$1390 IRS Direct Deposit Payment: If you’ve been hearing buzz about a $1390 IRS direct deposit payment coming in November 2025, you’re not alone. With tons of mixed info swirling online, it’s important to cut through the noise and get the facts straight, especially if you’re counting on this payment. So, what’s the real deal with this $1390 payment? Is it a legit stimulus check like we saw during the pandemic? Who’s eligible? When can you expect it? Let’s break it down in plain English, seriously make it easy to understand, and keep it real for everyone—whether you’re just curious or crunching numbers professionally.

Table of Contents

$1390 IRS Direct Deposit Payment

While the idea of a $1390 IRS direct deposit payment in November 2025 sounds promising, the truth is, no new federal stimulus or relief payments have been approved or are coming this year. What you might see instead are state rebates and inflation relief checks, which vary widely. As always, stay informed using official IRS and state resources, and watch out for scams trying to prey on folks hoping for extra cash. Whether you’re a regular taxpayer or a finance pro, knowing exactly what’s happening helps you avoid confusion and make informed financial decisions.

| Topic | Details |

|---|---|

| $1390 IRS Payment Status | No official $1390 federal payment approved |

| Eligibility | No eligibility for new federal stimulus |

| Payment Date | No confirmed federal deposit date in 2025 |

| State Relief Programs | Some states offer rebates & tax relief |

| Scam Alert | Beware fake payment scams and phishing |

The Journey of IRS Stimulus Payments: A Quick History

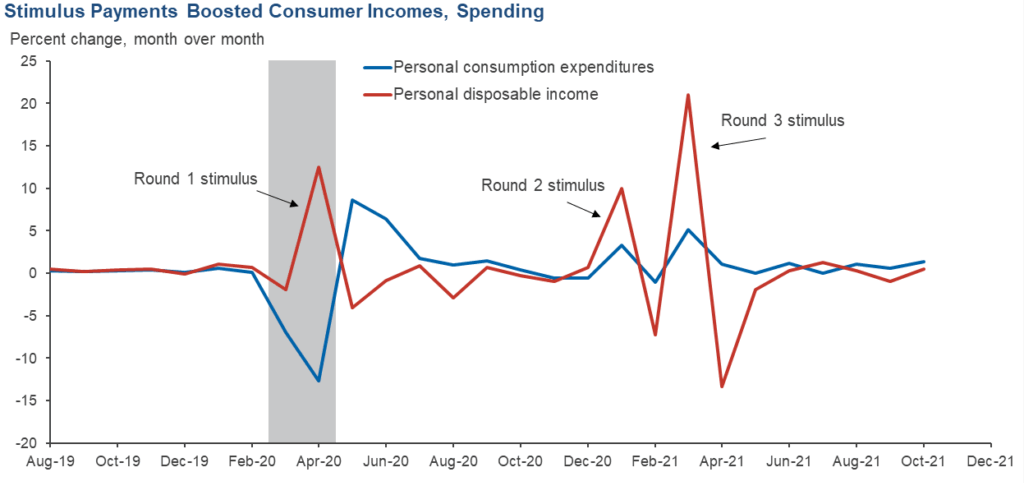

To understand why people expect payments like the $1390 check, let’s rewind to recent history. During the COVID-19 pandemic, the government issued multiple rounds of stimulus checks—direct payments designed to help Americans cope with economic challenges. The Economic Impact Payments lined up as $1200, $600, and later $1400 checks for eligible individuals. These had specific eligibility, income caps, and distribution timelines.

While the pandemic-era stimulus payments have ended, talk of similar payments naturally surfaces whenever the economy faces new pressure points like inflation or recession fears. The American Worker Rebate Act, proposed recently, aimed to restart such payments but hasn’t become law. This is why no official $1390 payment will be sent in November 2025.

What’s the $1390 IRS Direct Deposit Payment All About?

Let’s get straight to the point: The IRS and federal government have confirmed that no new stimulus or relief payments, including any direct deposit payment of $1390, are approved or planned for November 2025 or the rest of this year. Despite the chatter on social media, the reports floating about new federal payments like $1390, $1702, or even $2000 are simply rumors or misinformation.

What you might be hearing about are proposals like the American Worker Rebate Act, which was brought forward by Senator Josh Hawley. This bill suggested payments ranging between $600 and $2400, but it has not passed through Congress—meaning no checks are going out. So if someone tells you dollars are headed your way soon, it’s likely not from an official source.

Why the Confusion? State Rebates vs Federal Stimulus

Now, here’s where it gets a little tricky. While there’s no federal payment, some states are handing out inflation relief checks or property tax relief rebates to qualifying residents. For example:

- New Jersey’s ANCHOR program offers property tax relief ranging up to $1,750 for seniors and smaller rebates for younger homeowners and renters.

- States like New York, Pennsylvania, Georgia, and Colorado have distributed one-time inflation relief checks to offset rising costs.

These payments are state-initiated, based on specific eligibility, not part of the IRS’s federal stimulus programs, and vary in amount and distribution timing.

How Does the IRS Refund Process Work?

Beyond stimulus payments, the IRS manages tax refunds—money you may owe yourself if you paid extra tax throughout the year or qualify for refundable credits.

- Filing Electronically with Direct Deposit: Typically takes about 21 days for the IRS to issue refunds. This is the fastest way to get your money.

- Paper Returns: Can take 6 to 8 weeks or longer.

- Refund Delays: May occur if returns have errors or need additional review.

Beware: How to Spot IRS Payment Scams

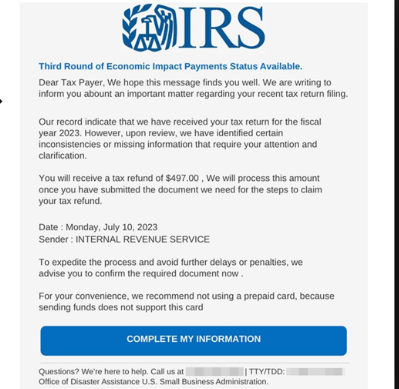

The IRS has been proactive warning taxpayers about scams related to fake stimulus payments. Scammers often:

- Send texts or emails claiming you’ll receive payments like the $1390 check but ask for banking details.

- Call demanding personal or payment information.

- Use convincing logos or language, pretending to be IRS agents.

Tips to protect yourself:

- The IRS never calls or emails asking for personal info. They initiate contact through postal mail for official matters.

- Never click links or download attachments from suspicious messages.

- If doubtful, verify details on IRS.gov or call IRS directly.

- Report scams to the IRS via IRS Scam Reporting.

Tips to Maximize Your Legitimate Tax Refund

If you want to make the most of your tax refund season:

- Check that you’ve claimed all eligible credits like the Earned Income Tax Credit (EITC) and Child Tax Credit.

- Keep organized records of expenses for deductions.

- Consider e-filing and direct deposit for faster refunds.

- Set up payment splits to direct refunds into multiple accounts if desired (official IRS option).

Advances in IRS Payment Technology

The IRS continues to upgrade systems to deliver secure and faster payments. Innovations include:

- Enhanced electronic filing systems with real-time tracking.

- More flexible options to split refunds across accounts.

- Improved fraud detection systems to protect taxpayers.

Staying updated on IRS tools can help you navigate refunds with peace of mind.

Detailed Guide: What You Need to Know and Do

Step 1: Don’t Buy into Rumors

Ignore social media hype about new stimulus payments unless it’s confirmed by official government sources like IRS.gov or Congress announcements.

Step 2: Check Eligibility for State Programs

Look up your state’s government website to see if you qualify for any state-level inflation relief, property tax rebates, or similar programs.

Step 3: Keep Your Tax Filing Up to Date

Make sure you file your federal and state tax returns promptly. If you’re owed a refund, electronic filing with direct deposit is the fastest way to get it.

Step 4: Use Official IRS Resources

- Use the Where’s My Refund? tool to track federal refunds.

- Call IRS customer service at 800-829-1040 for help with refunds or direct deposit questions.

- Visit official state tax websites for state rebate tracking.

Step 5: Stay Alert for Scams

- Never give out your personal or banking details to unsolicited contacts.

- Check IRS news updates regularly to avoid misinformation.

- Educate your friends and family about IRS scam tactics.

IRS Stimulus Checks 2025: What You Need to Know About Potential Payments and Tariff Rebates

$3000 on Average Confirmed By IRS As 2025 Tax Refunds: Check Eligibility & Payment Credit Date

$1702 PFD Stimulus Check in November 2025: Know Amount, Eligibility & Payment Dates