clawed back if your income is above a certain threshold (~$90,000+ in 2025).

The Role of GIS: Guaranteed Income Supplement

The Guaranteed Income Supplement (GIS) is a non-taxable benefit added on top of OAS for low-income seniors.

- Single seniors with incomes below $22,440/year can receive up to $1,105.43/month.

- Couples see different amounts, depending on whether their partner also receives OAS or GIS.

- The less income you earn, the higher your GIS amount.

This is why the “$1,450 monthly OAS benefit” you keep hearing about is really an OAS + GIS combination.

Breaking Down the $1450 OAS Benefit Monthly

Not everyone is getting $1,450 flat. Let’s unpack how that number shows up in real life:

- Maximum potential (single senior, no income): $740.09 OAS + $1,105.43 GIS = ~$1,845/month.

- Typical cases: Many seniors have small amounts of CPP or savings income, which reduces GIS. For them, the combined payment often falls near $1,400–$1,500/month.

Example Cases:

- Mary, 68, Winnipeg: Lives alone with no income beyond OAS. She qualifies for nearly $1,450 in October 2025.

- Tom, 72, Ottawa: Has OAS and CPP of $400/month. His GIS drops, leaving him with ~$1,250 total.

- Jean & Paul, both 70, married: Their combined OAS is ~$1,480, and their GIS adds another $1,200. Together, they receive ~$2,680/month.

Payment Schedule for October 2025

For the quarter of October–December 2025, the OAS and GIS payments will be made on:

- October 29, 2025

Payments are monthly, usually landing near the end of each month. Direct deposits arrive instantly, while cheques may take several days longer.

Step-by-Step Guide to Check Eligibility for $1450 OAS Benefit Monthly

Here’s how to know if you’ll qualify for OAS and GIS in October 2025:

- Check your age – Must be 65+.

- Residency requirement – At least 10 years in Canada since age 18.

- Income level – Your previous year’s tax return determines GIS eligibility.

- Application – Some people are auto-enrolled, but confirm via My Service Canada Account.

- Stay in Canada – GIS is only paid while you reside in Canada (OAS can follow you abroad in some cases).

OAS vs CPP vs GIS

It’s easy to confuse Canada’s retirement programs, so here’s a quick breakdown:

| Program | Eligibility | Funding Source | Taxable? |

|---|---|---|---|

| OAS | Age + residency | General taxes | Yes |

| CPP | Based on contributions from work | Payroll deductions | Yes |

| GIS | Low-income seniors receiving OAS | General taxes | No |

Why the $1450 OAS Benefit Monthly Matters in 2025?

Let’s be real—retirement isn’t getting cheaper. According to Statistics Canada, nearly 1 in 5 seniors live below the poverty line without OAS and GIS.

The Consumer Price Index (CPI) has driven food, housing, and utilities up significantly in recent years. OAS and GIS adjustments every January, April, July, and October ensure benefits don’t lose purchasing power.

But many argue it’s still not enough, especially in high-cost cities like Vancouver and Toronto where rent can swallow half of a senior’s monthly benefit.

Practical Advice for Seniors & Families

- File taxes annually – No tax return = no GIS.

- Consider delaying OAS – Deferring up to age 70 increases payments by 0.6% per month (but reduces GIS).

- Plan withdrawals carefully – Large RRSP withdrawals can reduce GIS eligibility the following year.

- Check provincial top-ups – Ontario’s GAINS, BC’s SAFER, and other programs provide extra relief.

- Use direct deposit – Faster, safer, and more reliable than cheques.

- Review annually – Income thresholds and payment rates change every three months.

The Future of OAS and GIS in Canada

As Canada’s population ages—projected to hit nearly 25% seniors by 2030—programs like OAS and GIS will play an even bigger role. Policymakers are already debating how to keep these benefits sustainable while addressing rising costs of living. Some proposals include increasing the GIS maximum or adjusting OAS age thresholds. For seniors and families, staying engaged with these changes is key. The best advice? Keep an eye on quarterly updates from Canada.ca and review your financial plan annually to adapt to evolving benefits and policies.

Professional Perspective

For financial advisors, social workers, and policy professionals, understanding OAS and GIS is crucial. Many clients confuse these benefits with CPP or assume everyone gets the same. Clarity helps families plan for:

- Estate planning (tax implications of OAS).

- Retirement budgeting (knowing GIS is income-tested).

- Government advocacy (ensuring seniors get the maximum support possible).

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility

$742 OAS Boost Confirmed by CRA for October 2025: Check Eligibility & Payment Schedule

OAS $808 and GIS $1,097 Payments for in October 2025: Is it true? Check Eligibility