$1,000 Cash App Settlement: If you’ve seen headlines or TikToks shouting about a “$1,000 Cash App Settlement Incoming”, you’re not alone. All across the U.S., people are wondering if Cash App users are about to receive a surprise payout. It sounds exciting — who wouldn’t want an easy $1,000 dropped into their account, right? But here’s the truth: while there are legitimate Cash App settlements, the viral “$1,000 for everyone” claim is mostly clickbait. That doesn’t mean there’s no money available — it just means you need to understand what’s real, what’s exaggerated, and how to safely check if you qualify.

Let’s break it all down, clearly and simply. Whether you’re a high schooler with a side hustle or a professional who uses Cash App for business, this guide will help you separate fact from fiction — with real data, sources, and expert-backed advice.

Table of Contents

$1,000 Cash App Settlement

The buzz around the $1,000 Cash App Settlement might sound too good to be true — and in most cases, it is. But there are real, verified settlements for users who experienced fraud, poor dispute handling, or unwanted marketing from Cash App. At the end of the day, these settlements aren’t just about getting money back — they’re about building trust, improving digital safety, and reminding fintech companies that users deserve the same protections as bank customers. Stay informed, stay cautious, and protect your hard-earned cash.

| Detail | Information |

|---|---|

| Topic | $1,000 Cash App Settlement – Real or Fake? |

| Official Settlement Type | Class-action lawsuits & CFPB restitution (2024–2025) |

| Who’s Eligible | Cash App users affected by unauthorized transactions, security breaches, or unsolicited promotional texts |

| Estimated Payouts | Between $50 and $2,500, depending on individual losses and documentation |

| Important Dates | Most claims deadlines fall between late 2024 and early 2025 |

| Official Source | ConsumerFinance.gov |

| Average Real Payout | $88–$147 for most users (per Money.com report) |

| Scam Warning | Beware of fake “$1,000 payout” links or unsolicited messages |

| Legal Oversight | U.S. Consumer Financial Protection Bureau (CFPB) |

| Payment Type | Refund checks or direct deposits |

| Expert Insight | Legal and financial experts stress verifying all claims on official sites only |

What Is the $1,000 Cash App Settlement Everyone’s Talking About?

The “$1,000 Cash App Settlement” is tied to a combination of real legal settlements and government actions involving Cash App’s parent company, Block, Inc. These cases deal with user complaints, unauthorized transactions, and consumer protection violations.

Over the past few years, millions of Americans have used Cash App for payments, side gigs, or investments. But as usage exploded, so did reports of fraud, scams, and poor customer support. The U.S. government stepped in, demanding that Cash App fix its processes — and compensate users.

The viral number, $1,000, likely came from social media exaggerations. Some eligible users could indeed receive larger payments (especially those with documented financial losses), but the average payout is closer to $100–$200. Let’s look at what’s real.

Confirmed Settlements and Restitution Orders

1. The CFPB Restitution Order (2024)

The Consumer Financial Protection Bureau (CFPB) ordered Block, Inc. — Cash App’s parent company — to pay $175 million total, including $120 million in refunds to customers and $55 million in penalties.

Why? Investigators found that Cash App had mishandled thousands of fraud complaints, failed to promptly return stolen money, and didn’t properly secure user accounts.

Here’s what it means for you:

- If you reported a fraudulent transaction between August 2018 and August 2024, you may be eligible for compensation.

- Refunds are being processed automatically for some verified cases.

- The CFPB has published official updates on consumerfinance.gov.

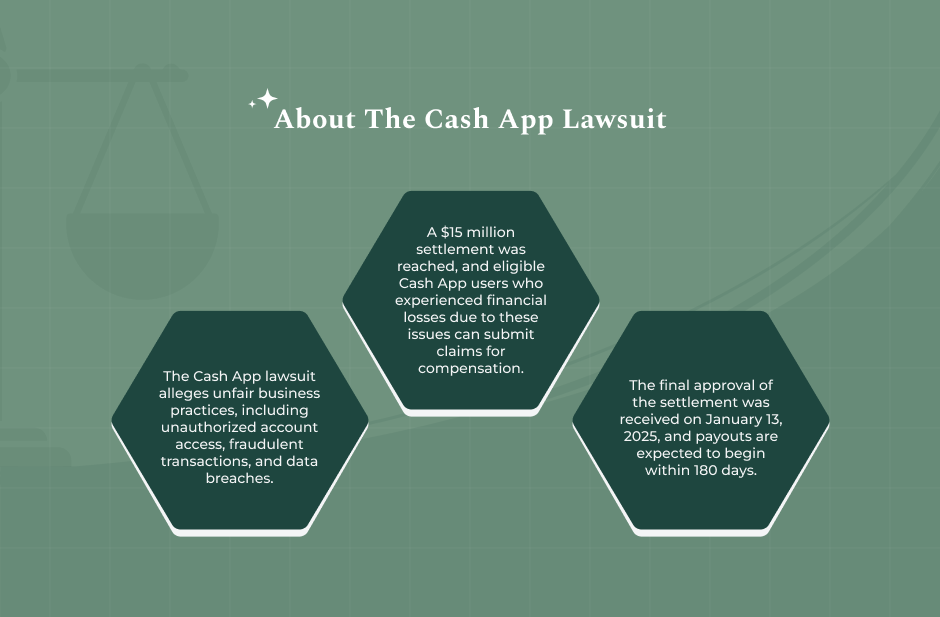

2. The Washington State Class Action (2025)

A $12.5 million class action settlement was approved in early 2025 for Cash App users who received unsolicited promotional or referral text messages.

The lawsuit claimed that Cash App violated the Telephone Consumer Protection Act (TCPA) by sending spam texts without consent.

- Estimated payout per eligible user: $88 to $147.

- Applies mainly to residents in Washington State, but similar suits may emerge in other states.

- More info: FFESP Settlement Tracker.

Together, these cases show how regulators are holding fintech companies accountable — and how users can finally get some money back.

Beware of Fake Settlement Scams

Where there’s money, there’s fraud — ironic, right?

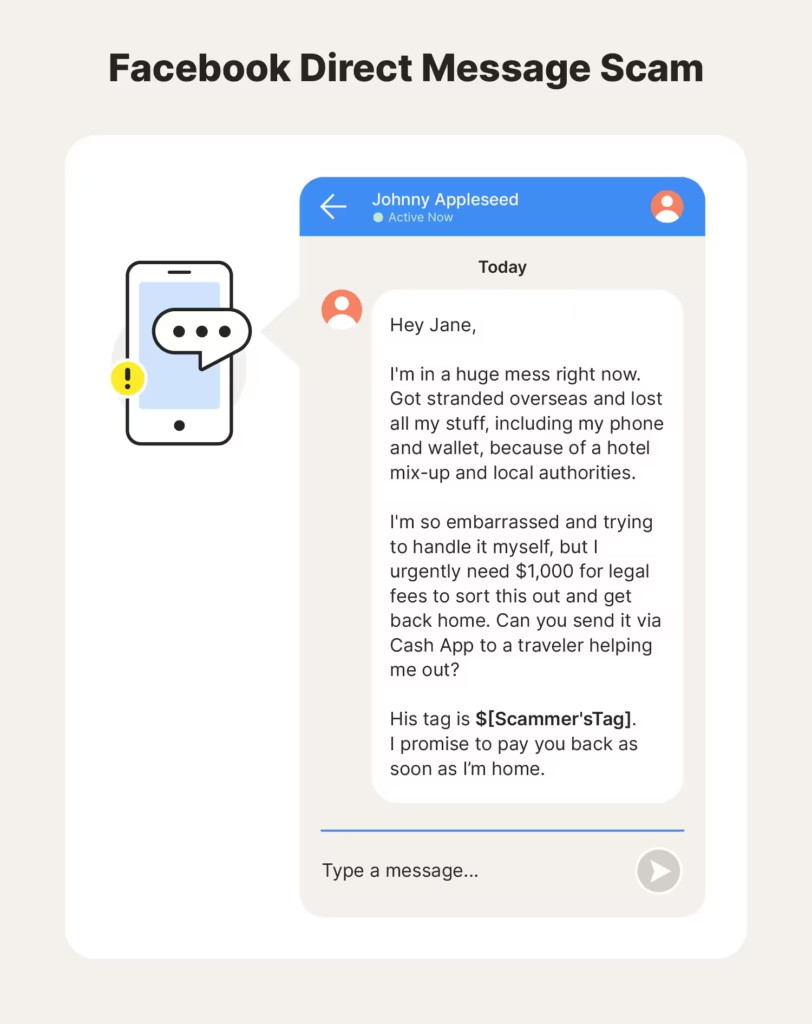

Scammers have flooded social media, email inboxes, and even text messages with fake “Cash App Settlement” links promising $1,000 or more. These links often look convincing but lead to phishing websites designed to steal your login info, bank details, or social security number.

Here’s how to spot fake claims:

- Look at the web address: Real settlement sites are hosted on domains like

.gov,.org, or clearly official domains tied to law firms or settlement administrators. - Check the sender: Official notices won’t come from Gmail, Yahoo, or unknown accounts.

- Never click unsolicited links: Instead, type the official site into your browser manually.

If you’ve already clicked a suspicious link, immediately:

- Change your Cash App password and PIN.

- Contact Cash App Support through the app or cash.app/help.

- Report the incident to the FTC’s Identity Theft Center.

How To Check If You Qualify for the $1,000 Cash App Settlement?

Wondering if you’re eligible for any of these payouts? Follow these simple steps:

Step 1: Review Your Cash App Transactions

Check your Activity tab for unauthorized transactions, missing refunds, or account lockouts from 2018–2024. If any occurred and weren’t properly resolved, you might be part of the CFPB’s restitution group.

Step 2: Search for Class Action Notices

Many people are automatically included in class actions based on their registered phone number or email. You can check:

- TopClassActions.com

- ClassAction.org

- ConsumerFinance.gov

Search “Cash App Settlement” or “Block Inc. Restitution.”

Step 3: Submit a Claim (If Required)

If your case requires a manual claim:

- Visit the official settlement portal listed in your notice.

- Fill out the claim form with accurate personal details.

- Attach proof (emails, screenshots, or bank statements).

Step 4: Monitor Payment Status

Once submitted, you’ll receive a claim ID. Use it to check payment updates.

Payments are generally made via check or direct deposit within a few months after the court’s final approval.

Understanding Class-Action Lawsuits

A class-action lawsuit is a way for many individuals to come together and file a claim against a company for similar harm. This saves everyone time and money while ensuring that big corporations are held accountable.

In the Cash App case, users who were victims of fraud, unauthorized access, or unwanted marketing messages joined together to form a class.

You don’t need to hire a personal attorney — the lawyers handling the class get a percentage of the overall settlement, and you still receive your individual compensation once it’s processed.

Why These Settlements Matter?

These lawsuits represent more than just payouts. They highlight a much larger issue: digital finance accountability.

Cash App, Venmo, and similar apps handle billions in daily transactions. But when customers experience fraud or account issues, traditional banking protections don’t always apply the same way.

According to Statista (2024), more than 55 million Americans actively use Cash App. With that kind of user base, even a small percentage of fraud cases can affect millions of dollars in lost funds.

This settlement is a warning to fintech companies — consumers expect the same security standards as banks. And for users, it’s a reminder to stay informed and vigilant.

Smart Tips To Keep Your Cash App Secure

Even if you’re not part of a settlement, these habits will help protect your money:

- Turn On Security Lock – Always require a PIN, Touch ID, or Face ID before completing a payment.

- Enable Two-Factor Authentication (2FA) – Add an extra verification step when logging in or making high-value transactions.

- Don’t Keep Large Balances – Transfer money to your bank after receiving it. Don’t leave hundreds sitting in your Cash App wallet.

- Avoid Random Giveaways or “Instant Payouts” – No official Cash App giveaway will ever ask for your login info or advance payment.

- Verify All Requests – If a friend or relative asks for money suddenly, confirm by calling or texting them directly — scammers often impersonate contacts.

- Use a Dedicated Email for Finance Apps – Keeps your main inbox clean and safer from phishing attempts.

What Experts Are Saying?

Consumer law experts are urging users to stay realistic about potential payouts. According to Money.com, while some users could receive hundreds of dollars, “the $1,000 figure circulating online is largely unsubstantiated.”

Tech analysts also note that as fintech apps grow, they must adopt bank-grade protections for fraud detection and dispute handling.

Financial advisors recommend that users regularly update passwords, enable alerts for every transaction, and avoid linking multiple apps to one debit card — since that increases exposure to fraud.

AT&T $177M Data Breach Settlement – Apply to get $7,500 Payment, Check Eligibility

Millions Getting $51 From Amazon – What You Need to Know About the Prime Subscription Scandal