$1,080 Old Age Payment: When it comes to looking out for its elders, Singapore has developed a well-structured system to keep its older citizens financially secure. The $1,080 Old Age Payment under the Silver Support Scheme is a core component of this safety net, targeted at seniors who had lower lifetime earnings and might not have accumulated enough savings by retirement. Whether you’re a retiree, a future retiree, or just curious about global social security frameworks, this article provides a clear, detailed breakdown of how the scheme works, who qualifies, and how it fits into Singapore’s overall social security framework. The goal is to make it approachable for everyone, from young learners to seasoned professionals.

Table of Contents

$1,080 Old Age Payment

Singapore’s Silver Support Scheme, with its generous $1,080 quarterly payment, exemplifies a targeted, well-managed social safety net designed for low-income seniors who may not have saved enough for retirement. Combining mandatory savings with cash supplements, it balances self-reliance and social equity, ensuring that older Singaporeans can live with financial dignity. This program offers important lessons for both policymakers and retirees globally, setting a high standard for retirement security in a fast-aging world.

| Topic | Details |

|---|---|

| Scheme Name | Silver Support Scheme |

| Payment Amount | Up to S$1,080 (~$800 USD) per quarter |

| Payment Frequency | Quarterly (January, April, July, October) |

| Eligibility | Singapore citizens aged 65+ with low lifetime wages and modest household income |

| No Application Needed | Eligibility is automatically assessed annually |

| Payment Method | Direct deposit via PayNow NRIC, CPF-linked bank, or GIRO |

| Relation to CPF | Supplement to the Central Provident Fund retirement savings |

| Official Website | Silver Support Scheme – CPF Singapore |

What is the $1,080 Old Age Payment?

This S$1,080 payment (approx. $800 USD) is the maximum quarterly cash payout under the Silver Support Scheme, providing a much-needed financial top-up for seniors. It helps cover basic living expenses such as food, transportation, and medical visits—things that most people take for granted but can become a challenge without adequate retirement funds.

Singaporeans receiving this quarterly payment can think of it as a valuable “boost” to their fixed retirement income, offering a steadier financial footing to handle day-to-day needs. The scheme particularly benefits those who worked in lower-paying jobs or had limited CPF contributions.

How Singapore’s Social Security System Works?

Singapore’s system for senior support brings together two key pieces:

1. Central Provident Fund (CPF)

The CPF is a mandatory savings programme where employees and employers contribute parts of monthly wages into individual accounts. These funds are earmarked for retirement, healthcare, housing, and insurance. Upon retirement, seniors draw from CPF LIFE or the Retirement Sum Scheme to get a regular income.

CPF sets Singapore apart by enforcing disciplined savings to reduce dependency on government pensions, encouraging self-reliance.

2. Silver Support Scheme

Recognizing that mandatory savings alone might not be enough for everyone, the Silver Support Scheme supplements income for seniors with low lifetime earnings and smaller CPF balances. It targets citizens who live in smaller Housing & Development Board (HDB) flats with modest income, filling gaps and helping reduce elderly poverty.

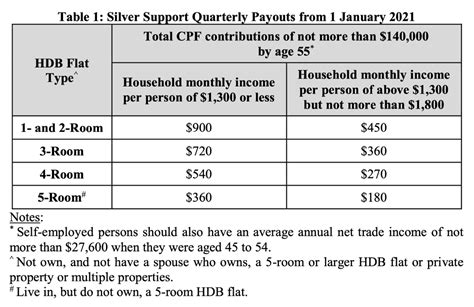

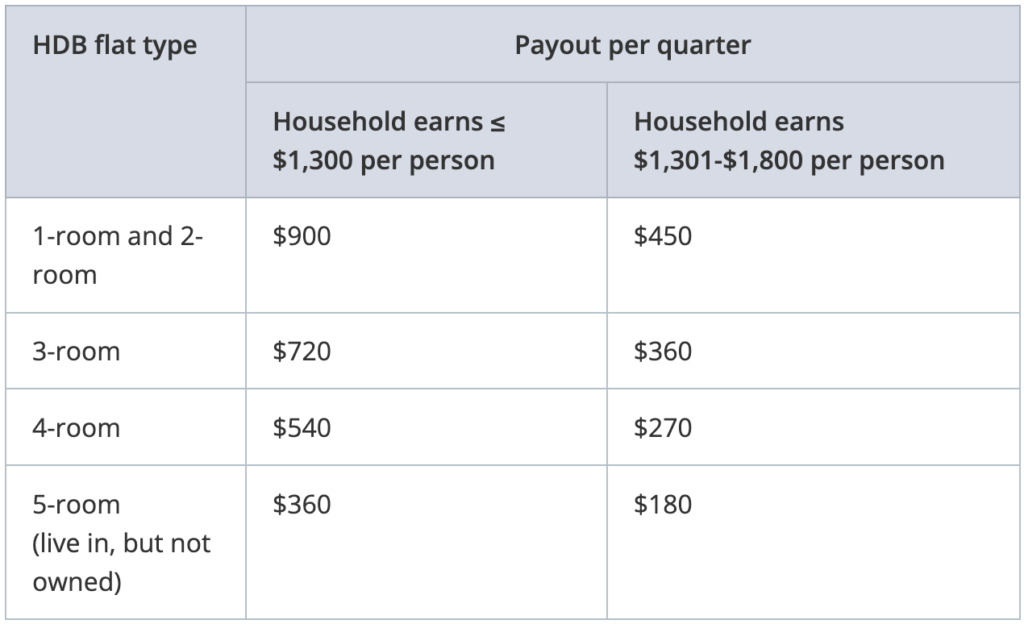

Qualification & Eligibility: Who Gets the Silver Support?

You don’t have to file any paperwork—Singapore’s government automatically determines eligibility yearly using existing data. The requirements include:

- Singapore citizenship and age 65 or older.

- Lifetime earnings below certain thresholds during peak working years (e.g., self-employed individuals with an average annual net trade income not exceeding S$27,600 between ages 45-54).

- Living in small public housing flats like 1-, 2-, or 3-room HDB flats.

- Household income per capita below set limits.

- Not owning private property or substantial assets.

Recipients who receive ComCare Long-Term Assistance get a fixed S$430 quarterly payment regardless of housing type.

Payment Details & How Seniors Receive Funds

Payments are distributed quarterly—in January, April, July, and October—and credited directly to bank accounts via preferred PayNow NRIC routes or CPF-linked bank accounts if PayNow isn’t set up.

Each December, recipients receive a notification letter detailing their eligibility and expected payout for the subsequent year, helping seniors plan their finances.

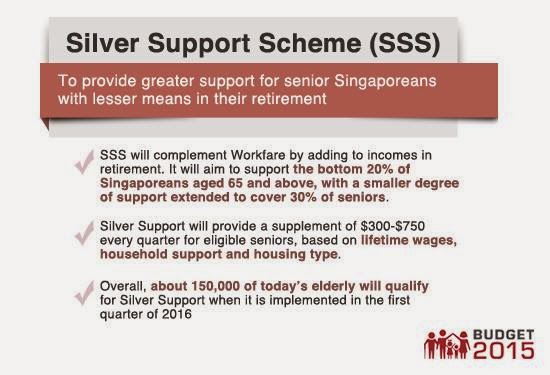

History Behind the Silver Support Scheme

The scheme was formally announced by Prime Minister Lee Hsien Loong at the 2014 National Day Rally and rolled out in mid-2016. It aimed at the bottom 20% of elderly citizens who were vulnerable financially due to limited savings or interrupted careers. Originally, eligibility took into account CPF savings limits (initially capped at S$70,000) and household income, coupled with residence in smaller flats.

Over time, the government raised the CPF cap (now around S$140,000) and adjusted income thresholds to keep pace with inflation. Starting 2025, the maximum quarterly payout increased by 20% to S$1,080 from S$900, reflecting government efforts to provide stronger support amid rising living costs.

Studies on the scheme reveal its success in increasing recipients’ consumption, demonstrating that direct cash support can be more effective than vouchers or targeted subsidies in improving living standards. The program exemplifies Singapore’s targeted, data-driven welfare approach.

Comparing Singapore’s Scheme with U.S. Social Security

Here’s how the two systems stack up:

| Feature | Singapore Silver Support Scheme | U.S. Social Security |

|---|---|---|

| Target Group | Low-income seniors aged 65+ | Retirees, disabled workers, survivors |

| Payment Frequency | Quarterly | Monthly |

| Payment Amount | Up to S$1,080 per quarter (~$800 USD) | Average ~$1,600/month (varies by earnings) |

| Application | Automatic eligibility, no application required | Requires application |

| Funding Source | Funded by government budget | Payroll taxes (FICA) |

| Relation to Retirement Savings | Supplement to CPF savings | Primary retirement income source |

Unlike the broader U.S. system funded through payroll taxes, Singapore’s Silver Support acts explicitly as a top-up for those who have limited retirement savings, illustrating a complementary but targeted safety net.

Expert Insights

Dr. Anne Lee, a retirement policy expert, comments: “The Silver Support Scheme is a smart, respectful safety net recognizing that life circumstances vary and not all can build substantial retirement savings. It shows how governments can balance self-reliance with targeted support.”

Financial advisor Mark Thompson advises: “Programs like Silver Support mitigate financial risks in retirement, but personal savings and wise investment strategies remain essential to achieving financial security.”

The Social Impact of the Silver Support Scheme

Since its launch, the Silver Support Scheme has significantly improved the financial confidence and quality of life for thousands of low-income seniors in Singapore. Recent data shows that over 60,000 seniors receive this support, with two-thirds of recipients being women, reflecting the scheme’s role in bridging gender income disparities in retirement. By providing a steady quarterly cash supplement, the program helps reduce stress related to daily expenses and medical needs among the elderly. It also encourages social inclusion, as beneficiaries can better participate in community activities without the worry of financial constraints. Importantly, Silver Support has been shown to increase consumption of essential goods, stimulating local economy sectors that serve seniors. This real-world impact highlights the scheme’s success not only in poverty alleviation but also in promoting dignity and independence for aging Singaporeans.

Future Directions and Challenges for Elderly Support in Singapore

As Singapore’s population continues to age rapidly, the Silver Support Scheme will face evolving challenges and opportunities. Policymakers are considering integrating digital tools to streamline beneficiary communication and payments, enhancing accessibility, especially for less tech-savvy seniors. There is also growing emphasis on coupling financial aid with programs on financial literacy and health management, ensuring recipients use their supplements effectively. However, sustaining long-term funding as demand grows will require careful budget balancing and possibly innovative financing options. Singapore’s model offers valuable lessons for other nations confronting similar demographic shifts, emphasizing the need for adaptable, data-driven approaches that combine government support, personal responsibility, and community engagement for comprehensive elderly care.

Practical Financial Tips for Seniors and Workers Preparing to Retire

- Confirm Eligibility: Check government resources yearly on your Silver Support status.

- Maximize CPF Contributions: Use voluntary top-ups to bolster your retirement nest egg.

- Prepare a Realistic Retirement Budget: Consider healthcare and unforeseen expenses.

- Explore Part-Time or Side Gigs: Supplemental income can ease financial pressure.

- Seek Professional Guidance: Financial advisors can help optimize retirement planning and benefits.