$10,800 CRA & Service Canada Payments: If you’ve been hearing chatter about $10,800 CRA & Service Canada Payments expected in October 2025, you’re not alone. Canadians from coast to coast are buzzing about what this payout could mean, who qualifies, and how to make sure the money hits their accounts on time. But here’s the reality check: this isn’t one giant cheque from Ottawa. Instead, it’s the maximum possible amount someone could receive in October if they qualify for several different programs. That includes tax credits, family benefits, retirement pensions, and even provincial top-ups. For some households, October 2025 could be one of the most financially rewarding months of the year.

$10,800 CRA & Service Canada Payments

The buzz about $10,800 CRA & Service Canada Payments in October 2025 is based on a combined total of multiple benefits. While most Canadians won’t see that full figure, many will receive significant payments from programs like the CCB, CPP, OAS, GST/HST credit, and provincial top-ups. The bottom line? File your taxes, keep your accounts updated, and know which benefits apply to you. With the right preparation, October 2025 could bring a welcome boost to your bank account.

| Detail | Information |

|---|---|

| Maximum Possible Payment | Up to $10,800 (combined benefits across CRA & Service Canada) |

| Programs Involved | GST/HST Credit, Canada Child Benefit (CCB), CPP, OAS, Ontario Trillium Benefit, Veterans Disability Pension, Advanced Canada Workers Benefit (ACWB) |

| Main October 2025 Dates | GST/HST: Oct 3, 2025 OTB: Oct 10, 2025 ACWB: Oct 10, 2025 CCB: Oct 20, 2025 CPP/OAS: Oct 29, 2025 Veterans Disability: Oct 30, 2025 |

| Eligibility | Based on age, income, family status, disability, residency, and tax filings |

| Official Info Source | Government of Canada – Benefits Calendar |

Why the $10,800 CRA & Service Canada Payments Are in the News?

The number $10,800 started appearing in online articles and finance blogs as a way to capture attention. But it’s not an official government-announced benefit. Instead, it’s a calculation of what someone might receive if they qualified for multiple programs in the same month.

For example, imagine a parent who gets the Canada Child Benefit, the GST/HST credit, and the Ontario Trillium Benefit — and at the same time, their retired parent living with them collects CPP and OAS. Add everything together, and October suddenly looks like a pretty profitable month.

Breaking Down Each Benefit

Let’s go program by program.

GST/HST Credit – October 3, 2025

This quarterly tax-free payment helps low- and modest-income Canadians offset sales taxes.

- Eligibility: Resident of Canada, filed 2024 taxes, 19+ (or with a spouse/child).

- Payouts: Around $496 per adult and $261 per child (CRA updates annually).

- Example: A couple with two kids could see $1,514 in October just from this credit.

Ontario Trillium Benefit (OTB) – October 10, 2025

A monthly Ontario-only benefit that combines energy, property tax, and sales tax credits.

- Eligibility: Ontario residents with qualifying income and housing costs.

- Payouts: Varies widely — could be a few hundred dollars annually or more depending on rent/property taxes.

- Example: A family in Toronto paying high rent might see $100–$150 per month.

Advanced Canada Workers Benefit (ACWB) – October 10, 2025

This refundable tax credit supports low-income workers.

- Eligibility: Must earn modest income and file taxes.

- Payouts: Up to $1,518 for singles, $2,616 for families (split into advance payments).

- Example: A single worker earning $22,000 annually might see about $300 in October.

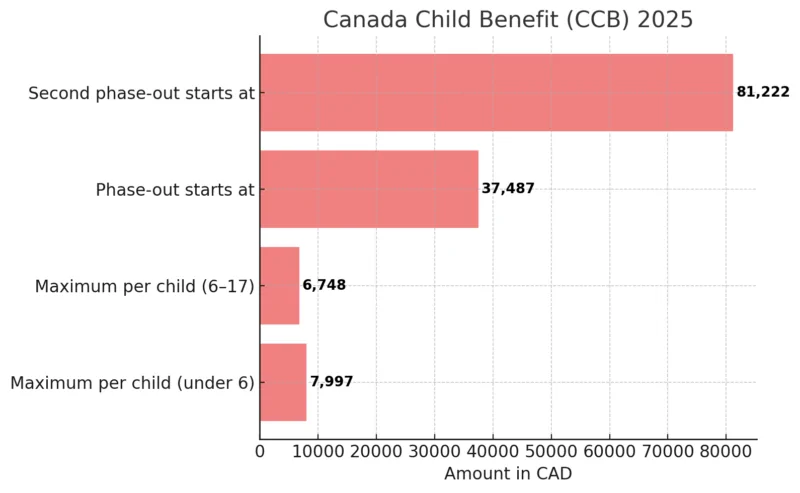

Canada Child Benefit (CCB) – October 20, 2025

The big one for families with kids.

- Eligibility: Parents/legal guardians of children under 18.

- Payouts: Up to $7,437 annually per child under 6; $6,275 per child aged 6–17.

- Example: A family with two young kids under six could get over $1,200 this month alone.

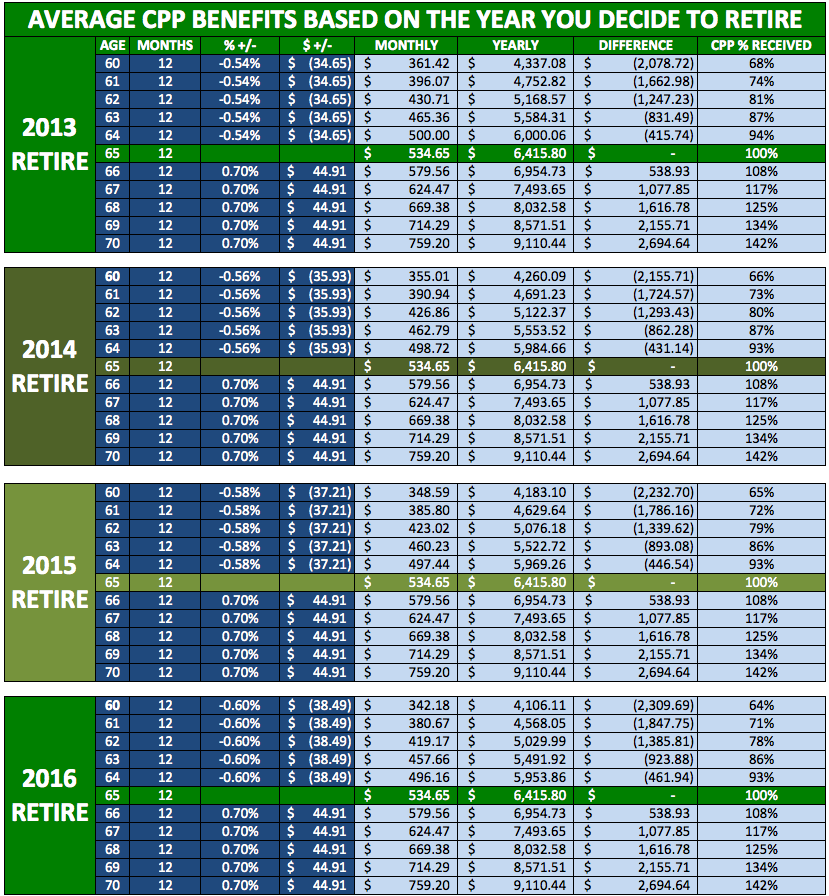

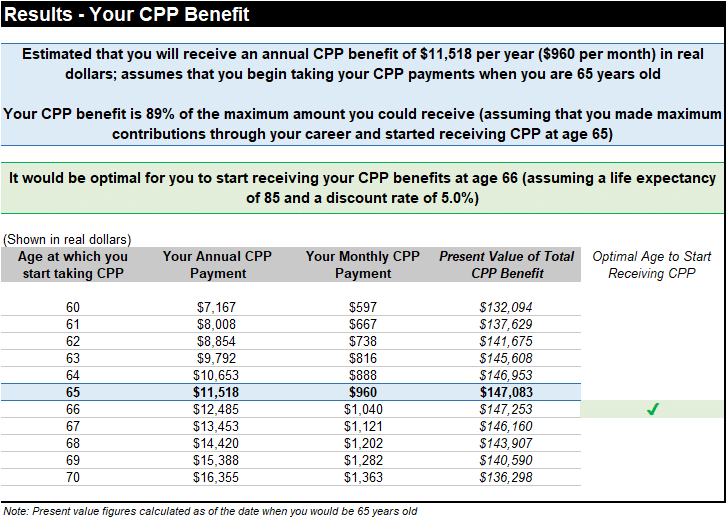

Canada Pension Plan (CPP) – October 29, 2025

The retirement backbone for working Canadians.

- Eligibility: Must have contributed through work and meet age/disability/survivor requirements.

- Payouts: Average ~$758/month, maximum ~$1,364/month (2025 estimate).

- Example: A retiree who worked full-time for decades could get $1,300 in October.

Old Age Security (OAS) – October 29, 2025

Monthly pension for seniors 65 and older.

- Eligibility: Canadian citizens or legal residents who’ve lived in Canada for at least 10 years after age 18.

- Payouts: Around $713/month (average), plus possible supplements.

- Example: A low-income senior may also qualify for the Guaranteed Income Supplement (GIS), adding hundreds more.

Veterans Disability Pension – October 30, 2025

Support for veterans with service-related disabilities.

- Eligibility: Former Canadian Armed Forces or RCMP members with an approved disability claim.

- Payouts: Based on disability rating and service rank.

- Example: A veteran with a 30% disability rating may see several hundred dollars monthly.

Case Studies: How This Adds Up

To really picture it, let’s look at different scenarios.

Case 1: A Working Parent with Two Kids in Ontario

- GST/HST Credit: $1,514

- CCB: $1,200

- OTB: $120

- ACWB: $300

Total in October: $3,134

Case 2: A Retired Senior in B.C.

- CPP: $1,200

- OAS: $713

- GST/HST: $496

Total in October: $2,409

Case 3: A Veteran Retiree with One Child

- CPP: $1,000

- OAS: $700

- GST/HST: $757

- CCB: $600

- Veterans Disability: $400

Total in October: $3,457

Clearly, only someone who qualifies across multiple categories — like a working parent who’s also a senior or veteran — would approach the $10,800 mark.

Historical Growth of Benefits

These programs didn’t appear overnight. Over the years:

- The GST/HST credit increased steadily by around 10% in the past decade.

- The CCB was introduced in 2016, replacing several smaller programs, and delivers higher, tax-free monthly payments.

- OAS and CPP are adjusted annually to reflect cost-of-living increases.

- Temporary boosts, like during the COVID-19 pandemic, showed how benefits can expand when needed.

Step-by-Step Guide: Preparing for $10,800 CRA & Service Canada Payments

- File your 2024 taxes on time — no tax return, no benefits.

- Set up CRA My Account for benefit tracking.

- Check Service Canada for pensions and employment benefits.

- Update direct deposit info so payments land smoothly.

- Apply early for CPP or OAS if you’re turning 65.

- Know your provincial programs — Ontario has OTB, but other provinces have their own.

Common Mistakes to Avoid

- Missing the tax deadline = automatic benefit delays.

- Forgetting to report changes in marital status or number of children.

- Thinking benefits are automatic when some require applications (like CPP or OAS).

- Ignoring clawbacks: high-income seniors may see OAS reduced.

Regional Differences

While the big federal programs (CPP, OAS, GST/HST, CCB) apply nationwide, provincial programs vary:

- Ontario: OTB.

- Alberta: Affordability Payments (temporary programs).

- Quebec: Separate child and family allowances.

- Northern territories: Higher credits for heating and living costs.

This means two Canadians with similar incomes could see very different totals in October depending on where they live.

Scam Awareness

CRA scams are rampant, especially around benefit season. Protect yourself by remembering:

- The government won’t text you asking for banking details.

- Real CRA emails come from “@cra-arc.gc.ca” and direct to “.gc.ca” sites.

- If in doubt, call CRA or Service Canada directly.

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

Canada GIS Allowance for October 2025: Check Expected Payment Date, Rules and Eligibility