$1280 OAS Payment Coming: If you or a loved one are in retirement or nearing that phase, you’ve likely heard talk about the $1280 Old Age Security (OAS) payment coming in November 2025. But let’s break it down—what is this exactly? Who qualifies, how is the amount figured, and when do you get it? This detailed guide offers straightforward answers with a mix of friendly conversation and expert insight, making it easy for anyone—whether a casual reader or financial professional—to grasp all you need to know about this crucial Canadian government benefit.

Table of Contents

$1280 OAS Payment Coming

The $1280 figure often mentioned about November 2025 OAS payments likely represents combined benefits, including the OAS base pension (about $740 to $814 monthly) and income supplements like GIS. To qualify, seniors must be 65 or older, meet residency and citizenship requirements, and carefully manage their income to avoid clawbacks. Mark your calendar for November 26, 2025, when the next payment deposits. Staying proactive by applying on time, keeping personal information updated, and planning your income streams will help you maximize your retirement income and enjoy financial peace of mind in your golden years.

| Topic | Details |

|---|---|

| Maximum OAS Payment | $740.09 (ages 65–74), $814.10 (75 and over, includes 10% bonus) |

| Eligibility Requirements | Must be 65+, lived in Canada ≥10 years since age 18, citizen or legal resident |

| Income Limits (“Clawback”) | Payments reduced if net income > $148,451 (65-74), $154,196 (75+) |

| November 2025 Payment Date | November 26 (direct deposit), postal delay for cheques |

| Additional Benefits Available | Guaranteed Income Supplement (GIS) for low-income seniors |

| Official Resource | Service Canada – Old Age Security |

What Is Old Age Security (OAS)?

Old Age Security is a federal government pension program in Canada designed to provide a reliable income stream for seniors aged 65 and older. Think of it akin to the U.S. Social Security system, but with key differences: OAS doesn’t depend on your work history or how much you contributed during your career. Instead, the primary factors are your age and your residency history in Canada.

The goal is to ensure that older Canadians can maintain a reasonable standard of living in their retirement years, cushioning them against inflation and rising costs of living. OAS is part of Canada’s three-pillar public pension system, alongside the Canada Pension Plan (CPP) and the Guaranteed Income Supplement (GIS).

While the often-mentioned $1280 figure isn’t a fixed, universal payment amount—it usually reflects combined benefits including OAS base pension and supplements—understanding the components clarifies who gets what amount.

Who Qualifies for the $1280 OAS Payment Coming?

To get the OAS payment—and potentially that $1280 figure combining OAS and supplements—you need to meet certain conditions:

- Age: You must be at least 65 years old. No early perks here; 65 is the magic number.

- Residency:

- If you currently live in Canada, you must have lived in Canada for at least 10 years since turning 18.

- If you’re living outside Canada when applying, that minimum residency requirement doubles to 20 years since age 18.

- Citizenship/Legal Status: You must be a Canadian citizen or a legal resident at the time your application gets approved.

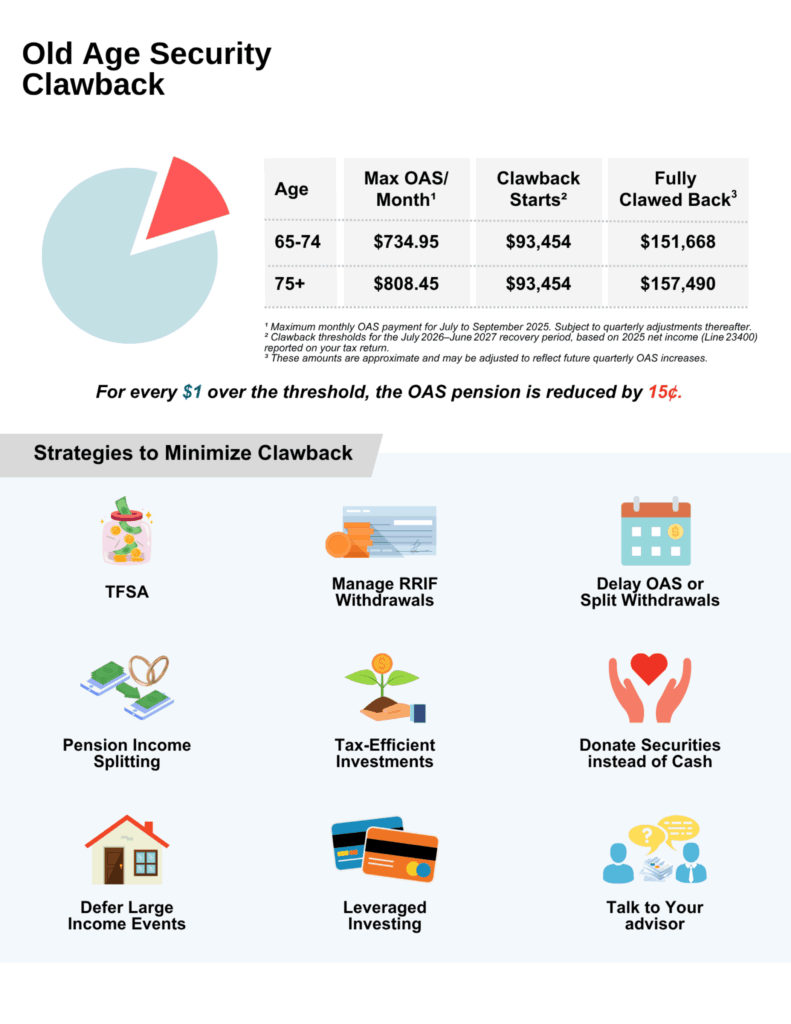

- Income Threshold: If your net income surpasses certain limits, your OAS payments reduce dollar-for-dollar by 15 cents for every extra dollar earned, a process known as “clawback.”

- For ages 65-74, the threshold is approximately $148,451 annually.

- For people aged 75 and over, it rises slightly to $154,196.

Understanding the Payment Amounts

OAS payments vary by age and residency years:

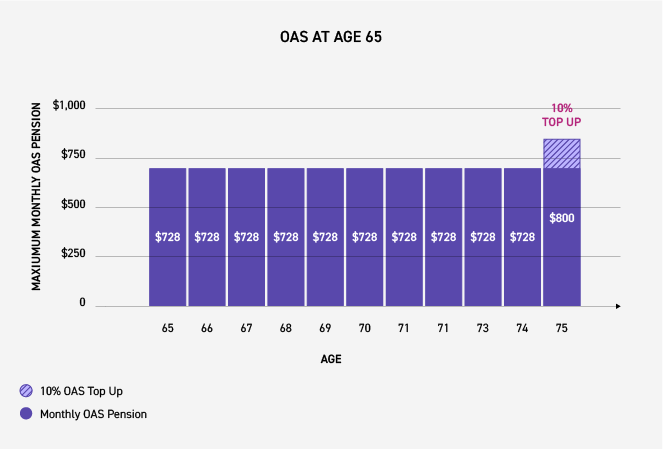

- The maximum monthly OAS pension from October to December 2025 is about $740.09 for seniors aged 65 to 74.

- Seniors aged 75 and above get a 10% increase, raising the maximum to approximately $814.10 per month.

- You can choose to delay claiming your OAS up to age 70, increasing payments by up to 36%. This increases your monthly payout and might be lucrative if you plan to keep working or rely more on other income sources for a few years.

The often-cited $1280 figure generally includes the OAS pension plus the Guaranteed Income Supplement (GIS)—extra financial help for seniors with limited income. Depending on circumstances, total monthly benefits can approach or exceed $1,280 when these supplements are added.

When Will the November 2025 Payment Be Deposited?

Payments get deposited on November 26, 2025, for most recipients who use direct deposit, which is the quickest and safest way to get payments. If you receive your money by cheque, expect slight delays due to mail transit times.

OAS payments are typically made monthly, hitting accounts the last week of every month to provide steady income support.

Step-by-Step Guide: How to Apply for $1280 OAS Payment Coming

If you aren’t automatically enrolled, here’s how to make sure you get your OAS payments on time:

- Check Automatic Enrollment: Many recipients are enrolled when approaching 65 if they’ve been filing taxes and have updated banking info with the government.

- Apply Manually if Needed: You can apply online via the official Service Canada website or mail in your application form. Be prepared with documents verifying your age (birth certificate or passport), Canadian residency, and citizenship or legal resident status.

- Select Payment Method: Choose direct deposit for secure and fast payments.

- Retroactive Payments: If you missed applying upon becoming eligible, you might receive up to 11 months of retroactive OAS payments if eligible.

- Update Annually: Report any income changes, address moves, or marital status changes to avoid payment disruptions or clawbacks.

Understanding Income Clawback and Its Impact

The income clawback is a crucial concept to grasp:

- If your net world income exceeds the threshold ($148,451 for most), your OAS benefit decreases by 15 cents for every extra dollar earned over the limit.

- The clawback continues until your OAS benefit reduces to zero at a higher income ceiling. This mechanism focuses OAS support on those who need it most.

Proper financial planning—including managing investment withdrawals, pensions, or other income sources—can help minimize clawbacks.

Interaction With Other Government Benefits

OAS often works alongside other benefits:

- Guaranteed Income Supplement (GIS): Provides additional monthly payments for low-income seniors to ensure basic financial stability.

- Allowances: For spouses aged 60-64 who do not qualify for OAS.

- Provincial Supplements: Some provinces and territories offer top-ups or extra benefits.

Receiving OAS can affect eligibility for other programs, including certain tax credits or healthcare benefits, so seniors should understand how their full financial picture interacts.

Common Mistakes Seniors Should Avoid

- Failing to apply or delaying unnecessarily: Missing out on retroactive payments or benefits.

- Neglecting income reporting: Can lead to overpayments that you’ll need to repay later, or underpayments you miss out on.

- Ignoring personal info updates: Outdated address or marital status can delay payments.

- Falling for scams: Always verify any message claiming to be from the government and never share personal info unless sure of the source.

Protecting Your Privacy and Security

The government handles your OAS payments securely, but you need to:

- Use official websites like Service Canada’s OAS page for applications and inquiries.

- Be alert to phishing emails, fake phone calls, or texts asking for personal or banking details.

- Review your bank accounts and statements regularly for any unusual activity.

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

Pension Boost Canada in November 2025: Check Expected CPP and OAS Pension Increase in 2025