$1,250 Monthly Payment For Seniors: Starting October 2025, Canadian seniors will receive a new $1,250 monthly payment designed to boost their financial security amid rising living costs. This payment is an addition to your regular Old Age Security (OAS), Canada Pension Plan (CPP), and Guaranteed Income Supplement (GIS) benefits, aimed especially at low- to moderate-income seniors. Whether you’re retired, planning retirement, or advising family members, this comprehensive guide breaks down eligibility, payment details, and practical steps to help you claim and maximize these benefits.

$1,250 Monthly Payment For Seniors

The Canadian government’s new $1,250 monthly payment for seniors starting October 2025 is a meaningful upgrade to the country’s pension landscape. Designed to fight inflation and rising living costs, it works alongside OAS, CPP, and GIS benefits to give seniors a more secure financial footing. If you’re 65 or older, a Canadian citizen or permanent resident, with income below set thresholds, you should automatically receive this payment on October 29, 2025. Filing taxes every year and staying up to date with your information ensures you won’t miss out. With thoughtful financial planning and community resources, this payment can help seniors live their golden years with dignity, comfort, and peace of mind.

| Topic | Details |

|---|---|

| Monthly Payment | $1,250 (Supplemental to regular OAS and CPP) |

| Eligibility | 65+, Canadian citizen or PR, 10+ years residency after 18, enrolled in OAS/CPP, income below threshold |

| Payment Date | October 29, 2025 |

| OAS Monthly Max (65-74) | Approx. $742 after October 2025 inflation adjustment |

| OAS Monthly Max (75+) | Approx. $814 post-inflation adjustment |

| Income Clawback Threshold | $93,454 to $151,775 depending on age |

| Tax Implications | Payments generally taxable — consult tax advisor or CRA |

| Additional Resources | Service Canada, Benefits Finder, provincial senior programs |

| Official Website | Canada Old Age Security |

What Is This $1,250 Monthly Payment For Seniors?

This new $1,250 monthly payment launching in October 2025 is a supplemental benefit designed to help seniors offset inflation and rising expenses in areas such as rent, groceries, and healthcare. This amount comes in addition to your existing Old Age Security (OAS) pension and Canada Pension Plan (CPP) payments, giving your monthly income a significant boost.

Canada ties these payments and benefits to inflation adjustments based on the Consumer Price Index (CPI), ensuring the amount keeps pace with the cost of living. The roughly 0.7% inflation adjustment effective in October 2025 is reflected both in the baseline OAS payment and this new supplemental benefit.

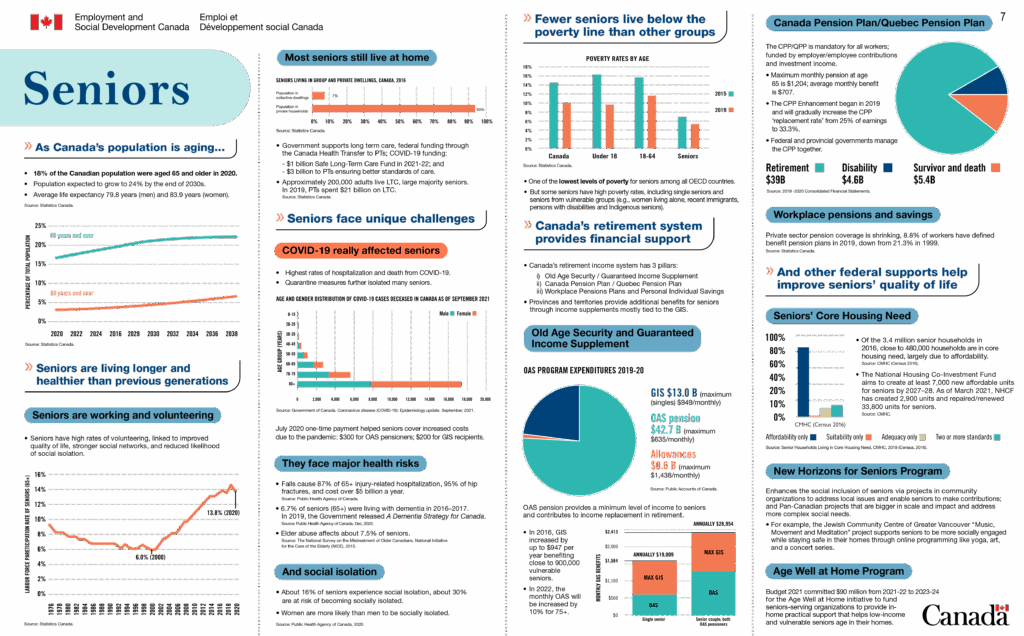

A Brief History: Evolution of Canada’s Seniors Benefits

Canada’s senior benefits system has a rich history dating back to 1927 when the first old-age pension was introduced, primarily targeting the “worthy poor.” The system evolved significantly:

- 1952: Old Age Security (OAS) program was launched as a universal pension for citizens aged 70 and older.

- 1966: Introduction of the Canada Pension Plan (CPP), a contributory earnings-based pension.

- 1967: Guaranteed Income Supplement (GIS) created to provide additional help for low-income seniors.

- Over the decades, eligibility ages have lowered, benefits have been indexed for inflation, and supplemental programs have been implemented.

The 2025 $1,250 monthly payment is part of ongoing efforts to address modern economic challenges like inflation and healthcare costs — continuing a tradition of adapting the pension system to seniors’ needs.

Who Is Eligible?

To qualify for this $1,250 payment, you need to meet these criteria:

- Age Requirement: You must be at least 65 years old.

- Residency: Be a Canadian citizen or permanent resident with at least 10 years of residence in Canada after the age of 18.

- Enrollment: You must be enrolled in or receiving OAS or CPP benefits.

- Income Cap: Your income, based on your latest tax return, must be below the designated clawback threshold. For 2025, this threshold ranges roughly from $93,454 to $151,775 depending on your age and filing status.

- Filing Taxes: File your income tax returns on time each year — your eligibility depends heavily on reported income.

If you meet these, the payment should be automatically added to your regular pension deposit without additional application steps.

How Does It Work With Other Benefits?

Most seniors rely on a combination of:

- Old Age Security (OAS): A universal pension based on residency and age. The maximum monthly OAS payment is around $742 for seniors aged 65 to 74, and about $814 for those 75 and older after inflation adjustments.

- Canada Pension Plan (CPP): A work-contribution pension based on earnings. Monthly amounts vary widely depending on employment history.

- Guaranteed Income Supplement (GIS): A means-tested program for low-income seniors providing additional monthly payments.

The new $1,250 payment acts as a supplemental layer on top of these, strengthening the financial security of seniors who often face fixed or limited incomes.

When Will Seniors Receive $1,250 Monthly Payment For Seniors?

Payments for October 2025, including this new benefit, are scheduled for deposit on:

October 29, 2025

Seniors with direct deposit will receive payments more quickly and securely; those receiving paper checks should expect delivery around the same time but potentially slower.

A Day in the Life: How $1,250 Makes a Difference

Let’s put this in perspective:

- Louise, age 68 (Toronto): Before the new payment, she often had to stretch her fixed income to cover skyrocketing grocery bills and medication. Now, extra funds let her buy fresh produce and fill prescriptions without stress.

- Henry, 72, retired postal worker (Vancouver): He uses the supplemental amount to cover increased home heating costs during colder months and chipped away at overdue dental bills.

These stories highlight how such a payment isn’t just numbers — it’s about improved quality of life.

Tax Implications of the Payment

You should be aware that this new $1,250 payment is generally considered taxable income by the Canada Revenue Agency (CRA). What does this mean for you?

- It must be reported on your annual tax return.

- Depending on your total income, you may receive a tax refund or owe taxes.

- Seniors should consider consulting a tax professional, especially if combining multiple income sources or benefits.

- Online resources and CRA services can help estimate tax impact.

What If You Miss a Payment or Need Help?

The government systems are robust but errors happen. If you don’t receive your payment or believe it’s incorrect:

- Contact Service Canada immediately at 1-800-277-9914.

- Use your My Service Canada Account online to check payment status.

- Reach out to local senior advocacy groups or community centers for assistance.

- Keep your contact info, banking info, and tax info current to prevent interruptions.

How to Maximize Your Benefits: Practical Tips

- File Taxes Promptly Every Year — This is crucial because benefit eligibility and amounts depend on your income assessment.

- Enroll in Direct Deposit — It’s fast, secure, no waiting on mail, and avoids lost checks.

- Monitor Income Levels — If your income rises beyond clawback thresholds, plan for reduced benefits.

- Use Government Tools — The Canada Benefits Finder can help identify additional support you might qualify for.

- Explore Provincial Programs — Many provinces supplement federal benefits with cost-of-living or healthcare supports. For example, Alberta’s Seniors Benefit helps low-income seniors further.

- Plan Financially — Utilize budgeting apps and connect with financial advisors specializing in senior finances.

- Seek Social Support — Leverage government hotlines, local non-profits, and community centers offering counseling and assistance.

Canada OAS Payment Increased to $1,615 in October 2025: Who will get it? Check Payment Date

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

$10,800 CRA & Service Canada Payments Expected in October 2025 – Check Eligibility & Payment Date